You likely have come across Theopetra on Twitter talking about taking back housing from large institutions. Or maybe you resonated with giving the power back to the people. Or just noticed more ‘V for Vendetta’ masks than usual.

The protocol certainly has been gaining traction. Founding and VIP members spots are being filled and account follower milestones are being exceeded.

But what exactly is Theopetra?

Is it an Ohm Fork? A REIT with some DeFi? A non-profit helping veterans and the middle class? A lending protocol? There was something about self-repaying mortgages and NFTs too, right?

More importantly, does a start-up crypto protocol really have a chance to take on Trillion dollar institutions in real estate?

This first article will summarize the basics of Theopetra. It will cover how the protocol plans to bootstrap itself initially and some of the longer-term roadmap.

What are the basics of Theopetra?

Theopetra plans to purchase physical real estate and use it as a ‘better stable value’ for the protocol’s Treasury. It will attempt to move off-chain property into an on-chain protocol. The end result is to capture the best economics of both on & off-chain projects.

The protocol plans to bootstrap liquidity through the mechanisms made popular by Olympus DAO. Then, once adequate liquidity has been raised, the protocol will purchase physical multi-family housing.

The protocol has the ability to make revenue from both TradFi and DeFi methods:

- Utilize protocol owned liquidity (POL) to capture most of the fees on market-making

- The ability to mint/burn tokens when above/below Treasury Value

- Arbitraging the difference in TradFi real estate lending rates vs DeFi borrowing rates on loans

- Cashflow & Appreciation on the underlying real estate

- Tax benefits of depreciation on property

- Ability for leverage through real estate

The protocol plans to start with multi-family purchases to hold in the treasury alongside stable coins.

As the protocol scales it intends to enter into self-repaying mortgages for single family homes, DeFi lending, and passing ‘losses’ from depreciation of the asset to token holders to offset other crypto gains.

How does Theopetra help with Rent / Homeownership?

A major marketing point so far is reclaiming home ownership for the middle class. But how does the protocol intend to do this?

Theopetra projects sufficient revenues from the DeFi side alone to support itself. This means the protocol doesn’t need to earn profits on the cashflows from the real estate. Therefore, this allows for Theopetra to offer renters stable, slightly below market rents. Rental cashflows just need to break even on the management of the property & servicing the cash-out refinance loans.

The value to the protocol of the real estate holdings is as an appreciating asset & the tax benefits.

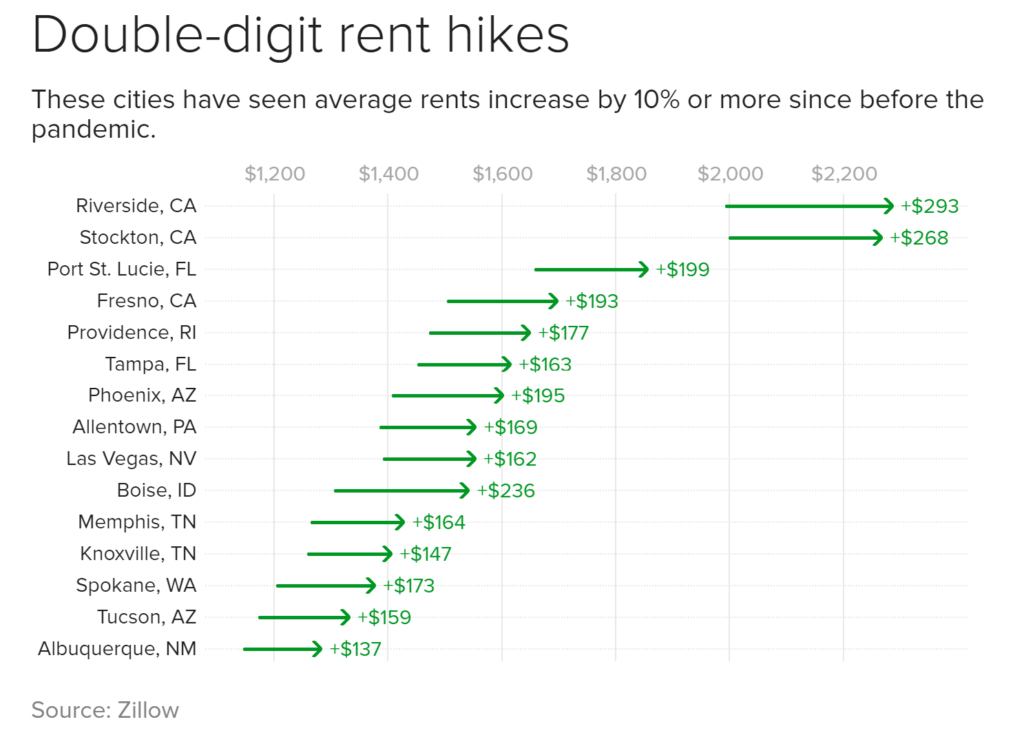

There is a real problem as rising rent and home ownership costs continue to price the average American out of the market.

Government responses have historically been to apply rent control. This policy has previously lead to deterioration in housing quality and rationing. Consequently, renters & homeowners are incentivized to take care of properties they know they will live in for the long haul.

Therefore, Theopetra also benefits with less turnover and maintenance expenses from its responsible long-term renters.

A free market on-chain solution to rising rents is a better approach than top-down government rent control.

The incentives around Theopetra lead to win-win-win outcomes for the protocol, renters, and also government.

What Is Protocol Owned Liquidity (POL)?

Protocol Owned Liquidity (POL) was made popular by Olympus DAO as an alternative to the liquidity pool (LP) method.

Automated Market Makers (AMMs) use LPs to have the liquidity needed to perform swaps. Liquidity providers put one or both tokens in a swappable pair into the pool. The AMM charges a fee for performing the swap. Then the AMM pays out a portion of this fee to the liquidity providers for providing the liquidity.

The POL model is when the protocol locks up all of its token through staking. This allows the protocol to be the provider of liquidity and keep the swap fees as revenue.

The protocol rewards holder of the tokens who stake the token with the protocol with rewards.

Additionally, most protocols need to provide large farming rewards to incentivize liquidity providers to provide liquidity and remain in the pool. The POL model avoids this cost.

Is Theopetra Just Another Ohm Fork?

Theopetra may be using many of the innovative features made popular by Olympus DAO, but it is far from a copy-pasta Ohm Fork.

Theopetra believes that real estate provides a better Treasury asset than the stable coins of most Ohm Forks. The future roadmap currently includes:

- Earning additional revenue through DeFi lending. There is a material difference in TradFi real estate lending rates vs DeFi borrow rates

- Offering self-repaying mortgages on single family homes

- Creating a legal entity to pass through property depreciation as an investment loss to offset other crypto gains

Why is Real Estate a Good Potential Treasury Asset?

Real Estate has been a popular wealth builder for generations as:

- Value increases over time with inflation

- Cashflows from collecting rent

- Tax depreciation

- Able to borrow against it at favorable rates

Stable coins are pegged to the US Dollar, which means they also suffer from many of the same issues that plague the dollar, namely inflation.

Why Should You Look At Theopetra?

First, Theo is not a BowTied Bull or Degen Jungle affiliate project. However, many BowTied accounts are founding or VIP members and actively involved in the project. Additionally, developers from other DAOs, Stacks ecosystem, and other active crypto names have onboarded.

The protocol is taking innovative features from other successful DAOs and looking to improve on them. The protocol is also looking to bridge the gap from fully digital to the real world. This is the biggest source of risk and consequently the part to be most excited about.

Having nearly all physical assets represented on chain is the future vision of many in the crypto world. Homes are the biggest asset & expenditure for the majority of the populaion. Therefore, if Theopetra is able to move peoples home ownership on chain it would be a huge step in the decentralized vision.

Is Theo Just a Real Estate Investment Trust?

Real Estate Investment Trusts (REITs) share some similar characteristics as Theopetra, but are unable to match all the potential benefits.

First, a REIT is defined as:

A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investments—without having to buy, manage, or finance any properties themselves.

-Investopedia

Theopetra will have all the underlying real estate management functions of a REIT, but with the additional revenue sources previously discussed. REITs are companies with lots of overhead expenses. However, since Theopetra plans to make most of its revenue from the DeFi protocol it can scale much cheaper than REITs.

Why Would Anyone Choose Theopetra?

This is a great question and there are many stakeholders in the future Theopetra system.

1) $THEO token holders:

Holding the $THEO token allows for all the benefits of other POL models. You get a share of the revenue from providing liquidity and the tokenomics around token creation/burns.

However, as previously discussed, $THEO comes with additional potential benefits of:

- Cashflowing & value appreciating Treasury assets

- That are leverageable at low borrowing rates

- Allow for on chain arbitrage since DeFi lending rates are much higher than TradFi borrowing rates, and

- Real estate provides taxable ‘losses’ on depreciation which may be used to offset crypto gains in your portfolio.

Additionally, Theopetra plans to provide a limited number of self-repaying mortgages for single family homes. There are 2 ways to improve your place in line and holding $THEO is one of them (the other being the burning of one of the limited number NFTs).

2) Renters/Homeowners

Theopetra’s main sources of revenue are going to come from on-chain. Unlike most real estate property owners, there is no need to make profits from the renter or homeowner. This should allow for very stable rents to renters (potentially below market rates) and self-repaying loans that allow homeowners to cut total payments by potentially 20%.

3) Real Estate Agents

By bootstrapping liquidity from crypto protocol, Theopetra can be an all cash buyer of properties and close quickly. Additionally, if Theopetra is able to earn most protocol revenue from on chain, it will have more flexibility on the real estate purchase economics.

Theopetra is onboarding real estate professionals of all stripes as VIPs.

The Bottom Line

Theopetra has a long way to go before officially launching and the roadmap is still in development. There is very real regulatory risk that the protocol gets denied the ability to buy property.

Additionally, there are many going assumptions about rates, tax-favorable pass-through ability, and customer acceptance. If these assumptions end up wrong, it can change the

The couple thousand members currently involved in the discord seem genuinely excited. The 1,000 item NFT launch raised well over $200,000. The money from the NFT is going to be used for legal, accounting, and tax experts. NFT holders have the right to “jump the line” on receiving the limited future self-repaying mortgages.

Theopetra claims it can be the future of real estate. Take a look and see what do you think.

Disclosure: The author was one of the early 250 people who qualified as board members, is in the discord, and has helped collaborate on some of the white paper and tokenomics of Theopetra.