The fallout of the FTX bankruptcy is not yet done. Digital Currency Group (DCG) is the parent company to both troubled Genesis as well as the Grayscale Bitcoin Trust $GBTC. As Genesis is under pressure from FTX, it is pressuring the parent company DCG, which in turn is imperiling GBTC.

Grayscale Bitcoin Trust is the largest institutional Bitcoin product and has just hit a new record discount to net asset value (NAV). The product had a previously high premium to NAV of over 40% in 2020 but has been at a discount since the beginning of 2021.

What is going on with GBTC and should you invest? (No. The answer is no unless you are a speculator. Not your keys, not your coins).

DCG, Genesis, Grayscale, and how they fit together

For the rest of the post to make any sense, you need to know each of the entities involved.

1) Digital Currency Group (DCG)

Digital Currency Group (DCG) is the “parent” company and it owns a portfolio of assets. It was founded in 2015 by Barry Silbert, one of the people early to the industry. It has investments in over 150 companies in 30 countries.

DCG owns and operates 5 different businesses in crypto:

- CoinDesk – crypto media platform

- Genesis – institutional lending and brokerage firm

- Grayscale – largest digital currency asset management firm

- Foundry – financing and advisory firm with a focus on mining and staking

- Luno – digital asset exchange

You can see all the assets DCG owns here.

2) Genesis Global Trading & Genesis Global Capital

Genesis has different entities that make up the firm. Genesis Global Trading is a crypto trading, lending, and asset custody platform that focuses on institutional and high-net worth (HNW) clients. Genesis Global Capital is the USA retail facing entity. Additionally, Genesis Block is an international entity. Collectively they make up Genesis.

Genesis froze withdrawals and redemptions on Nov 18, 2022. This freeze came one day after a Wall Street Journal report that Genesis was facing a ‘run on deposits’ and needed an emergency $1 billion.

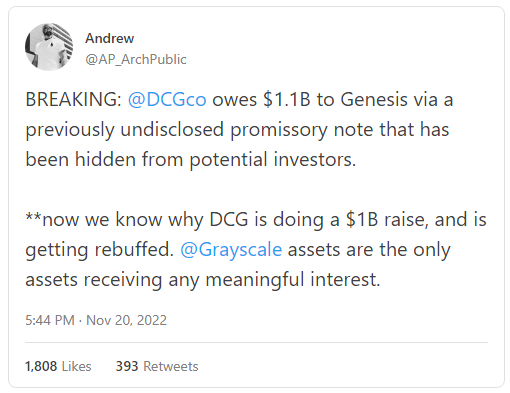

Twitter sleuths have also found an alleged undisclosed $1.1 billion promissory note between DCG and Genesis. This further ties DCG into the mess.

DCG has allegedly been shopping around for a $1 billion capital raise and getting rebuked, leading to speculation that they may need to sell off assets. The main asset worth anything is the Grayscale Investment segment.

Genesis is a key lender in the crypto space, including the main backer of the stable coin Circle.

3) Grayscale Investments

Grayscale investments is a digital currency asset manager that offers both private funds for institutions and accredited investors as well as publicly traded products.

Grayscale’s public products are:

- Grayscale Bitcoin Investment Trust ($GBTC)

- Grayscale Ethereum Trust

- Grayscale Ethereum Classic Trust

- Grayscale Digital Large Cap Fund

- Grayscale Litecoin Trust

GBTC was approved on 1/21/2020 to be the first digital currency financial product to be an SEC reporting company.

Grayscale charges a 2% management fee based on the price of GBTC (and the other 4 public products). With over $10 Billion in market cap, this brings in $100s of million.

It is worth noting, the 2% fee is based on the value of Bitcoin in the trust, not the GBTC security. Since GBTC is at a massive 40% discount, this means that the fee drag on the asset is well north of 2%. Quick math: If the trust has $100 of NAV and trades for $60 (a 40% discount), this means it has a $2 fee. But $2 on your $60 security is 3.33% annual fee. Ouch.

Trouble Starts at GBTC

When the Greyscale Bitcoin Trust was trading at a premium to NAV, DCG & Genesis could print money.

Simple math: If BTC is $50k but the trust trades at a value equivalent to $60k, Greyscale could buy a BTC at $50k for the trust and sell shares at a $60k equivalent and ‘make $10k’. However, when the trust trades at a discount you can’t do that anymore.

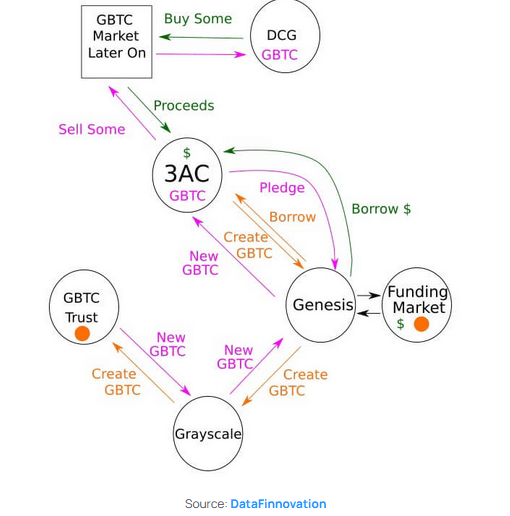

There is a very convincing theory out there that 3AC, Genesis, Grayscale, GBTC and DCG were all working in concert to maximize profits to themselves by pumping up demand and price for $GBTC.

This was described as 3AC and DCG working together to squeeze as much from the premium to NAV as possible. Arthur Hayes shared the theory by linking to the post.

The full post is here.

With both the Greyscale and Genesis being registered with the SEC, they need to make public disclosures.

The $GBTC premium flipping to a discount and the 3AC blow-up put a serious hurt on the profits to Grayscale and ultimately DCG.

Note – The above theory has been labeled as slander by representatives of DCG.

Genesis A $2.4 Billion Creditor to 3AC

In mid 2022, Genesis revealed it had $100s of millions of losses from loans to both Babel Finance and to the bankrupt crypto lender Three Arrows Capital (3AC). At the time, DCG had taken on some of the outstanding debts to keep Genesis alive.

More recently, it has come to light that Genesis might be in even deeper. Genesis had loaned over $2.3 billion to the now defunct 3AC.

The parent company DCG has been trying to get a $1 billion capital raise, presumably to shore up its balance sheet and help keep Genesis solvent.

“It looks like DCG and 3AC were engaged in some kind of scheme to extract value from the GBTC premium.”

Grayscale Refuses To Provide Proof of Reserves

With the backdrop of all the negative news, questions have arisen about the location of the Bitcoins that are supposed to underlie GBTC.

Grayscale has publicly tweeted that it will not provide proof of reserves nor will it list the on-chain wallet. The Nov 18 tweet from Grayscale sited ‘security’ concerns in revealing the wallet(s). But refusing to show proof has only lead to further speculation of insufficient backing.

GBTC is supposed to hold ~$10.5 billion of Bitcoin, totaling over 633,350 BTC.

Grayscale and FTX

On Nov 10th, Genesis Trading posted that it lost $175 million in the FTX bankruptcy. The Bahamas-based SBF owned firm, FTX, has been all over the news due to what appears to be fraudulent use of users funds.

FTX was alleged to have been swapping user’s funds with the prop shop Alameda (also owned and run by SBF). In return, FTX was receiving its own token $FTT which it was printing and giving to Alameda. If true, this amounts to theft.

Conclusion:

The discount to net asset value for $GBTC continues to extend and was recently at 40%. It is unclear how much of the discount is due to:

- Huge 2% management fee (actually more) being a drain on value

- Loss of institutional interest and confidence in crypto

- The inability to transition from a trust to an ETF

- Concerns over the solvency of all the parties involved

- Reluctance to buy knowing their might be a fire sale on $BTC if Grayscale unwinds

- Some combination of the above or items unlisted

GBTC and the other Grayscale funds appear likely to continue to be at a massive discount to NAV due to the fee and continued uncertainty.

But there is a real risk that the FTX fallout may claim more companies and protocols and GBTC seems priced like there is a chance they may be one of them.

Additionally, if Grayscale sees massive outflows, it can lead to large selling pressure on the crypto assets. It seems like the contagion from Luna and FTX may still have room to run.