January 3, 2009 the very first Bitcoin block was mined, the Genesis Block. What started as something small and was only used by a small number has become the fastest asset to reach a $1T market capitalization, among an entire ecosystem changing the world of finance.

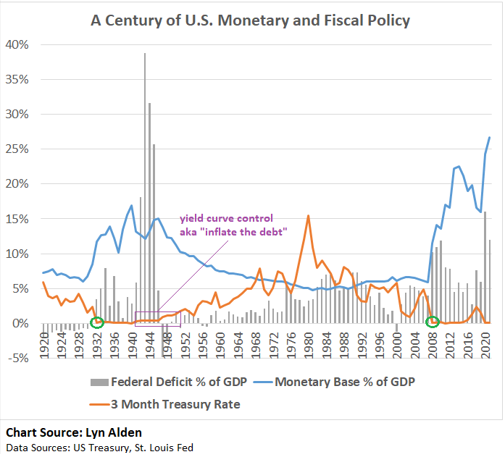

Central Banks like The Federal Reserve and the European Central Bank will simply print money whenever they want to, or need to. Mostly achieved through a monetary policy called quantitative easing where the central bank puts an electronic entry into their balance sheet in cash and they use that “money” to purchase long term government bonds. The government creates new money to purchase bonds, and citizens who don’t own assets suffer as a result.

Satoshi Nakamoto, the pseudonym for the person or group of people who created Bitcoin, didn’t trust Central Banks, the government, and the system as a whole. The thesis of Bitcoin was written in the genesis block and was launched after the Great Financial Crisis. Bitcoin was made for the individual.

The Emergencies Act and the ongoing situation in Canada has now escalated into the Canadian government’s mobilization of the banks against their own citizens. They are freezing targeted individuals bank account’s involved in the protesting or the funding of the protestors. Scary.

Satoshi created Bitcoin as a means for people to opt for something better, more secure, more valuable, and censorship resistant. The current state of Canada couldn’t be more of a clear example for people to realize that Bitcoin and crypto truly brings power back to the individual.

What is Bitcoin?

Bitcoin is a decentralized peer-to-peer (P2P) electronic currency with a long-term finite supply. After the first block was mined, it was the beginning of a brand new and far superior financial network on a global scale. It’s 2022 and you can use bitcoin for a variety of things. Users can transfer bitcoin to anyone over the Bitcoin network. It can be spent, sent, purchased, sold on a 24/7 basis. It was the next step in an evolutionary change in finance.

Bitcoin consists of a decentralized peer to peer network (the bitcoin protocol), a fully immutable and distributed ledger (the blockchain), a defense mechanism for a decentralized consensus on a valid blockchain (Proof of Work), and an agreed upon set of consensus rules for transaction validation and supply issuance (consensus rules).

How does it work?

Bitcoin is decentralized, meaning not in one central place. All of the node operators, miners, and users, all of it is decentralized. The operations are distributed globally without a central means of power, authority, or weakness.

The Bitcoin Blockchain is a chronological public record of transactions saved in time, and shared by all bitcoin users. This public ledger secures the history and ongoing use by verifying all transactions.

Bitcoin utilizes public key cryptography, proof of work, and peer-to-peer networks. Public Key Cryptography is what secures everything using mathematics. It is used to prevent anyone from spending another user’s bitcoin and accessing their wallet. Simply put, it uses a pair of keys, public and private keys and it is impossible to derive your private keys from your public keys.

There is a big difference between public keys and private keys. Your bitcoin private key is generated in random when you first start using your wallet. It is a sequence of numbers and letters, which enable funds to be spent whenever you want to send a transaction. This private key is impossible to reverse because of the incredibly strong encryption code base within the Bitcoin protocol.

A bitcoin private key will always remain mathematically related to the specified user and their bitcoin wallet address. The public key is connected to the public address generated to receive BTC. It is seen by everyone. It is made up of, also, a long sequence (hash) that is compressed and shortened to generate the Bitcoin payment address. It is impossible to derive your private keys from your public ones.

- Public Key – A public key is a very large number that is created using asymmetric-key encryption algorithms, from the corresponding private key. Together the public and private keys are sometimes called a “key pair” and they have a specific mathematical relationship. As the public key is made up of an rather long string of numbers, it is compressed and shortened to form the Bitcoin payment address by further hashing. If an owner loses their public key, it is easy to recreate it using the private key.

- Private Key – A secret number that allows bitcoins to be spent. Every Bitcoin wallet contains one or more private keys, which are saved in the wallet file. The private keys are mathematically related to each Bitcoin addresses generated for the wallet. Because the private key is the “ticket” that allows someone to spend bitcoins, it is important that these are kept secret and safe. Ideally, private keys themselves are never handled by the user, instead the user will typically be given a seed phrase that encodes the information needed to regenerate all private keys associated with the wallet.

- Proof of Work (PoW) – Proof of work (PoW) is a decentralized consensus mechanism that requires members of a network to expend effort solving a “mathematical puzzle” to prevent anybody from gaming the system. Proof of work is used widely in bitcoin mining, for validating transactions and mining new tokens. Due to proof of work, Bitcoin and other cryptocurrency transactions can be processed peer-to-peer in a secure manner without the need for a trusted third party.

- Peer to Peer Networks (P2P) – The bitcoin network is a network that operates on a cryptographic protocol. Users send and receive bitcoins, the units of currency, by broadcasting digitally signed messages to the network using bitcoin cryptocurrency wallet software. Totally global, decentralized and distributed everywhere, and provides users the freedom to transact with each other through the network.

The wallet is a device that stores your private keys and enables you to send your coins. It contains the necessary information to access your BTC. It contains the “keys” to your coins, your private keys. These “sign” or produce “cryptographic signatures” to send BTC to another address. To be clear, you are not “downloading” your coins. You’re not sending them into the wallet. The wallet is used to access and use your BTC.

Since BTC is a peer-to-peer (P2P) electronic currency, BTC are sent/released from the *senders bitcoin address* to the *receivers bitcoin address*. Each Bitcoin user can/should have multiple Bitcoin addresses for privacy reasons. Don’t store it all in one address, remember your wallet be able to access them all.

If you plan to purchase Bitcoin and want to be smart you should purchase a wallet. Start with a Trezor or a Ledger, or, if you are more experienced, a ColdCard from CoinKite (BTC only) is the best for security.

After each transaction is sent, it is broadcasted to the network so it can be included in the blockchain. The blockchain contains each transaction to prevent the bitcoins being spent twice. This includes a timestamp to lock it in each block and confirm it. Once it is confirmed it is broadcasted out to the network. All the bitcoin miners and full node operators validate and see this.

The Bitcoin Miners are complex computers running programs to complete mathematical calculations to secure the bitcoin network and confirm transactions. The reward and “payment” for their work are fees paid to them and newly created BTC.

New transactions from wallets are added into the bitcoin network, constantly. Node validate these transactions within the bitcoin consensus “rules”. Bitcoin mining will create new bitcoin, and also secure the network. The transactions waiting to be added into the next block are arranged by “transaction fees” in the mempool where “realized” but “unconfirmed transactions” are seen. Transaction arrangement and “priority” in this stage can be based upon the size of the transaction, and the fees set by the users based upon urgency, or choice.

When miners are, mining, if successful they will receive a mining reward. This reward is comprised of both new bitcoin and transaction fees. The miner only collects the reward if it validates all the transactions and operates within consensus. Consensus is used to provide security and deny malicious transactions and irregular/crooked transactions.

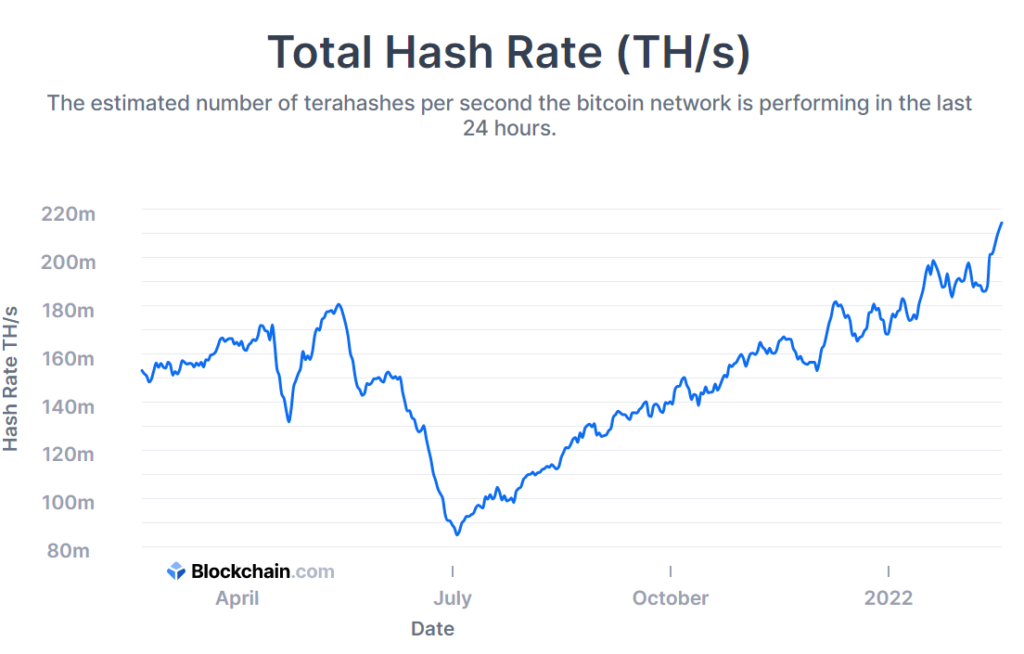

The amount of power all of this requires is measured in the Hash Rate which shows the true processing power of the network. You can see a dip where all the chinese miners had to move their mining operations, an incredible recovery and display of strength in the network, now already back to all time highs.

The full node operators validate all the transactions and blocks. This all goes on in the backgorund. They also provide assistance to the bitcoin network by accepting transactions and blocks from other nodes operators, validate those blocks and transactions, and sending them to more full nodes, further securing the network.

More importantly, the protocol is an open source software. Meaning anyone can download it and use it.

Why is it Valuable?

First, bitcoin is a peer-to-peer (P2P) electronic currency with a finite supply. Secondly, it brings autonomy (sovereignty) to the individual over the legacy financial system. You are operating outside of the banks, and you are becoming your own bank with a much more valuable asset.

It is permission less and borderless. Anyone can use it. It is a global, digital, elite financial network. You have the complete freedom to store, save, use, convert, send, and spend your BTC any way you want. You can access and use the bitcoin network all over the globe.

It is censorship resistant. Nobody can freeze or prevent anyone from sending a transaction. The exact opposite of which is happening in Canada.

It is FAST. No waiting for intermediaries. On the base layer transactions settle within 10 mins, and on the lightning network user transactions settle instantly. It is a much better system for transactions large and small.

It is cheap, fees are low to send BTC.

Storage – highly secure hardware wallets. Nearly zero physical storage space required as it is easy to store a hardware wallet. Just make sure to be smart about placement and location.

It is a scarce asset. The supply now is at ~19 million bitcoins. There are only ~10% left to be mined. There are only ever going to be 21 Million bitcoin (unlike gold or the dollar). This issuance schedule is reduced every 4 years through the code. This means it is literally programmed to be scarce.

It is called “digital gold” because it carries similar properties of scarcity, value, and durability but is a superior version of gold because of it’s ease usability, and easily stored and transported. Bringing many to see it is the 21st century version of gold.

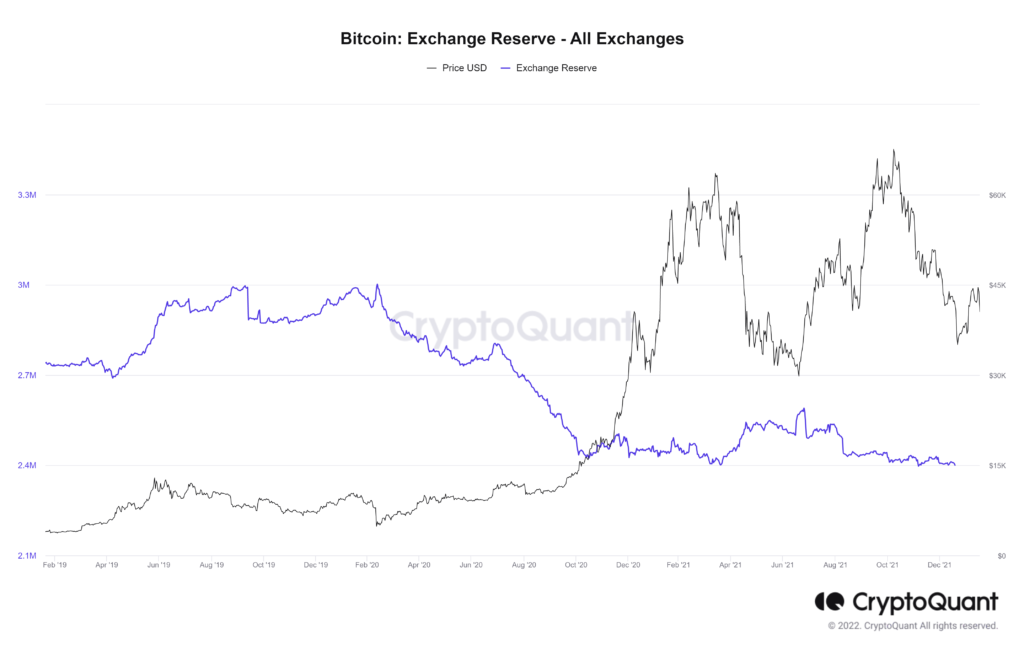

There is only ever going to be 21 Million ever created. Long term holders and new holders continue to move their BTC off the exchanges, into their personal wallets, and holding. You can see that now on the centralized exchanges like Binance where they have lowered the amount of BTC you can withdraw. It is a store of value. Bitcoin cannot be printed or debased. Bitcoin market cap is currently right under $1 Trillion.

Bitcoin has received lots of attention from institutions and companies all over the world as an investable and usable asset. One of those being Fidelity and their Digital Assets division. In their latest paper Bitcoin First, they state:

“Bitcoin is fundamentally different from any other digital asset. No other digital asset is likely to improve upon Bitcoin as a monetary good because Bitcoin is the most, relative to other digital assets, secure, decentralized, sound digital money, and any improvement will necessarily face trade offs.”…“Other non Bitcoin projects should be elevated from a different perspective than Bitcoin.”

Fidelity

BTC as an Inflationary Hedge

Fiat currency and the US dollar possess the exact opposite qualities. Fiat currency is a currency that isn’t backed by anything other than “the full faith and power of the government”. It is a government issued currency. Inflation recently has gone sky high, but the truth is the problem has been brewing and consistently becoming worse for decades. Ever since the Great Financial Crisis that started in 2008 has perpetuated ever since. Fast forward to today and we’ve gone fully parabolic on money supply. Bitcoin is the exact opposite.

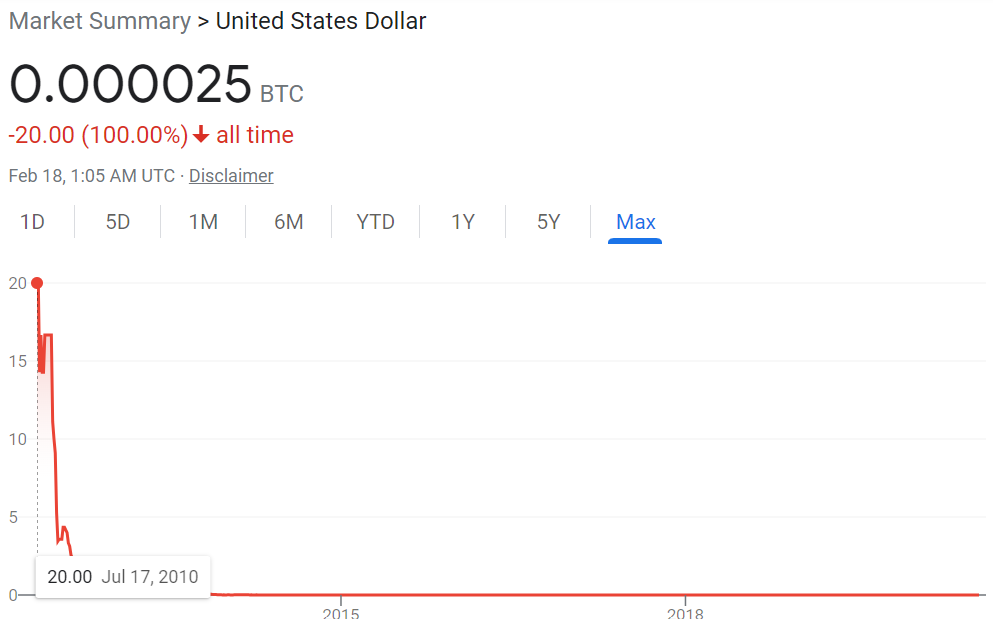

The supply of Bitcoin being capped at 21 million and the issuance of the asset being restricted in the block rewards shows an interesting relationship that BTC has to the dollar. Right here you can see that relationship.

This chart displays the value of $USD against BTC over the long term. 12 years ago you could’ve converted $1 USD for about 20 BTC, now you get approximately 2500 sats (0.000025 BTC). The direct value of the dollar against a superior form of money is what you’re looking at in the chart. Bitcoin’s code that runs the protocol cannot be tampered with or changed.

The USD and other fiat currencies will be printed and inflated away. People are starting to catch on that the USD is going to collapse after the FED printed approximately half of the total supply of the USD in the last couple years. Those who don’t own assets have suffered as a result. Bitcoin is one asset that operates as a “savings technology”.

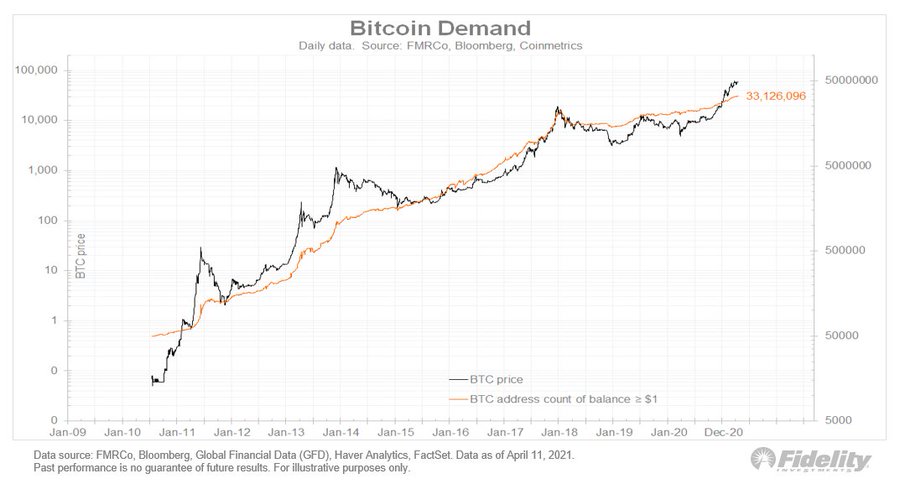

The demand of bitcoin can also be seen address growth, a proxy for user growth in this chart shared by Fidelity’s Jurrien Timmer (Fidelity Head of Global Macro). This chart shows the price (black line) moving in a direction similar to the bitcoin address count (orange line), address used in this chart are all addresses holding more than $1 of BTC.

So you can begin to see why there is such a large level of adoption occurring. Think of the adoption in a few ways. Easy examples could be found in comparing Bitcoin adoption to the adoption of the internet and smart phones. Smart phone adoption and internet adoption are the most recent large technological adoptions that Timmer and the team at Fidelity Digital Assets share in a few other charts. These are large enough adoptions that share a relevancy to the ongoing growth in Bitcoin over the last 13 years.

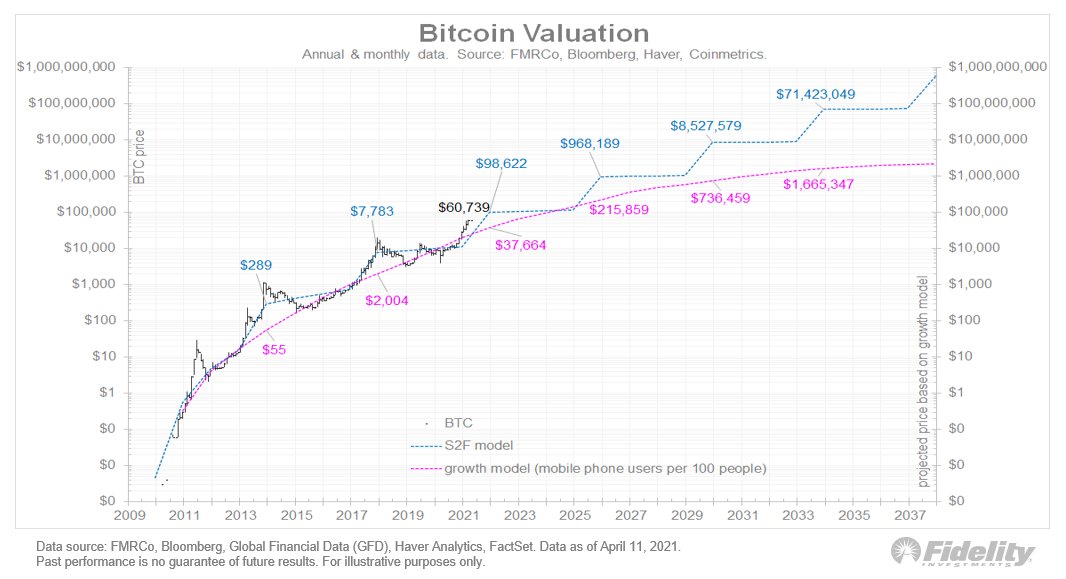

The chart here shows Bitcoin supply issuance (Stock-to-Flow/S2F) against Fidelity’s mobile phone user growth model. Stock to Flow is meant to be inflation regressive against price, Timmer says.

“I find it interesting that both the demand and supply models line up as well as they do, each appearing to predict ongoing impressive price gains. But the demand model turns more conservative than the S2F the further out we go…While the S2F model seems too optimistic in the out years given its persistent exponential slope, the demand curve seems more plausible to me…Bitcoin is the only asset class that I know of where you have both that supply scarcity and that exponentially growing demand side…that combination of supply scarcity and exponential demand growth or exponential network effects, I don’t know of any other asset class that combines those two.”

Jurrien Timmer

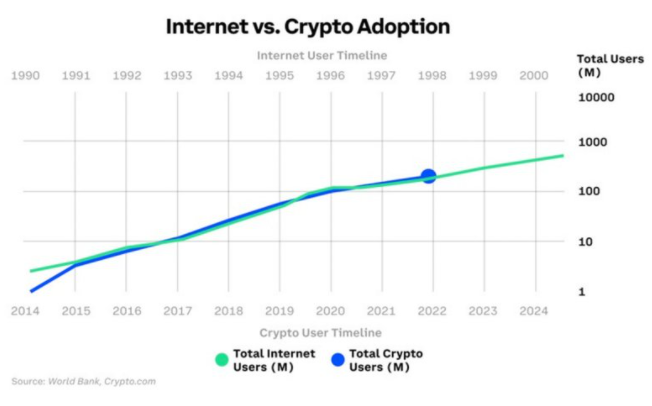

For the internet you can see that the adoption level has a lagging trend against crypto adoption in this chart here. Worldwide crypto adoption grew 881% in 2021 according to data collected via World Bank and Crypto.com.

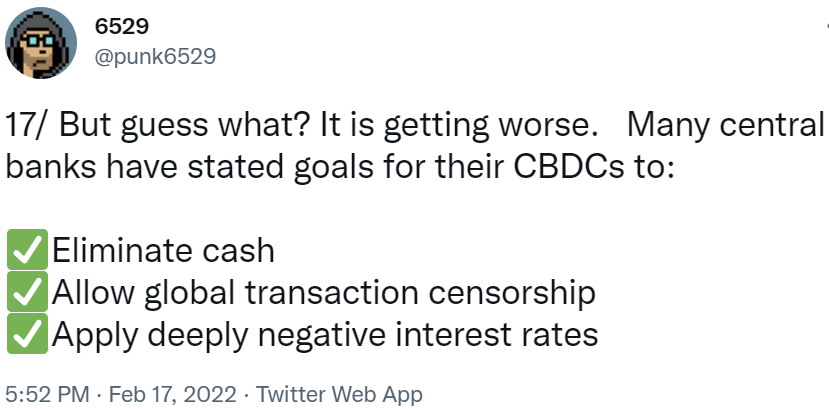

Central banks are quickly racing to keep up with the ongoing global adoption of Bitcoin and crypto. They are creating central bank digital currencies (CBDCs) which are a digital claim on central bank “money”. The CBDC is both issued and backed by the central bank. $1 of CBDC is worth the same as a $1 bill or $1 in a bank account. In this case fiat money ($USD, $EURO). They are “pegged” to those currencies on a 1:1 ratio so they maintain their equivalence.

These are going to be digital, programmable, and and controllable form of existing fiat money. They will still be subject to the same pains as we experience today, except it will be worse. The programmability and tokenization of CBDCs will enhance spending and transacting, and most users will use this via a smartphone based digital wallet application.

Summary

Bitcoin and crypto provides a better option to transact in a currency that is more elite and finite. Completely outside of the purview of the current traditional system and gives anyone access to their crypto anywhere, and can use it and transact with it 24/7.

The legacy financial system’s products are not open source and transparent like they are with crypto. Nor are they as productive and advanced. The Central Banks know this and are trying to adapt and bring new ways to work more efficiently in the traditional system, which brings us to the reasons and the “why” behind developing CBDCs.

The Market cap of crypto right now is right at $2 Trillion, with BTC making up ~40% of the market and ETH holding ~18% of the crypto market respectively. DeFi market is sitting at ~7% today with a lot of growth ahead. It is a superior version to the current financial system, simply put, DeFi is replacing the legacy/traditional financial system through smart contracts on the blockchain → through code.

Bitcoin and Ethereum offer you a whole new way to deal with money. They make you the sole owner of your assets. Bitcoin and Ethereum function to make middlemen completely obsolete. Bitcoin makes you your own bank, and DeFi additionally gives you the ability to lend out and earn yield on your crypto assets. Now you should know why all of it is so important, and, inevitable.