Are Vote-Escrowed Tokenomics becoming the next big trend in crypto?

You are likely going to come across Vote Escrowed Tokens (veTokens) soon if you haven’t already. Many well-known protocols are looking to, or already have, incorporated them.

Yearn Finance is considering a $veYFI token for its revamp. Andre Cronje & Daniele Sesta have been teasing a launch on Fantom blockchain of a ve(3,3) token. (This combines vote escrowed with the (3,3) mean popularized by Olympus DAO). Hundred Finance has $veHND, Pickle Finance with ‘Dill’, and Astroport Finance all currently use some form of the ve model.

The crytpo-verse is a series of rotating narratives. We had DeFi summer. We had ponzu season where Ohm-forks were being launched left & right. There has been NFT crazes, Curve Wars, and Alternative Chain runs. With the number of protocols looking to adopt vote escrowed tokenomics, do we see ve season next? If so, do you know enough to be prepared?

When done correctly, vote escrowed tokenomics can help align incentives between users and the protocol. There is huge opportunity for the vote escrow model to be a success by keeping all stakeholders aligned and focused on long-term protocol performance.

However, relying on game theory has been hit & miss in other protocols. Vote-Escrow is just the next evolution of game theory in crypto. Additionally, bad actors may be able to leverage token time-locks to take advantage of users.

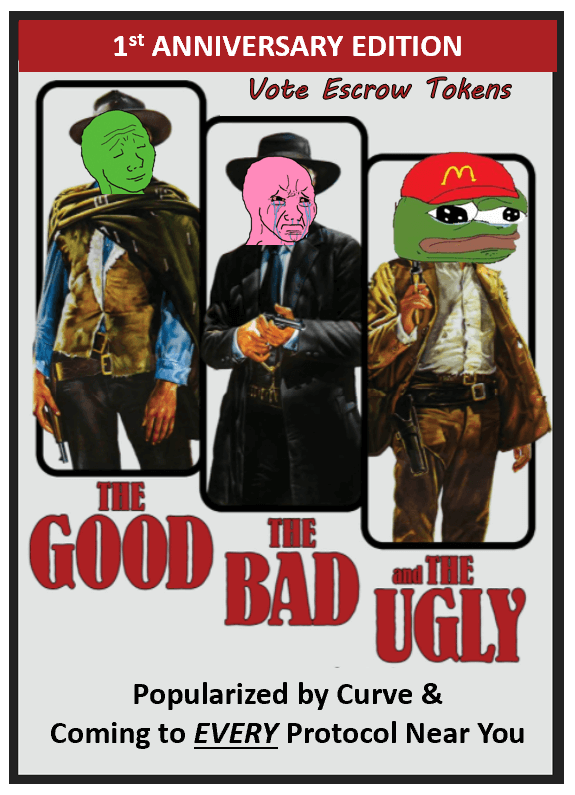

What are the potential good, bad, and ugly results of the vote escrowed model? Is time-locked tokenomics a positive step for crypto as a whole?

What Are Vote Escrowed Tokens?

Vote-Escrowed (VE) tokens have been slowly gaining more and more usage across protocols. Curve finance is probably the most well-known of the VE tokenomic models. Curve pioneered the basic foundations for the vote-escrow model and seen massive success, where Curve is called ‘the backbone of DeFi’.

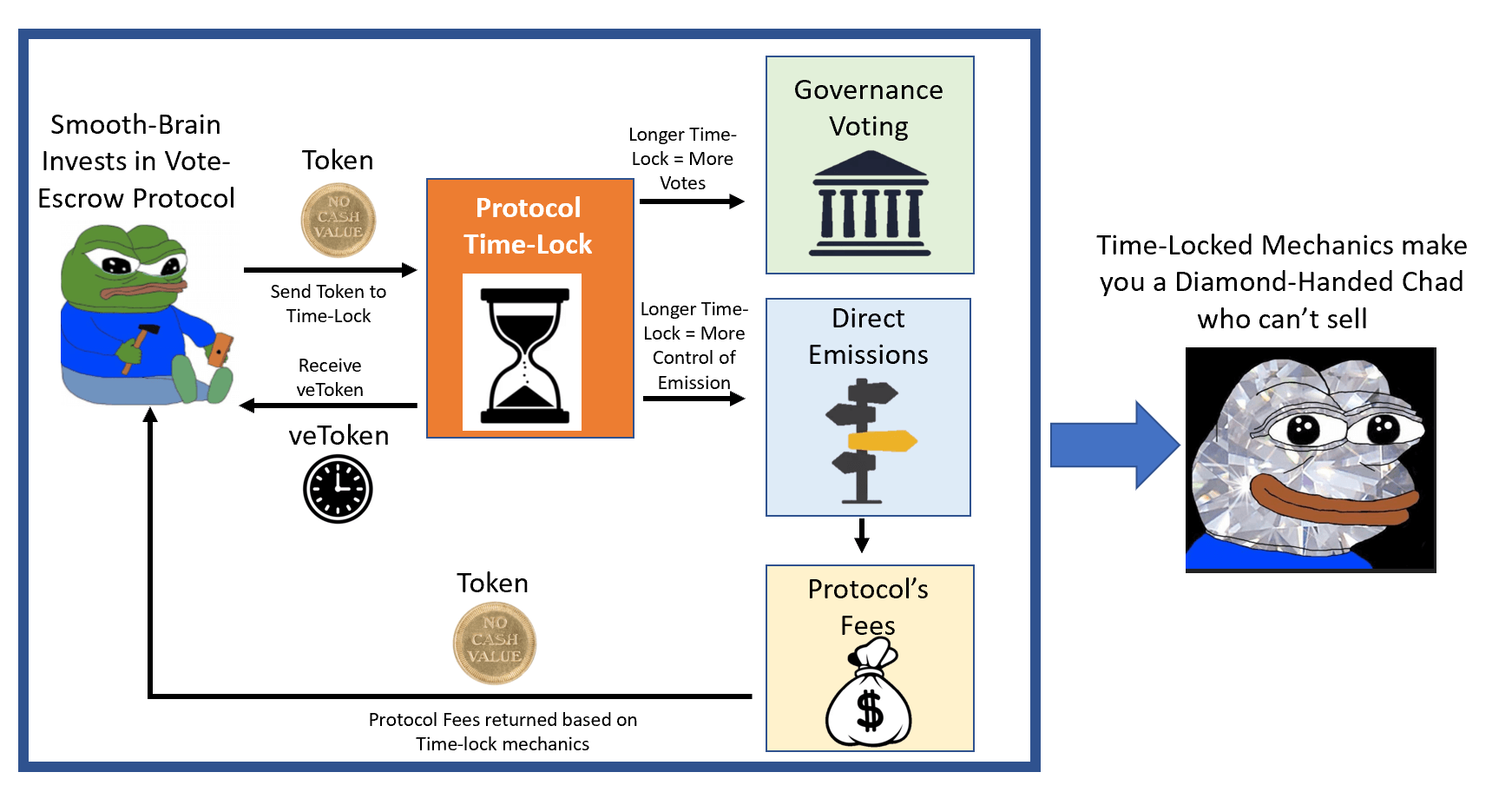

How does the VE model work? Vote escrowed tokenomics allow the token holders to select a lock-up period for their tokens. The longer you elect to lock-up your tokens, the more weight your tokens may get in:

- Governance voting

- Earning staking rewards

- Voting on boosts to certain pools

The theory is that those willing to time-lock tokens the longest are those who believe in the protocol the most. Therefore, these are the people who should reap the most rewards and have the most say.

Vote Escrowed Tokenomics Example – Curve

If you are unfamiliar with vote escrowed tokens, a quick walk through of curve may help.

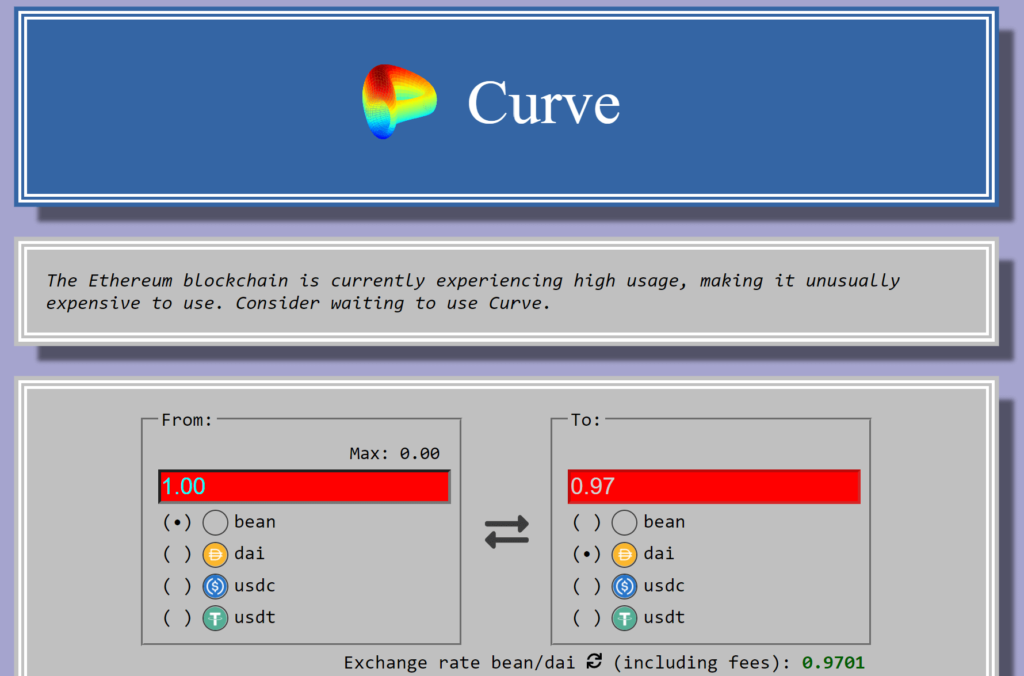

Curve aims to minimize stable coin swap slippage and has become one of the most crucial components of DeFi. Any stable coin issuer who can own a lot of curve’s token, $CRV, can direct $CRV emissions to their stable coin’s pool. More emissions to your pool, means a higher APR, which attracts more liquidity and results in a tighter peg & less slippage.

Tight pegs and low slippage are pretty much the most desirable components for a stable coin swap.

Curve introduced giving different weights to tokens proportional to how long they were locked up for. You can earn up to a 2.5x reward boost if you lock your token for the max 4 years, meaning 1 token > 1 vote.

So a protocol that wants to control emissions is incentivized to lock up their $CRV for 4 years to gain the most voting power. A protocol can improve their stable coin performance by having more voting power and tighter pegs & low slippage will help drive more users to the stable coin.

Therefore, in the Curve model, the stable coin protocols benefit from higher user growth if they can acquire more votes to send better APRs to their pool. And the Curve protocol has less sell pressure and more stability on their token as everyone is incentivized to buy and lock $CRV for the longest period to get the most voting power. The result to curve protocol is alignment between token holders and the DAO.

Convex & Other VeToken Aggregators

Getting into the nuances of Convex and its relationship to Curve is out of scope for this post. At a high-level, Convex allows $CRV holders (both governance coin and LPs) to deposit their Curve tokens on Convex.

Convex pays users a higher APR than they could likely get on their own by pooling the deposited curve tokens. Additionally, Convex has its own token, $CVX, that it adds in to boost the APR further which helps encourage people to use the protocol. Convex is essentially enticing users with higher yields if they let Convex pool voting power to try to maximize its own Curve emissions.

There are definitely benefits and negatives to the Convex model. However, Convex sprung up to pursue the huge opportunity in controlling Curve emission. In the future of many veToken protocols, you have the risk of a cartel-like group pooling resources and taking over.. I will mostly ignore the possibility of aggregators for the remainder of the post. Instead this post will focus on the good, bad, and potentially ugly of the stand-alone ve model.

Vote Escrowed (ve) Tokens – The Good

Vote Escrowed Tokens (veTokens) have many positive attributes. It makes sense that many protocols have started to use or plan to use a form of vote escrowed tokens. Many future protocols are discussing including time-locking as well (without vote multipliers, but better APR)

veTokens Align Incentives

As previously stated, veTokens attempt to align the protocol and the token holder’s incentives. If you locked up your money for 4 years, you are incented to see the protocol succeed. Four years in crypto is 100 years in other markets, so this is a large commitment.

Additionally, large accounts can gain lots of additional rewards by controlling more of the protocol. Having large holders locked into a protocol for a long time should encourage them to continue to support the protocol.

VeTokens Encourage Participation in DAO

One issue many DAOs have is lack of participation in voting & governance. When the protocol gives extra votes for longer time-locks it is an opportunity for users to multiply their voice. Therefore, token holders most interested participating in the DAO governance can do so by max time-locking.

Additionally, regular users are also going to be more incentivized to participate. If a user locks up tokens solely for higher emissions, they now have an illiquid token. They have locked up wealth for a long time and need the protocol to last. This also gives them an incentive to participate more in the democracy around the protocol.

Vote Escrowed Tokens – The Bad

However, there is some downsides to vote escrowed tokenomics. The bad revolves around both the ethos of crypto & potential holes in game theory. I wouldn’t consider anything here a ve-killer, but should be in the broaders conversation

VeTokens Creating a New “Old Guard”

First, VE tokenomics allow whales to consolidate their control. The richer you are, the less liquidity you need. The VE protocols can quickly turn into whales just owning them all. Similarly, older protocols with large treasuries can take control and make it harder for any new protocols to challenge them.

Both of the above points arguably go against one of the aspirational goals of crypto – provide equal opportunity and level the playing field for all, not just the favored few. TradFi had too many gatekeepers allowing for the already wealthy to control the system. Crypto was supposed to do away with those gatekeepers.

Since whales and DAOs have less liquidity needs, they can max lock all their tokens and take a majority of a protocol with less than a majority of the coins. (Assumes most non-whales / DAOs will not max lock all their tokens.

Some recent protocols have been created for the sole purpose of trying to optimize the profitability from veTokens. For example, Redacted Cartel used the OHM model to bootstrap liquidity to invest in $CRV and other protocols to control the governance and direct more emissions back to its treasury.

As these protocols grow, at some point the old guard may be too large for a new protocol to overcome.

Game Theory in Crypto – Ponzis

VeTokens are not the only coins that have relied on game theory. Ponzi season saw the success of OHM and all the OHM-forks.

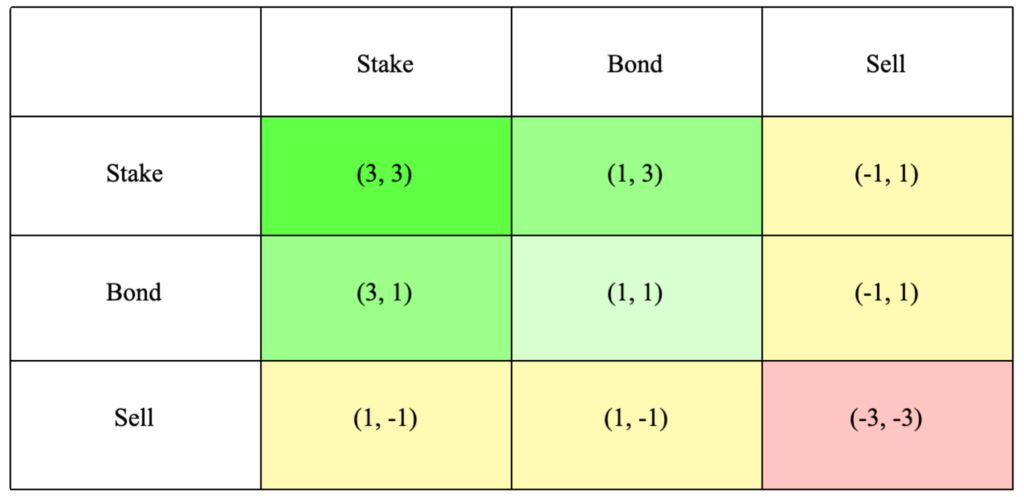

Ponzu’s success was based on game theory. The common expression of this was (3,3) based on Olympus DAO’s popularization of the meme in their white paper.

In short, the best outcome for everyone is if all token holders stake their tokens and hold. The protocol has stability which entices new money to flow in and stakers see an increasing price along with an increase in coin supply.

(Coin accumulation was pre-migration to the gOHM model that is currently used where the rebases are implied in the gOHM price. However, the theory doesn’t change).

However, if you remember the prisoners dilemma part of game theory, you know what the problem is. Even if the best outcome for the 2 prisoners is if neither one of them talk to the police. The risk of the other guy snitching and you getting charged is the biggest punishment.

If you are trying to maximize your outcome in any prisoners dilemma scenario, the best option is to rat first.

Similarly, if you are in a ponzi, the best option for you personally is to get out early before you are left holding the bag.

We have witnessed that behavior.

Game Theory in Crypto – Lock-up Periods

Temple DAO had a lock-up period for early investors. These were members who completed all the tasks to be in the limited early release group. However, the lock-up design lead to price dumping post lock-up. Each user in the early group was locked for the same length of time from purchase. However, for temple the purchase time of everyone was different meaning unlocks from the first cohort of owners would mature at different times. So some members of the early release group were able to sell $Temple while everyone else was still locked for others.

During the purchase window of the early release, users could only buy and not sell. As more users purchased throughout the early release period the price of $Temple increased (no one could sell). When the first users lock-up period expired, they had a token that appreciated a lot and lots of supply getting unlocked in the coming days.

Even though everyone would be better off staking & chilling, the rational move for these early unlockers were to sell and take the gains while no one else could rather than hold and potentially be dumped on. When the next unlocks came up, those holders were even more incented to dump as they now had evidence other holders would.

This lead to a negative flywheel and the late unlockers were stuck holding an illiquid token as the price dropped.

Vote Escrowed Tokens – The Ugly

I can foresee a lot of potential for abuse in vote escrowed tokens due to having a lot of tokens locked up and illiquid. This seems like a ripe opportunity for the scammers, fraudsters, and pump & dumpers to get retail to have long lock-ups and then dump on a helpless retail base.

Nothing in this section is specific to the ve model. However, the problems all seem exacerbated due to the time-lock of tokens. Especially as small market cap ve protocols get launched.

Long-standing protocols, like Curve, and protocols with strong well-known creators likely won’t participate in any of these shenanigans. However, this is crypto and there is still a lot of shady characters.

VeTokens and Dev Abuse

We already see many protocols that pay fairly obscene salaries to their devs in new tokens. In a lot of the less scrupulous protocols, the devs immediately dump the tokens. The regular dev dumping cadence is done despite every token holder also having the ability to sell their tokens.

How much more dev token abuse can happen when the majority of your token holders can’t sell for 4 years. Market your token well, get a bunch of money locked in and while you continue to sell your tokens you are granted.

Additionally, if you have a bunch of tokens locked for a long period of time, there can be less incentive to keep delivering. More than one project has abruptly ended midway through its roadmap because a dev was ‘stretched too thin’.

VeTokens and Whale abuse

Similar to above, many whales have a ‘known public wallet’. In the veToken system, they can max time-lock the tokens in their public wallet and use shorter time-locks in the unknown wallets. That allows them to dump on smaller retail from private wallets but can claim to be supporting the protocol with long-term locks on public wallets.

Liquidity & Liquidations

For all the degenerates among us who like to take on leverage, one other thing to consider with your time-locked tokens is how it impacts your ability to de-lever. The crypto market is currently down nearly 50% from highs and there are large wicks down in price. Token prices are moving 20%, 40%, and more over a couple of hours.

If you have a loan out and need liquidity, but a large amount of your portfolio is locked up and not available, do you run into your other positions being liquidated?

Imagine having a loan using ETH as collateral and ETH is dropping in price, but the majority of the rest of your tokens are locked in long-term on other protocols and illiquid. You can hope that secondary markets spring up around the locked tokens similar to locked Curve, but with every protocol using the VE model who knows.

Additionally, there is a strong belief that institutions and whales make large trades to quickly cause a large price swing and liquidate positions. This potentially becomes easier if token holders don’t readily have access to large amounts of their portfolio.

Conclusion on Vote Escrowed Tokenomics

Vote Escrowed tokenomics are definitely an exciting way to set up a protocol. It is hard to look at the success of Curve and the ongoing ‘Curve Wars’ to control the protocol emissions and not see the potential for veTokens.

However, if we see a true VE-season in crypto with every protocol adding veTokens, the design does seems ripe for abuse.

Watching how the vote escrow system impacts protocols and evolves over time will be interesting. This post covers just one observers thoughts based on the current landscape. Crypto is constantly evolving and protocols may come up with innovative ways to deal with the downsides of the VE model while maintaining the upside. At a minimum, make sure you think through the potential for a good rugging if you lock up tokens for years in some newly launched DAO.