News moves fast in crypto. Dani Sesta was liquidated in his own protocol yesterday. This sent $wMEMO, the token of Wonderland.Money, into a freefall. Crypto Twitter rumors swirled that Dani purposely allowed himself to be liquidated to have plausible deniability while rugging $TIME. (seriously, read the previous article).

Another theory going around is that the liquidation of Dani was driven by a whale hunting for a chance to cause a liquidation cascade. This whale may potentially be one angry at Dani. The price action of $wMEMO today with huge price wicks up and down is indicative of a whale fight.

Additionally, Dani & Sifu had previously announced that Wonderland would buy back $wMEMO below the backing price. This announcement, combined with Dani & Sifu publicly showing their liquidation price, encouraged many holders to also take out loans. The users assumed keeping liquidation prices below backing & the founders would be safe. These users also got liquidated yesterday leading to separate complaint for these $wMEMO holders.

This morning, Dani posted that the ‘buy back bot’ ran out of money. He also claimed the liquidations were caused by whales nuking the price to buy back cheaper. The whales know there is a buyback in place and if they can buy below treasury, they can arbitrage the buy back.

What has transpired today?

New Proposals for Wonderland & Abracadabra

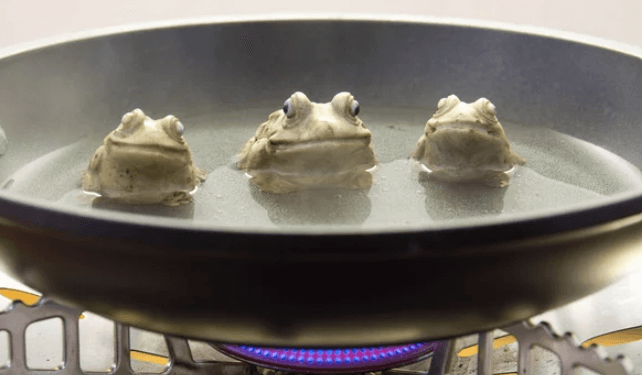

Two proposals have been put out to frog nation today.

- Proposal to merge Wonderland & Abracadabra

- Proposal to allow users to “rage sell” $wMEMO and receive the backing value in return

Proposal to Merge Wonderland and Abracadabra

The first proposal is to merge wonderland and abracadabra. Depending on your view, this will make “the most powerful entity in DeFi” or is “bailing out $TIME with $SPELL”.

The attached medium article says that Wonderland’s $800mm+ treasury would move over to abracadabra. $SPELL and $sSPELL holders would keep their governance control over cauldrons, $MIM replenishments, and the new $800mm treasury. The document is sparse on details and numbers but claims this would be accretive to everyone.

Additionally, upon the merge, spell’s emissions would go to 0.

In the ask-me-anything (Twitter AMA today) Dani discussed taking the 98Billion $SPELL available to buy all the $wMEMO. This 98B is made up of 80B in the Treasury and 18B from Dani & Merlin.

Proposal to Trade $wMEMO for Treasury Value

For users who don’t like the merger, they will have the option to ‘rage sell’ their token back to the treasury at the backing value. This seems fair and would allow $wMEMO holders who purchased for the APY to get some value above the current price.

However, this lead to a separate discussion around Wonderlands Treasury Value.

What is the Real Wonderland Treasury Value?

One important outstanding question is, ‘what is the actual treasury value’? Many users have questioned if the $800million value quoted will align with the actual value from a future audit.

For one, a large portion of the Treasury is in Time/AVAX LP, wMEMO/MIM LP, and TIME/MIM LP. This ‘self-investing’ means when the $TIME & $wMEMO price drops, the Treasury value drops. Similarly, if a large portion of the revenue for time is derived from the protocol owned liquidity (POL) model, then that revenue goes away post merger.

Secondly, Wonderland’s other holdings are largely exposed to $wETH and $AVAX. This isn’t a stable coin treasury like some OHM-forks.

Therefore, the question remains, has the Treasury been updated for the most recent price changes?

Dani Sesta Paying Liquidated $wMEMO holders from Wonderland Treasury

Dani & Wonderland have stated they would support the price of $wMEMO at the backing price through buybacks. With this implied price floor, many $wMEMO holders took loans out below backing. Additionally, other $wMEMO holders took loans with the liquidation value below Dani & Sifu’s liquidation values.

These holders largely got wiped out in the liquidation cascade.

In the Wonderland forum, it was announced that those who got liquidated will be made whole. This would not include Dani & Sifu who would take the loss. The payout to liquidated users would come from the Treasury. The proposal lead to a lot of infighting because that would dilute the backing value for everyone who didn’t get liquidated.

This issue is still an open one being discussed.

Olympus DAO’s Zeus Weighs in

Zeus, the creator of the original ponzi Olympus, weighed in on twitter around the buy back strategy.

Zeus’ position is that trying to prop up the price of the token near backing value leads to destruction of your treasury. Olympus will buy back tokens, but in a controlled way that rewards HODL’ers over time.

The further below Treasury value the protocal can purchase the token, the more profit that will accrue to HODL’ers. For example, buying $1 for $0.50 is always better than buying $1 for $0.99. Over the long-term, both buy backs should return price to treasury value. However, buying back tokens cheaper will lead to a higher treasury value but may take longer to reach backing value.

Dani’s Twitter AMA

Dani had a Twitter spaces ask-me-anything to answer questions from Frog Nation. Below are some notes from the AMA that weren’t already discussed in the post:

- Dani says he consistently moves coins from his doxxed wallets to private ones. The quoted transaction was from a few days prior and is just part of that process

- He claims with the recent decline in the crypto market he has been getting threats and stalkers. Therefore he wants to be even more careful with people being able to track him

- Dani lost ~$15mm in the liquidation that was posted on twitter. If he was rugging the project that was a ‘dumb expensive way to steal from the protocol’

- Wonderland was never ‘just an Ohm fork’ but an ongoing experiment of what the community wants to do with the large Treasury. The high APY was there to raise a war chest and now they can do something.

- Buying an aquarium is apparently an acceptable and funny option (hopefully said jokingly)

- Dani got liquidated because the phone number used to warn him of an impeding liquidation wasn’t white listed to come through at night.

- Dani’s personal phone number was found by someone and he was getting threats. He got a new phone and number.

- Dani only has a few numbers approved to get through at night, mostly his inner circle in case of another hack like in popsicle. He did not have the number warning of liquidations white listed and that is why he didn’t wake up and save his position from being liquidated.

The Future of Frog Nation

The proposal for the merger is being presented to both the Wonderland & Abracadabra communities for vote. Dani promised an audit of the Wonderland treasury will be provided before voting on the proposals close. However, so far the details provided are sparse so there is much speculation on what the value is of a merger.

Only $TIME will tell if Fog Nation is able to come together or if the user base of a 80,000%+ APY rebase ponzi and a governance token for a lending platform are too different to merge.