It is no secret that attention and focus on crypto is increasing on a yearly basis. Regulation crack downs from the US have been in the forefront of everybody’s minds. Banks can’t hide from it and this is all on top of the constantly growing CBDC developments occurring, globally. Crypto is an established asset class, and it’s capabilities give you complete ownership over the assets themselves.

CEX purchase and withdrawals are a popular route for the common retail buyer, but for those focused on the ethos of crypto, privacy, DEX should be your route. Anybody moderately involved in crypto knows that P2P trading is the preference. No KYC needed being one of the main attractions here.

Easier and more user friendly methods can be found in Bisq and Matcha. Bisq is for BTC and Matcha is for ETH and various alts you are interested in. First, we’ll start with Bisq.

Bisq

Bisq is a peer to peer decentralized exchange for independent users to trade using the Bisq software. No identity verification necessary, global P2P network of users trading BTC privately through an open source and user friendly way. Bisq uses Tor and includes a fiat on-ramp for users buying with their USD, EUR, CAD, and such.

Getting started is very simple:

- Download, install, verify the Bisq software. Process takes about 1 – 2 minutes and the software is completely free.

- Create your Bisq Wallet, set up a wallet password, and write down your seed phrase and store it securely and safely and include the wallet date when it was established.

- Back up your Bisq data. Preferably externally.

- Determine a payment method for purchasing BTC. Bisq only handles the BTC side of the trade, your fiat purchases or external crypto wallet should be determined. (Payment methods listed here.)

- The last thing you’ll need to do is put down a security deposit. The security deposit is one reason why trades run smoothly on Bisq. The BTC is locked into a multi-sig escrow until a trade is completed, aka putting skin in the game!

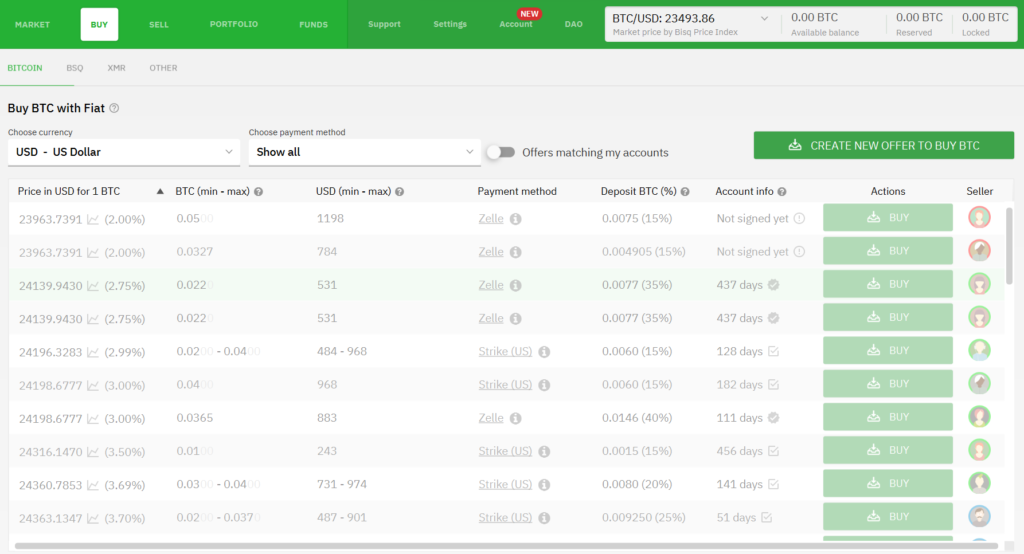

Now, you’re ready to trade on bisq. Below is a preview of the dashboard if you were just starting out.

It is noteworthy that in P2P trading, those who make offers usually have more power in the trade, people enjoy the convenience of accepting an offer more often than not! When entering into a trade you’ll be able to communicate with the buyer/seller via chat box. iOS and Android users can also download the Bisq app for their phones to notify them of trade updates when they’re away (if interested).

Out of all the DEX Bisq is not popular. It’s not even in the top 10 or top 100 in daily volume, but, it works. The fees aren’t too bad as well, averaging 1% fee per trade, which is much better than the average CEX trading fee you’ll find on Kraken, Coinbase, Binance, etc.

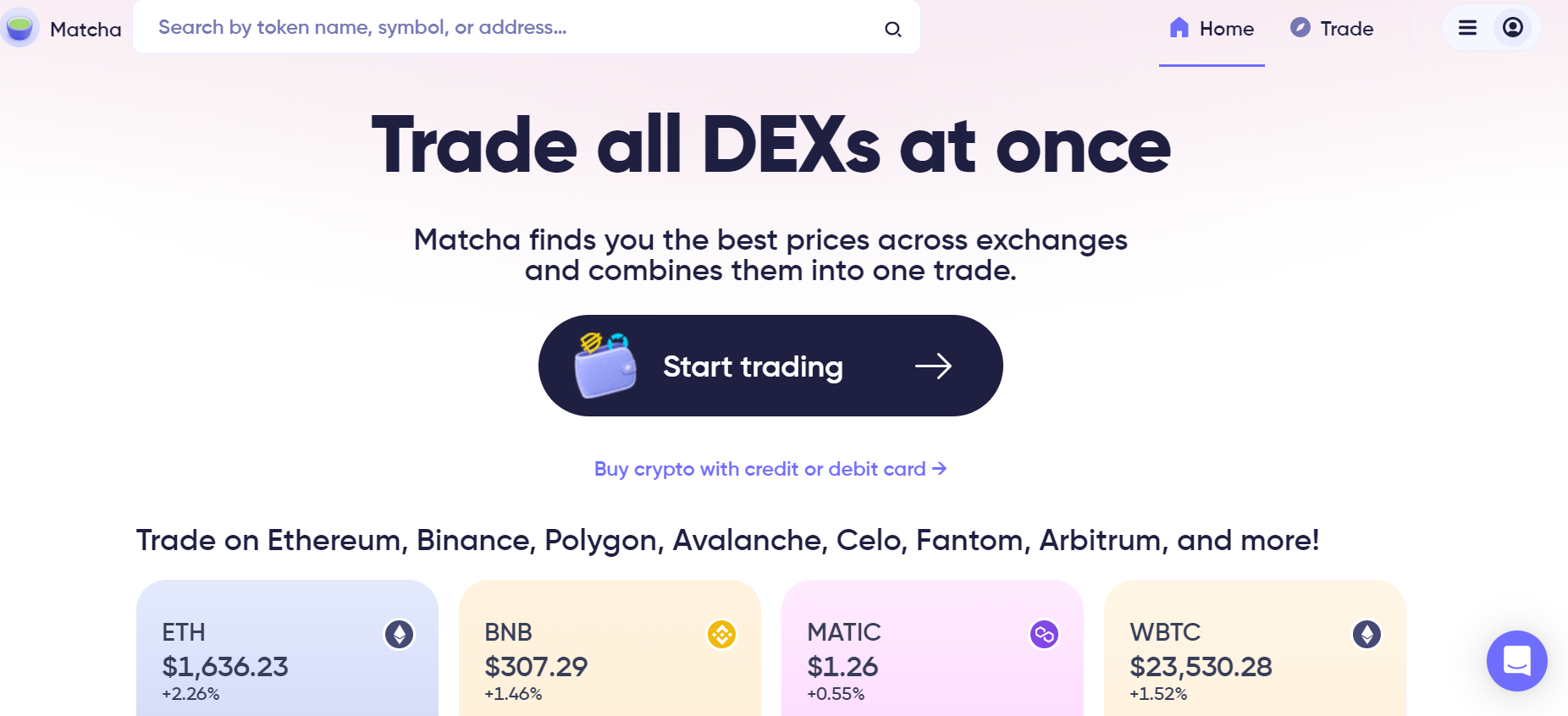

Matcha

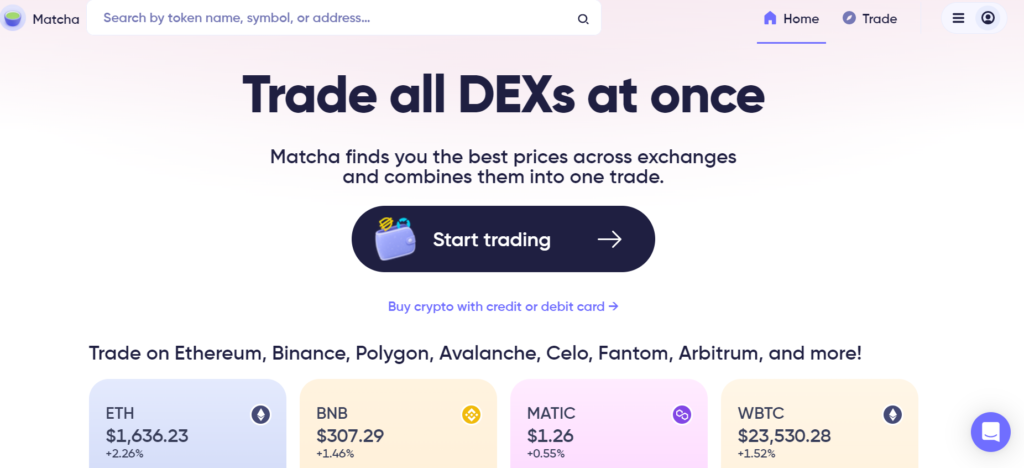

Matcha runs a little differently than Bisq, you can think of it as more of a DEX aggregator that is built on Ethereum. Matcha is powered by 0x Labs and provides users the ability to trade P2P in a simple manner. Users can connect their Ethereum wallet, or use debit/credit cards to buy across all DEX, and connect to the best current price. Thereby connect users to the best available market price. Matcha supports Ethereum, BSC, AVAX, Arbitrum, Optimism, and more.

Matcha allows you to then send your crypto to your dedicated cold storage after purchase. Bisq and Matcha should become some of your preferred ways of buying crypto. If you still use CEX, begin to move toward applications like Bisq and Matcha.

Matcha supports the following wallets as well: Metamask, Rainbow, WalletConnect, and Coinbase Wallet. Matcha, however, does not support hardware wallet connections directly, and you wouldn’t want to do that anyways! Use dedicated hot wallets/browser extension wallets when DCA or running quick trades.

Fees on Matcha are in the same ballpark as Bisq, but in my experience they tend to run slightly lower. Gas fees here are quite reasonable, with all associated trade costs placed up front. If buying with a debit/credit card it is worth noting the minimum buy is no less than $300.

Matcha does not have any limits for purchases, no deposit or withdraw fees.

Conclusion

Hope you’re all familiarizing yourself with DEX and the advantages they provide for you. It may be 1 min faster to click buy on Coinbase, but buying via DEX is the true way in crypto and better for you and your wallet.

If you haven’t already, the DeFi Education team also put out a great article on this subject back in January, check it out if you enjoyed this.