The US subsidiary of Binance has been selected by Voyager Digital to acquire its assets as part of Voyager’s Chapter 11 bankruptcy proceedings. This comes after FTX, the original acquirer, went bankrupt itself. The deal is valued at $1.022 billion with just over $1 billion being the Voyager portfolio and $20 million of ‘incremental value’.

Voyager will seek approval in bankruptcy court for the asset purchase agreement to proceed. The hearing is scheduled for January 5, 2023.

Voyager Bankruptcy

Voyager filed for bankruptcy protection back in July 2022. Voyager had extended a significant loan position to Three Arrows Capital (3AC) who then defaulted on the loan. The loan to 3AC was over $650 million and was lent in 2021 when Voyager had nearly $6 billion worth of assets.

However, with the crypto downturn, Voyager was down to only $1.3 billion in assets left.

FTX Bankruptcy Impact

FTX was the winner of the original bid process in late September. At the time, the deal was valued at $1.42 billion and was being reviewed by the Texas Securities Board.

However, in November FTX ran into its own troubles and claimed bankruptcy.

Since then we have learned that FTX was a proverbial dumpster fire of compliance. FTX and its founder Sam Bankman-Fried (SBF) was comingling customers funds with its own investments. Additionally, FTX was loaning customer’s funds to its related prop trading company, Almeda.

Almeda ended up getting into financial troubles in part due to the Luna/Terra blow up. (Read more about FTX, SBF, Almeda, and the theft of customer’s funds here.)

Cynically, there is speculation that FTX was going on a purchase spree in mid-2022 in order to acquire more assets to prop-up its balance sheet. As Almeda was losing money, it needed more liquird assets. It is speculated that the purchase of Voyager was part of a scheme to get access to more customer’s fund. FTX and Alameda would then be able to show more assets on its financials and fill liquidity gaps on Alameda’s positions.

SBF was recently arrested for numerous federal crimes in connection to the FTX bankruptcy.

Binance Steps In

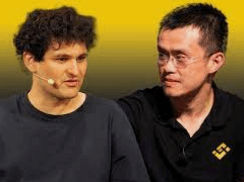

The Binance acquisition has its own hair on it. Binance’s CEO, Changpeng Zhao (CZ) has been blamed for having a hand in FTX’s downfall. Then CZ offered to purchase the failing FTX, before quickly pulling out of the deal once gaining access to FTX’s books.

However, others point out that CZ may have been acting prudently to quickly pass on FTX. The recent criminal charges, and the commingling of customer’s funds with its own trading, point to a lot of issues that CZ was wise to avoid.

Binance.US is a separate legal entity with a licensing agreement from major crypto exchange Binance. CZ is the majority owner of Binance.US.

Binance was established in 2017 and quickly gained popularity in the US. In 2019, Binance split out its US operations into Binance.US. The separation was done to have a ‘regulatory inquiry clearing house’ entity to ‘catch and contain concerns from US Federal regulators.

Last week, Binance temporarily halted the withdrawal of the stablecoin USDC. They cited daily banking hour constraints due to a period of record customer withdrawals. The ‘run’ on Binance was driven by the publication of its proof of reserves (PoR) report. The proof of reserves fell short of the expectations customers had.

The audit was done by French accounting firm Mazars and was less transparent than was expected. Without the full picture of its liabilities, investors in Binance were concerned the undisclosed reserves may prove to be a concern.

What does This Mean For Voyager Customers?

Once the deal between Binance and Voyager closes, Voyager customers will be able to access future disbursements. The disbursements of crypto holding will be through the Binance.US platform.

The 3.5 million Voyager accounts are waiting for a final decision. Under the original agreement with FTX, users were to receive an account credit and custody of specific cryptocurrencies that FTX supported.

If the asset acquisition is approved, the funds will be transferred from Voyager to Binance.US on a court-decided prorated basis. Then it is up to Binance.US to try to retain customers and assets.

The bankruptcy plan is subject to a creditor vote. If approved, the funds may be transferred as soon as March.

Conclusion

The fallout from the Luna/Terra blow out appears to be coming to some conclusions. Voyager was one of the bigger platforms to be bankrupted. And now after the original $50 million deal with FTX blew up, it appears that Binance may be able to acquire the assets for $20 million.

Voyager customers are likely relived to see a new potential end to this saga. However, with all the rumors and speculation around Binance, CZ, and its own financial issues, there may yet be another shoe to drop.