The billionaire FTX CEO Sam Bankman-Fried (SBF) released a report detailing his vision for the future of crypto regulation. The response to the proposal has been significantly negative with many crypto leaders claiming it would remove the USA out of crypto and set the entire industry back to traditional finance. What did SBF propose and why is the response to negative?

SBF Proposes Possible Digital Asset Industry Standards

In a document published on October 19, 2022, SBF proposed his ‘Possible Digital Asset Industry Standards‘ in a post on the FTX policy site. Bankman-Fried also tweeted out a summary of his proposal

The proposal reads like a very traditional finance regulatory structure and includes industry blocks on sanctioned addresses, how to handle hacks, and even a suitability test similar to being an accredited investor.

For many in the crypto industry who view it as the future and an alternative to traditional finance (TradFi), this proposal is sacrilegious.

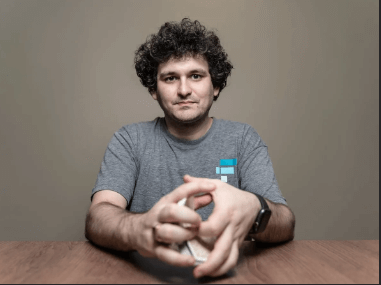

Who Is Sam Bankman-Fried?

Sam Bankman-Fried (SBF) is the billionaire founder & CEO of FTX, a cryptocurrency exchange. He also manages assets through the large and influential Alameda Research quantitative crypto trading firm. FTX has been a leader in the space, including being the first crypto entity to partner with a major sports franchise.

SBF is one of the richest, public crypto leaders at an estimated net worth of $10.5 billion. He has been quick to use his wealth to influence the industry.

However, like all crypto leaders SBF doesn’t come with his own controversy. It has long been speculated that SBF manipulates coins on the spot and derivatives on FTX to make money at the expense of retail. This is often done in concert with early investor/founder tokens he was given through Alameda’s investing.

A lot of the criticism of SBF’s proposal stems from the fact that he has allegedly made a lot of money through these less than ethical actions.

What Does Digital Asset Industry Standards Propose?

The Digital Asset Industry Standards has a long list of topics. His proposal covers the following:

Hacks

- Formalize an unambiguous standard for hacks that ensures that customer’s funds are all returned

- Additionally a ‘5-5 standard’ where the hacker can keep the minimum of 5% of the hacked amount or $5 million. This is treated as a bug bounty.

- The benefit of the 5-5 standard is it avoids egregious hack payoffs like we just saw with the Mango Markets hacker

Asset Listing & Security Definition

- SBF uses the 3 step test FTX US uses to determine is an asset is a security

- Does it pass the Howey Test?

- Does the SEC or a court declare its a security?

- Is it being properly registered?

- SBF is in support of the industry follows a clear process to register digital asset securities & is “excited” to work with regulators on the framework

Tokenized Equities

- SBF makes the case for on-chain trading being more powerful than TradFi using the Wall St. Bets induced freezes on $AMC and $GME. Since TradFi markets take 2 trading days to settle and go through 15 different entities (per SBF), when retail trading outpaces the least well capitalized of the 15 entities it poses systemic risk.

- However, on-chain lets you settle instantaneously and limits outstanding settlement & uncertainty counterparty risk.

- More importantly, it can do it with almost no regulatory capital

Customer Protections, Disclosures, and Suitability

- SBF encourages regulators to crack down on any misrepresentative or misleading marketing materials & claims

- Retail should not be able to lever up beyond what they have deposited on platform, especially whales who can crash a protocol unless bailed out.

- SBF claims ‘centralized, regulated digital asset venues, like FTX, are going to end up under various disclosure/transparency regimes including suitability checks.

- In support of knowledge-based suitability test over wealth-based

Sanctions, Allow Lists, and Block Lists

- It is crucial that validators and smart contracts are free, permission-less, and decentralized

- SBF supports block lists, not allow lists, to comply with sanctions

- Allowing all transfers opens the door to financial crimes, banning of all transfers, and can hinder innovation and/or freeze out economically disadvantaged

- Block lists prohibit illegal transfers and financial crimes

- Whereas allow lists can freeze out anyone and limit peer-to-peer transfers

- If a financial crime is committed, but not all parties know about it, how should the process work? SBF proposes:

- Custodial funds should have access to block lists including OFAC’s sanctions lists

- On-chain real-time updates should be made on what addresses are blocked

- Centralized applications should query the sanctioned addresses before sending or receiving transfers

- Since funds can be sent unilaterally, an account that receives funds shouldn’t be sanctioned, but should have a ‘burn’ address they can send tainted funds to. This would ‘cure’ the address.

- Additionally, your account should only be flagged if you try to pass along sanctioned funds

- Trusted actors should have their own list of flagged accounts that they suspect may be associated with financial crimes. Under this much lower bar, there shouldn’t be any legal limits on these addresses.

- However, it should be public enough that people can opt out of transacting with these flagged funds

- If the sanction list is updated in real-time, the industry could freeze on-chain any tainted funds.

DeFi (Decentralized Finance)

- DeFi is crucial to innovation. The industry needs to maintain free, decentralized validators and smart contract for DeFi and commerce to function

- Code and deploying of code to decentralized block chains or validating blocks according to on-chain rules should always be treated as free speech, expression, and mathematical constructs.

- Centralized financial services and centralized GUIs & marketing should be a regulated financial activity

- The result of the above 2 points would be:

- No license to upload code to the blockchain and smart contracts should remain permissionless and free

- Validators have a core duty to correctly validate blocks, not police or judge them, and should remain permissionless and free

- Americans hosting a website that facilitates US retail users to trade decentralized products or DeFi marketed to US retail would require some licenses & registrations

- Examples of free expression included are:

- Writing code for a decentralized exchange (DEX) and uploading the code to a blockchain

- Trading on a DEX with your own money

- Sending peer-to-peer transactions

- Validating transactions within the rules of the blockchain

- Decentralized Autonomous Organizations (DAOs) with purely on-chain activity

- Examples of actions that should be licensed or require registration would include:

- Websites facilitating and encouraging US retail to connect to and trade on a DEX

- Likely needs something like a broker-dealer/FCM/etc and KYC obligations

- Marketing products to US retail investors

- Actions that resemble traditional financial brokerages

- Websites facilitating and encouraging US retail to connect to and trade on a DEX

Stablecoins

- SBF sees stablecoins as a huge opportunity to modernize & democratize payments and should be regulated in a way that suports them while protecting against systemic risk

- If a coin is claiming to be stable relative the US dollar it should be backed by at least as many US Dollars or federally issued notes as their are stable coins.

- There should be KYC of traders who on-ramp/off-ramp.

- Don’t need a KYC requirement to purchase items from a store, but issuing and redeeming stable coins should be a ‘BSA-level KYC’ed activity’.

Response to SBF’s Proposal

Some of the responses and pushback to SBF’s proposal are around the high amount of regulation and type of regulation required. Specifically,

- Office of Foreign Asset Control (OFAC) is a US Treasury Department that has not only a lot of individuals, but entire countries on sanction list. For example, sending money to Iran to support a protest would not be allowed.

- Regulations in general vs standards. Standards are industry policed rules. For example the industry or any protocol could opt to follow a particular public block list as a standard. But calling in regulators means accepting ‘rules enforced coercively by the state’.

- Asset listings & securities are harder to define than SBF makes it seem. The SEC points to a nearly century old rule, the Howie test. But Gary Gensler and the SEC hasn’t clarified what is or isn’t a security, even on the top coins. This is likely due to how hard it is to define.

- Any regulation limiting a persons right to interact with any asset. The responsibility to understand and choose to interact with a smart contract should be solely on the user.

- DeFi is the future and any invitation to regulate DeFi would be catastrophic. SBF’s proposal would likely require KYC to use Uniswap. Wallets may be required to spy on and report suspicious activity to the authorities.

- Additionally the cost of monitoring would limit innovation as your average person wouldn’t have the resources to comply.

- This proposal would morph DeFi into TradFi.

- Stablecoins also received feedback that SBF only mentioned US Dollar-backed stables. What happens to collateralized stables like DAI, FRAX, and many others? They would likely go away under this proposal.

There was also a large general outcry by people calling SBF a sell-out who doesn’t care about crypto and only sees it as a way to make himself richer.

Conclusion – SBF’s Digital Asset Proposal

It is yet to be seen how this proposal and any other standards and regulations evolve. SBF laid out a plan, but the response from leading voices in the crypto space has been less than supportive.

Crypto and DeFi continues to grow and adapt. Making these types of changes now may stifle innovation. And any US-based regulation runs the risk of having the huge industry move off shore.