April 2022 was a month full of exploits and finished with the potential final straw in the Fantom coffin. If you recall, Andre Cronje ‘retired’ in March after getting his feelings hurt online and abandoned Solidly & Fantom ($FTM). At the time, it felt like a sure winner. But lost to the March 2022 Rug of the Month winner Tai Lopez for his impressive NFT money grab. However, the slow thread Andre started in March may have finally grown and knit itself into a full blow rug for April.

April was another exciting month in crypto with exploits in Fei Protocol for $76 million, Saddle Finance for $11 million, and Beanstalk Dao for $75 million. Both Hashmasks & Bored Ape Yacht Club (no surprise) saw members phished and careless coding had $45 million unrecoverable in AkuDreams.

However, all the exploits, hacks, and careless coding pales to wondering if one of the major alternative chain would be completely broken.

A Fantom whale is stuck with his liquid funds locked in 4-year vote escrow tokens. (We covered what are vote escrow tokens and what are the risks? here). His nearly $60 million loan on $FTM is dangerously close to being liquidated. Additionally, the Fantom network may not have enough liquidity to absorb a liquidation of that size, which may potentially bring the entire chain down.

What are the details and how did we get here?

Background on Fantom

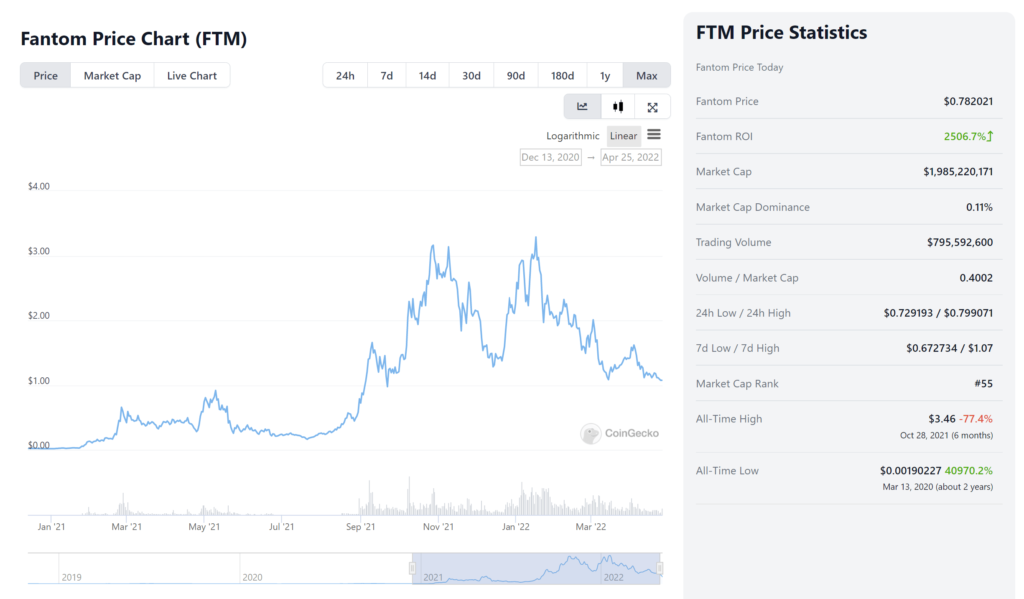

Fantom is one of the larger alt chains. Its native token, $FTM, is currently ranked #55 on CoinGecko by market cap. Albeit it was much higher before the recent price plunge.

Fantom is EVM compatible, proof-of-stake, open source, and uses a Lachesis consensus mechanism. Allegedly the consensus mechanism allows Fantom to be scalable, cheap, secure, and fast. (Want more? See the Fantom White Paper here)

Andre Cronje teamed up with Daniele Sesta to develop a new automated market maker with minimal slippage that had elements of vote-escrow (ve) locking of Curve and protocol owned liquidity (POL) made popular by Olympus DAO. This was to be Solidly.

Solidly was going to have a novel launch mechanism. It would distribute its tokens to the top 25 protocols on Fantom and then those protocols would decide how to allocate the tokens to the protocol’s users. This introduced a huge element of game theory as whales started positioning to max out their allocations.

What Happened to Solidly?

Solidly ended up being abandoned, in very unsurprising news.

Dani Sesta has a controversial past of hiring a notorious scammer to be his CFO, getting liquidated in his own protocol, and then having numerous protocols in his Daniele Coin Universe get rekt.

Dani left the project and soon after Andre, the serial project abandoner, had his feelings hurt and fully rugged the protocol & everyone who moved money to Fantom for the launch.

The trolling of Cronje started after Andre called out protocols who were trying to game the Solidly launch. This evolved into the followers of a particular whale, Roosh, giving Andre a hard time on Discord.

Ironically, Roosh was allegedly pump & dumping the tokens on his followers while rallying them to troll Andre. Roosh was using the money from his sales dumps to try to further game the Solidly launch for his own gain. However, this left Roosh exposed.

And then Andre Cronje did the most Andre Cronje thing and just quit the project. He didn’t get a team together and let them take over while he fades away to maintain order and avoid hurting retail who followed him onto Fantom. Nope. He had his partner tweet out the 2 of them were quitting and Andre deleted twitter.

What is the Current Liquidity Crisis On Fantom?

Who is the whale who is currently close to being liquidated? None other than Roosh. Roosh has a nearly $60 million loan out on Scream and most of his $80 million bag is locked long-term in Scream, Solid, & Deus, three Fantom protocols. With Andre rugging the Fantom ecosystem the health of the loan got down to 1.01.

The whale narrowly missed being liquidated by getting liquidity from Deus protocol, and the loan health now sits closer to 1.2. However, with $FTM price continuing to look weak, no large upcoming catalyst for the chain, and other whales circling, it is uncertain if the problem has only been prolonged.

If the nearly $60 million of the loan is liquidated, the concern is that there won’t be enough liquidity in the pools and swaps will become hard and have high slippage. If you add in some bots arbitraging the trades, you can quickly get to a largely unusable chain.

Any Counter Arguments?

There has been some pushback that the above tweets and theories were FUD. There are allegations that @alltheway08 is heavily involve with another chain and has been trying to FUD Fantom for a long time.

Fantom supporters have also said the fears of he liquidation shutting down the protocol are overblown. They point to Fantom’s low transaction costs and speed as support. However, the price on gas and transaction speed both took a hit as the news was breaking and people scrammbled to remove their assets.

Lastly, Scream had no incentive from a liquidation and there was thoughts that the protocol could work with the whale to avoid it..

Wrap Up – Andre Cronje Rugs so Hard He almost Broke Fantom

In the end, the whale did not get liquidated and Fantom is still around.

The calls to pull all your assets off Fantom seem to have subsided. The whale has a 1.2 health ratio on his loans, giving him some buffer. And after bottoming a bit below $0.69 (nice) the price of $FTM has rebounded a bit to $0.79 only days later. Therefore, despite not being in the clear yet, things are looking better than they were at the end of April.

However, after nearly winning the Rug of the Month award in March, Andre gets the crown for April. Rugging the chain you are the unofficial face of is impressive. Rugging the chain you are the unofficial face of so hard that you almost cause a liquidation event and break the entire chian…that is award-worthy.

[Editors Note – Andre was going to accept the award in person, but his cat looked at him funny so he had to decline due to emotional truama.]