The Securities and Exchange Commission (SEC) has allegedly opened an investigation of nonfungible tokens (NFTs). The SEC is exploring whether certain NFTs qualify as securities and therefore should be regulated. This new probe comes hot on the heels of the SEC charging the largest crypto fine of $100 million to the centralized exchange (CEX) BlockFi.

Gary Gensler is showing how quickly he comes after an enticing target to probe. After achieving his first success with the CEX, BlockFi, he seems ready to explore more broadly. He seems to firmly have his eyes set on the jpeg-ing world next, a big jump from CEX.

Before addressing Gensler’s alleged premature extrapolation of SEC oversight onto the NFT market space, lets review the basics.

What is an NFT?

Non-Fungible Tokens (NFTs) are digital assets that prove the ownership of something. NFTs are on all chains, but the headline grabbing ones have tended to be Ethereum-based. Ethereum NFTs follow ERC-721 or ERC-1155 token standards.

NFTs have been in the news due to the extreme prices some have traded for. NFTs have even traded for well over 7-figures at Christies auction house. Why would anyone pay so much?

NFTs are unique, scarce, transferrable, and prove the ownership of an asset. They can be shared with the world in the Metaverse. And ownership can be proven with the blockchain. This eliminates any questions about forgeries.

Some NFTs serve as rare collectibles and a way to ‘flex’ (show wealth) in the virtual world. Other NFTs have utility and provide rewards from using a protocol. There is also a growing list of NFTs that are offering real-world value, like entrance to events or gifts, to their holders.

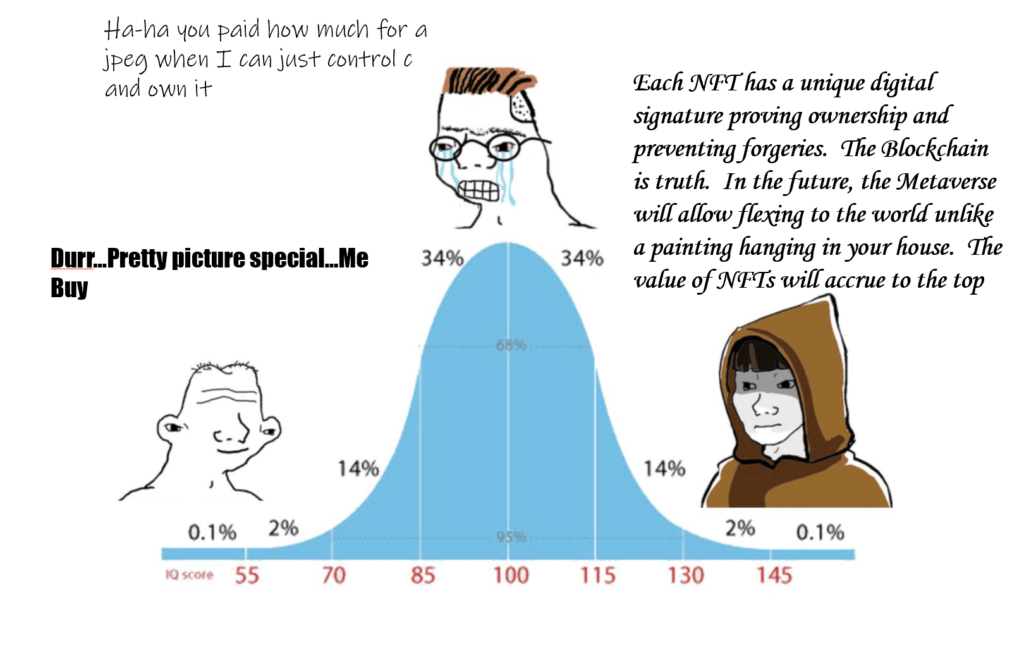

Can I Just Copy + Save the Jpeg and Own It?

The reply from midwits every where is that you can control+c and save the image and own a copy. However, this is where the non-fungible part of NFT comes in.

If an item is fungible it is interchangeable with other items. For instance, if you have a jar of pennies, each is entirely interchangeable with each other. They each hold the same value. If you dropped the jar on the street and people picked them up, there is no proof of your ownership on them.

Non-fungible means each NFT has a unique digital signature to prove the true ownership. If 2 people claim to own an NFT, the blockchain can easily prove who the real owner is. This makes it more secure than with traditional art where forgeries can be hard to prove.

How Big Is The NFT Market?

The NFT market has seen a recent explosion of activity. In 2021, approximately $44 billion of crypto was spent on NFTs. This is up tremendously from the $100 million spent in 2020.

As the NFT market boomed, there has been an increase in athletes and “celebrities” being tied to various projects. (See prior articles on Lana Rhoades NFT rug & Irene DAO). NFTs have looked to add use cases like adding royalties or helping raise funds for a business. These last two items seem particularly troublesome to the SEC, according to sources.

Why Is the SEC Investigating NFTs?

The SEC is scrutinizing if NFTs and the exchanges where NFTs trade are breaking agency rules. One of the big questions is whether NFTs are being used to raise funds like a traditional securities offering. Many NFT exchanges have started to avoid some NFT collections that may draw scrutiny from the SEC.

There have been numerous subpoenas sent by the SEC’s enforcement unit over the past months, according to sources. A particular focus is on ‘fractional’ NFTs. Fractional NFTs allow for the asset to be broken into smaller units that can be bought and sold separately.

Are NFTs Under The SEC’s Oversight?

The SEC uses the “Howey Test”, from a 1946 Supreme Court decision, to determine if something is a security. An asset is considered a security and under the SEC purview if investors in the project have the intention of profiting from the organizations efforts.

To be fair, some of the recent NFT launches do feel like a more traditional security raise. This is especially true if the NFT purchase funds a protocol that conducts a business and then shares back profits with the NFT holders. There is certainly some projects out there that feel very much like TradFi security offerings.

Even Hester Peirce has expressed concern over some projects in the NFT space. She is the most crypto-friendly SEC commissioner and has been the sole dissenting vote on crypto matters in the past.

However, the crypto community has pushed back and called the SEC’s action as overstepping its boundaries. Some have pointed to Gary Gensler and the SEC’s continued denial of a Bitcoin ETF as proof of being anti-crypto in general.

Wrap-Up: SEC Investigating NFTs

The NFT space has seen tremendous growth in the past year. However, it appears that the popularity has come with some downsides. Increased regulatory scrutiny from the SEC may hamper innovation, or move all protocols outside of the USA and the SEC’s jurisdiction.

On the positive side, the current alleged investigation does not mean there will be any future enforcement action. Not all SEC probes end with charges at the end.

We will have to wait to see if Gary Gensler continues the current pace of pumping out a few pieces of bad crypto news a quarter. If you are the kind of chump who is pumping out FUD quarterly, you earn a nickname like “Quarter Pump Chump”. We don’t want that nickname to become popular for Mr. Gensler.