What a difference a week makes. FTX went from the 2nd largest crypto exchange with SBF a poster boy. Then a week later a troubled company working with CZ and Binance for an acquisition. And now FTX declared bankruptcy, while Sam Bankman-Fried (SBF), the founder is under investigation. How quickly things happen in crypto.

Allegedly SBF and 2 of his associates are currently detained by Bahamian authorities, as of late Sunday night. This is after speculation that SBF, FTX’s CEO Caroline Ellison, and multiple other associates planned to flee to Dubai where there is no expedition treaty.

Bahama’s Investigating FTX

Authorities in the Bahamas have opened an investigation into potential criminal misconduct after the spectacular implosion of the crypto exchange FTX. FTX is headquartered in the Bahamas as of last year.

Under investigation is whether SBF used user’s funds from FTX to send to Alameda in order to invest. Alameda would ‘borrow’ customer funds for ‘free’ and post $FTT tokens to FTX. The $FTT tokens were previously given to Alameda by FTX.

FTX had stated it was allowing ‘Bahamian customers to withdraw funds from the exchange due to local regulatory requirements. However, Bahamian officials pushed back that they never made the request.

“Hack” of FTX for $600 Million

Almost immediately after the bankruptcy filing, there was an alleged ‘hack’ of FTX and user’s funds were being sent out of FTX. Late Friday, $600 million was moved from users wallets and out of FTX to separate wallets. At the time, the FTX site was also down.

The FTX Support Telegram chat had a pinned message from FTX’s General Counsel Ryne Miller that stated:

“FTX has been hacked. FTX apps are malware. Delete them. Chat is open. Don’t go on FTX site as it might download Trojans”.

-FTX General Counsel Ryne Miller

Sunday, Miller stated that the FTX was moving funds to cold storage as part of bankruptcy and the process was being expedited.

The hack was done very quickly and simultaneously across users accounts. The sophistication required to do this has lead to speculation that the ‘hacker’ was an insider.

More Scandals and Speculation

There are a lot of alleged speculation floating around crypto twitter about FTX, SBF, and a host of other acronyms. Some of the speculation includes:

- SBF, his CEO Caroline Ellison, and 18 male employees who all lived in a large residence in the Bahamas would routinely engage in meth-fueled orgies.

- SBF was the 2nd largest donor to Democratic politicians this election cycle (nearly $40 million)

- SBF’s proposed crypto industry standards were a way to create barriers of entry and fuel his Ponzi scheme. Or they were there as a way to invite more regulation from a politically connected insider.

- CZ saw both SBF’s centralized plan and cozying up to politicians/regulators and decided to blow it up to save crypto. (Serious guys, how many ‘heroes’ is crypto twitter going to build up who then quickly become villians. SBF was just an ‘effective altruistic’ savior bailing out companies after the LUNA fiasco to ‘save crypto’.)

- SBF built a back-door into FTX that allowed him to move funds in an invisible and non-auditable way

- SEC Chair Gary Gensler’s old boss’ daughter is FTX CEO Caroline Ellison

- Gensler was having the SEC provide legal guidance to SBF on how to navigate legal loopholes to avoid the worst parts of bankruptcy and/or was about to give a no action letter to avoid future investigations

- A former staffer of Gary Gensler is the head legal counsel at FTX. He was also involved in helping a betting site make off with $10s of millions of users funds previously.

- FTX was a money laundering operation that was sending user’s funds to politicians, NGOs, and Ukraine

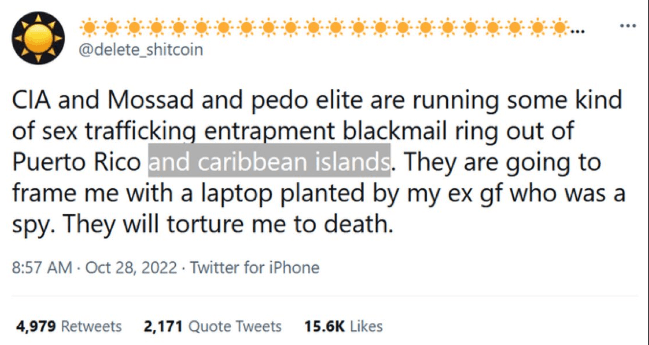

- Ties between FTX and a tweet by crypto founder, Nikolai Mushegian, 29, who was found dead shortly after tweeting this:

- FTX was exchanging user’s funds to Alameda (the crypto prop shop SBF also ran) and in return was accepting $FTT tokens that FTX was printing and gifting to Alameda.

- Alameda was ‘investing’ in ‘crypto start-ups’, but many of the start-ups have been nothing more than a 1 page website. This has lead to speculation that FTX employees/friends were siphoning user’s funds through Alameda by setting up fake start-ups for ‘investments’.

- FTX insider was the ‘hacker’ who stole $600 million in users funds as some of the actions required root level access only a high-level dev would have. This was supported by the ‘simultaneous’ moving of funds and ‘sophistication’ that would be required. A second theory is that the ‘hack’ was a government organization withdrawing money for its own use.

- SBF trying to purchase bankrupt entities from the LUNA crash was him trying to get more user’s funds to use to prop up Alameda

Conclusions

This is a very fast developing story with much more news to come. It appears like there was a lot of nefarious actions in addition to the misuse of user’s funds to send to Alameda to invest/trade to the tune of billions of dollars.

At this point, it should be clear that the only safe crypto is held off exchanges and in a cold wallet. Not your keys, not your coins.