Vitalik Buterin is the co-creator of Ethereum. Ethereum is a more programmable blockchain than Bitcoin, and a large and dynamic ecosystem.

What is Ethereum?

Ethereum is an ecosystem and a network, and the native asset is Ether (ETH). Ethereum is a smart contract platform that empowers the development of Dapps (Decentralized Applications) and other tokens. Ethereum enables the creation of applications which present a far better replacement to the incumbent financial system.

“It is the world’s programmable blockchain, the foundation for our digital future, all you need is a wallet to take part. It build’s on Bitcoin’s innovation with some big differences.”

Vitalik Buterin

What is a Smart Contract?

A Smart Contract is a self-executing contract with the terms of the contract being written directly into code. All of the information in the contract resides at a specified address for specified purposes (bets, purchases, exchanges, etc.). It’s a collection of code (its functions) and data that resides at a specific address on the Ethereum blockchain. Think of it as an “if -> then” function. The coding language most widely used is called Solidity.

The easiest way to think of smart contracts is to imagine them as a type of account. They have a balance and they can send transactions over the network once the agreement settled into the contract executes. This is why they’re not controlled by a user, instead they are deployed by the user to the network and run as programmed.

Think of Ethereum as a large global cyber system made of different dapps and each have their own role for the people to productively and actively use their crypto. All of that requires something called Gas.

“Gas is essential to the Ethereum network. It is the fuel that allows it to operate, in the same way that a car needs gasoline to run”

Sam Richards

The demand and use of the network is determined simply through supply and demand across the blockchain, thus the gas fees. ETH powers the Ethereum blockchain and is the power to the Ethereum network. When you see the gas fees on Ethereum you are looking at a major sign of success that people are willing to pay to use the chain because of it’s capabilities and value.

What is Ether (ETH)

Ether (ETH) is the native cryptocurrency on the Ethereum network. Essentially, it is the only acceptable form of payment for transaction fees. It will also be required in order to validate and add in new blocks on the first layer, the base layer, the Mainnet after “the merge” where Ethereum moves to Proof of Stake.

ETH used as a primary form of collateral in DeFi, it is a store of value, it is a medium of exchange, it is a unit of account, and widely used as payment for goods and services, and more. It currently makes up ~20% of the entire crypto market.

The supply of ETH is burning day by day after the London Upgrade (EIP-1559), the use of ETH is constantly growing on the world’s most widely used blockchain. It launched in 2015 and has since been a massive success. Currently ETH trades for ~$2,600.

Proof of Work vs Proof of Stake

Currently Ethereum is using Proof of Work (PoW) to mine ETH, but is moving toward Proof of Stake. Proof of Work is a decentralized consensus mechanism that fundamentally causes miners to use energy to solve a “puzzle” to prevent anybody from gaming the system. Proof of work is used widely used in mining cryptocurrency like Bitcoin and Ether, and is successful in validating transactions and mining new tokens. As a result of utilizing proof of work, Bitcoin, Ethereum, and other cryptocurrency transactions can be processed peer-to-peer in a secure manner without the need for a trusted third party.

Proof-of-stake on the other hand is a type of consensus mechanism used by blockchain networks to achieve “distributed consensus”. It is believed that it will make Ethereum more decentralized. It requires users to stake their ETH to become a validator in the network, therefore putting skin in the game. Validators are responsible for the same thing as miners in proof-of-work: ordering transactions and creating new blocks so that all nodes can agree on the state of the network.

Proof of Stake also comes with many other benefits and improvements. It is more energy efficient than PoW, lower barriers to entry by reducing hardware requirements, and should lead to more nodes operating on the network.

Node operators validate all the transactions and blocks. This all goes on in the background. They also provide assistance to the network by accepting transactions and blocks from other nodes operators, validate those blocks and transactions, and sending them to more full nodes, further securing the network.

More importantly, the protocol is an open source software. Meaning anyone can download it and use it.

Ethereum’s Primary Applications

Dapps (Decentralized Applications)

A Dapp, a decentralized application, at a minimum, is a smart contract and a web user interface. More broadly, a Dapp is a web application that is built on top of open, decentralized, peer-to-peer infrastructure services. In addition, many Dapps include decentralized storage and/or a message protocol and platform. The most popular and widely use cases for Dapps are listed below.

DeFi (Decentralized Finance)

Short for “decentralized finance,” a broad classification of dapps designed to provide financial products and services on the blockchain, without any intermediaries. Therefore, anyone with an internet connection can participate. It is no surprise that currently *most* DeFi applications and projects are on Ethereum.

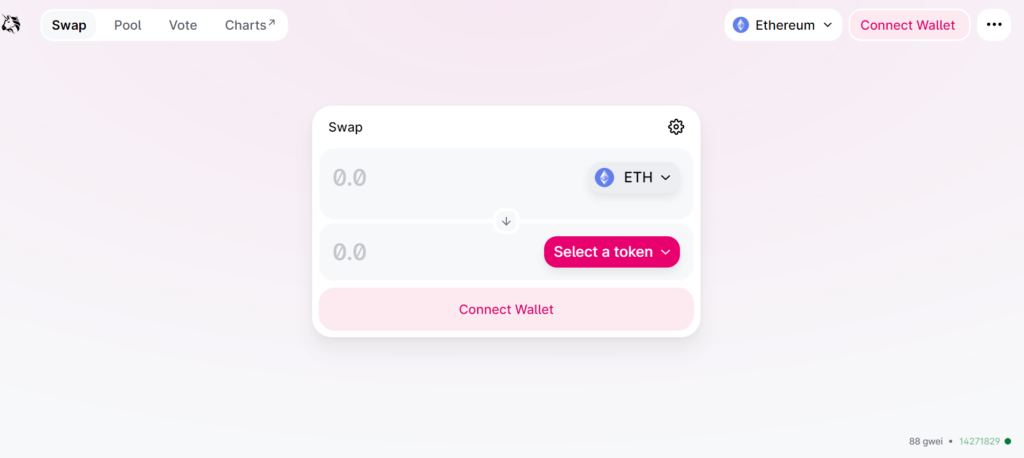

Ethereum Dapps turns all of this into “programmable money”. Below is an image from Uniswap, a popular DeFi application, a Decentralized Exchange used for token swaps. DEXs like Uniswap are disrupting traditional finance and inventing new methods. Uniswap allows you to swap other cryptocurrencies with the cryptocurrency you currently own. If you wanted to swap for another one, this gives you that option.

In DeFi you are given the ability to generate a yield on your own assets as the sole bearer. You can lend out money, borrow against your holdings, trade your assets, stake assets, swap assets, provide liquidity, and more. Thereby actively participating in a more elite global financial network. This is the biggest change and the most revolutionary change to come to finance in our lifetimes. This means all of us can fully automate our digital assets and turn them into something constructive. This is open to everyone, no restrictions and is “trustless”.

For clarification, in crypto “trustless” means that you aren’t placing your trust into a single stranger or any third party. The protocol functions on its own.

Decentralized finance makes money by replacing intermediaries with code. The premiums that banks and financiers earn by lending money, or being market makers, are available to anyone now that we have DeFi and can do this ourselves. Smart contracts and well-designed DeFi protocols allow many people to aggregate their capital and act as the collective middle man is a web-based application running on code. Thereby creating more efficiency and opportunity.

NFTs (Non-Fungible Tokens)

You probably saw the giant run-up in NFT markets last year. This caught the attention of retail and institutional players. Many have value for different reasons, the example below is a clown mask from The Hashmasks. The Hashmasks collection incorporates uniqueness in a variety of ways into their work.

“Hashmasks is a living digital art collectible created by over 70 artists globally. It is a collection of 16,384 unique digital portraits. Brought to you by Suum Cuique Labs from Zug, Switzerland.

By holding the artwork, you accumulate the NCT token on a daily basis, which allows you to choose a name for your portrait on the Ethereum blockchain.”

The Hashmasks

The first thing to know is that an NFT cannot be replicated as they are categorically non-fungible. NFTs can be traded, but each token is unique and specific. They are not interchangeable like ETH and other Ethereum based cryptocurrencies. NFTs represent ownership of digital and physical assets.

DAOs (Decentralized Autonomous Organizations)

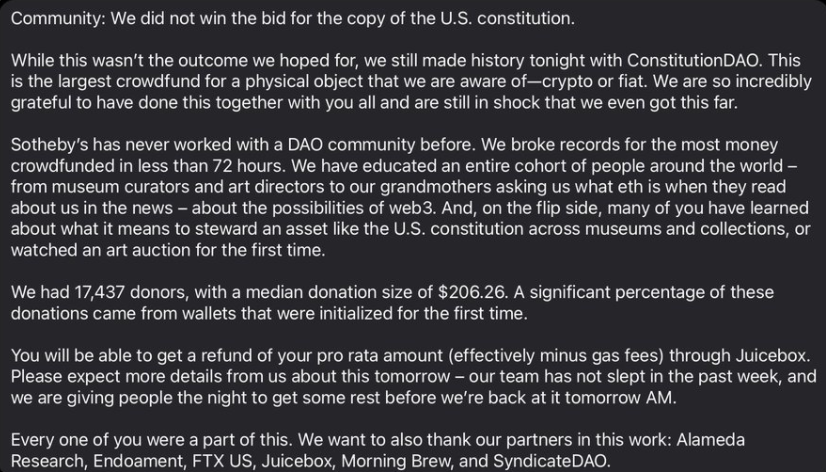

A company or other organization that operates without hierarchical management. DAOs can form for a variety of reasons. In an effort to purchase a copy of the US Constititution, Constitution DAO was formed growing to 20,000 people in the matter of a week via their Discord server. They attempted to be the winning bidder at the Sotheby’s Auction. Although they failed to win the bid, they made a considerable impact.

Ethereum for the Individual

You Are Your Own Bank

Saving, Lending, Borrowing, Staking. All secured by decentralization and cryptography. Thereby securing your wallet, your transactions, and your digital assets. Your Ethereum wallet is your proof of ownership, no middle-men are required to do anything.

Privacy

You can send assets across the network instantaneously and don’t have to provide any personal information. You don’t need to provide any details to anyone receiving your ETH because of smart contracts.

Peer-to-Peer Network

Between two Ethereum addresses (starting with: 0x) users can operate together 24/7 around the globe. Trading ETH for NFTs, sending and receiving, and doing so in agreed upon terms.

Censorship Resistance

It is decentralized. Nobody can tell you what to do. Nobody can debase ETH or change the consensus protocol of the network on their own.

Smart Contracts.

You and another party put up agreed upon assets and determine the conditions. Once the agreements are settled it is logged into the system. When this is over and the “pre-defined” conditions are met, the code executes the exchange. All logged into the blockchain forever since the code is publicly auditable and verifiable.

The Future of Finance

Dapps (Decentralized Applications) DeFi, NFTs, DAOs. DEXs like Uniswap are disrupting traditional finance and inventing new methods.

A Growing Network

Think of it as a marketplace. Containing services, games, apps, and none of it can be withheld from YOU. You are completely free to do whatever you want within the ecosystem.

Divisible, Scarce, and Valuable

You can see how valuable it is because of everything it provides, like use for transactions, store of value, investment qualities, declining supply issuance, use for applications on Ethereum, lending and borrowing abilities, and the power it gives to the Ethereum network. It is the most widely used blockchain in the world. BTC is divisible and ETH is also divisible. BTC = 9 digits ; ETH = 18 digits.

Secure

No government, company, or agency has complete and total control over Ethereum. Decentralization and the cryptographic security features in public key cryptography makes it impossible for anyone or any entity to stop you from receiving payments or using services on Ethereum. That reason is why it is private and secure.

Mental Framework

You are currently at a moment in time where massive revolutionary changes are taking place. There are plenty of people in this world who have no access to the traditional financial system and are interested in the benefits that crypto provides, and this is happening on a global level in large populated major countries and emerging countries.

Crypto is entering into the next phase of “adoption”. Just look at what is going on in El Salvador, the US, and Europe. There are many US states moving to pass favorable crypto regulatory framework.

Institutions are beginning to pile in, several ETF products are available from Valkyrie, VanEck, and many new users being onboarded via centralized exchanges on a daily basis. People are starting to jump on board in a big way. Global crypto adoption increased ~880% in 2021 according to Chainalysis.

Summary

Ethereum is building a brand new and better financial ecosystem, a better global economy.

Ethereum allows you to move your money wherever you want. You can make agreements (smart contracts) directly with anyone else whoever has an Ethereum wallet. You don’t need to go through intermediaries anymore; The reason why this is a big threat to the existing financial system.

Ethereum is removing unnecessary friction in the current financial system. You don’t have to adhere to the endless and prehistoric ways of legacy finance anymore.