BlockFi Lending, a subsidiary of BlockFi Inc. has agreed to pay $100 Million in fines to the SEC ($50mm) and 32 US states ($50mm). This fine settles a dispute that started in 2019. The SEC claimed BlockFi had material misstatements of the risks to customers and failed to register properly. BlockFi disputed both charges and pointed to the ‘market intermediary’ exclusions of the Act.

Other people have speculated that the SEC was making an example of BlockFi. The high yields offered by BlockFi made the 0.01% yield on bank savings accounts look flaccid. In a similar vein, since no customers were negatively impacted, the fine seems overly punitive.

The bigger concerns are around the impact this regulation may have on crypto more broadly.

What Is BlockFi?

BlockFi Inc. describes itself with the following:

BlockFi provides financial services to individuals and businesses worldwide and in all 50 U.S. states. Our offerings include interest-earning accounts, low-cost USD loans secured with crypto and fee-free trading.

-BlockFi Help Center

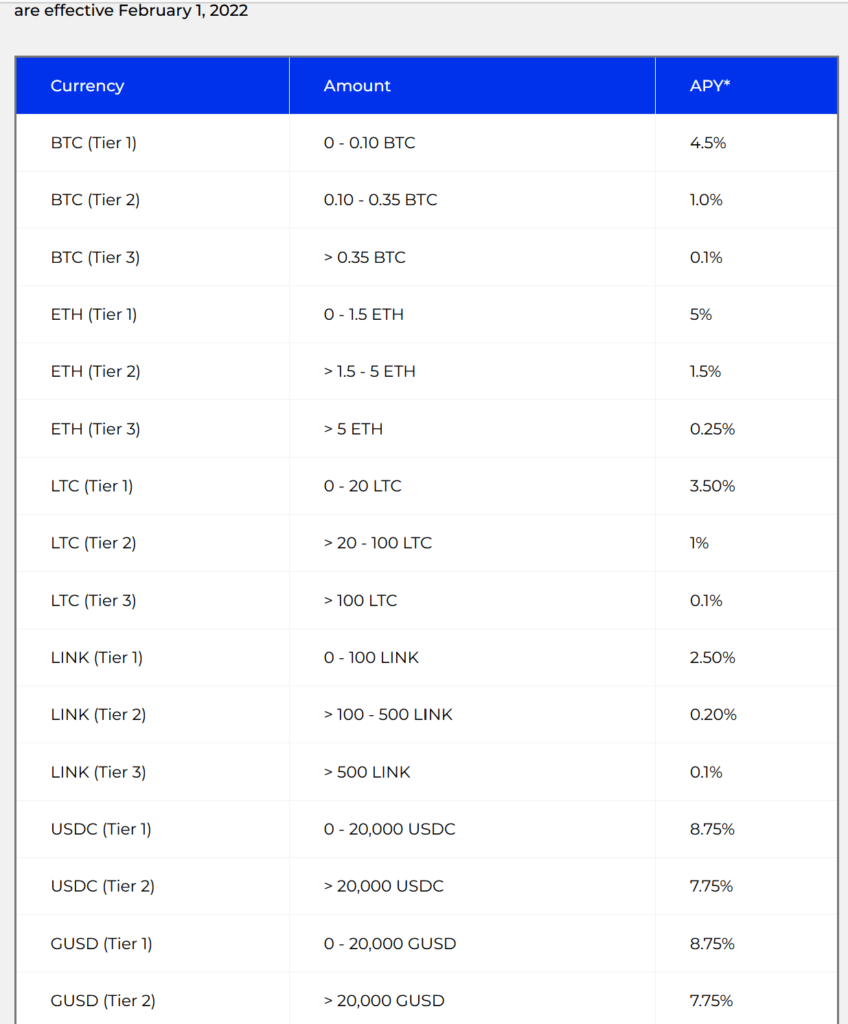

For many, BlockFi was an easy way to buy crypto with Fiat and earn a modest interest on their holdings. BlockFi was able to pay interest by lending out the crypto on the back-end for higher rates and earned a spread for themselves.

First, to get it out of the way, ‘not your keys not your coins’. Centralized entities like BlockFi & Coinbase are not aligned with the decentralized, sovereign individual ethos of crypto. Look at the recent news out of Canada freezing bank accounts of protestors. Keeping your crypto on a centralized platform takes away the ownership that makes crypto so appealing. However, BlockFi serves the important purposes of 1) onboarding new users in a familiar online-broker like setting, and 2) giving convenient exposure to people who are never going to be crypto experts.

BlockFi was the first crypto account I ever opened and I did so with the intention of only ever putting money into stable coins at 8-10%. “Crypto is a scam, but earning 800x the current savings rate is sweet” was my line of thinking. After having the BlockFi account open, it was very easy make a small purchase of BTC…and then another…and after seeing a little BTC interest get deposited in the account it, didn’t see so scammy. BlockFi was my gateway to getting involved in crypto and I assume many others too.

BlockFi also offers a rewards credit card that pays 1.5% cashback in the form of crypto deposits into your BlockFi account. Credit card rewards is another ‘soft-touch’ way to get people their first crypto exposure and into the ecosystem. You also can borrow against your BlockFi balances to avoid selling crypto. This gives access to your money without the tax hit. Borrowing against your crypto assets is a major part of the DeFi ecosystem. Therefore, once again, BlockFi is a way to get new users comfortable with using crypto.

What Did the SEC Charge BlockFi?

The Securities and Exchange Commission charged BlockFi with failing to register its interest accounts with the SEC. Additionally, BlockFi was charge with violating the registration provisions of the Investment Act of 1940 & Securities Act of 1933. (see full SEC release here). Lastly, the SEC alleged that BlockFi mislead customers about the safety of the interest accounts.

SEC Claims BlockFi Mislead Investors on Riskiness of Accounts

The SEC alleges that BlockFi materially mislead investors in how much risk was behind their interest accounts. BlockFi stated in numerous places that they loaned crypto on over-collateralized terms. Some places they threw a qualifier like ‘typically’ in there.

Over-collateralization is common for most DeFi lenders. The protocols require more money deposited in a token than the value loaned out. Borrowers need to maintain a certain level of collateralization, otherwise they are liquidated. This is a safety mechanism to limit losses to the lender.

The SEC documents point out that most institutional lenders were unwilling to over collateralize their loans. BlockFi needed to lend in order to offer the interest to customers. The end result was less than 25% of all loans over the prior 3 years were actually over-collateralized. By not requiring over-collateralization, BlockFi was taking on more risk of defaults and losing BIA customer’s money than it was implying in material.

Failure to Register

The SEC also charged BlockFi with failure to register as an investment company. They also charged BlockFi with failure to register the BIA accounts as investment securities. BlockFi was claiming an exclusion to this act based on being a ‘market intermediary’. The SEC disagreed based on the amount of revenue made from lending & investing being over the threshold.

Counter Argument to the SEC Decision

Materially misleading customers on the safety of their accounts is a serious issue.

That said, there was no actual customers hurt by BlockFi accounts yet. The largest fine from the SEC on a crypto organization when no customers were hurt seems punitive.

“This is the first case of its kind with respect to crypto lending platforms,” SEC Chair Gary Gensler said. “Today’s settlement makes clear that crypto markets must comply with time-tested securities laws, such as the Securities Act of 1933 and the Investment Company Act of 1940.”

I am sure Gary “the rat” Gensler could explain the difference between putting money in a savings account and the bank lending it out to make Billions and what BlockFi is doing. To the average person, however, the nuance is not important. BlockFi was paying an actual return to customers. Yes BlockFi absolutely shouldn’t issue misleading statements and should ensure customers are aware of the risks. But up to this point, BlockFi has been a positive to consumers.

The incredible irony is Gary “Goldman Sachs” Gensler just put out a video telling college kids to save $5 a week and maybe they can earn 8% on it. From his $100 million net worth, he was helping all of us save way less than $100k following his advice for 40 years. And then then took away one way to earn over 8% on a stable coin that was available.

What is the Impact of the SEC decision?

The $100 million fine paid by BlockFi isn’t the biggest issue here. It is a standard extortion charge. BlockFi is valued over $3 Billion and has raised over $450 million from seed funding. They will be fine.

The bigger issues are the impacts on crypto adoption and putting the US citizens at a less competitive position. There will also be a chilling effect on innovation in the US.

BlockFi serves a purpose even if it mitigates most of the benefits of crypto in the first place. Since it feels similar to standard online brokerages, it is usable by the masses. You can’t expect someone to buy a hardware wallet and start swapping tokens around on day 1. BlockFi was helping to onboard future crypto holders and grow the ecosystem.

Non-US customers will be unaffected by any changes because the SEC only has jurisdiction in the states. The world is increasingly global, and letting non-US based citizens get interest on crypto holdings that US citizens can’t only hurts US citizens.

Additionally, actions like this will drive future crypto business to being overseas to avoid the headache of dealing with the US. The end result is the worst possible one. By being based overseas, the SEC has no control over these future businesses and the US misses out on both high-paying jobs and profitable corporations.

Lastly, government regulation is not conducive to innovation and there is an expense to all the fillings and legal fees to be compliant. A big company like BlockFi may be able to afford this, but start-ups are going to have a much harder time. Crypto is supposed to break down barriers to entry. BlockFi is confident they have a path forward, but getting approvals for anything innovative is an iterative process.

The SEC could effectively prevent these accounts by never approving any registration. Look at the continuing saga with the long list of companies trying to get a spot Bitcoin ETF and being denied. Even if BlockFi feels they have a path forward, the SEC can drag out approval of any future registered interest accounts indefinitely…Or more likely until Goldman Sachs applies.

The US Debt crises and Dumb Regulation

To go on a complete side bar, with the US being $30 Trillion in debt, the idea of pushing companies away seems short-sighted. Countries that welcome and work with crypto have the potential to make massive tax revenues from the companies and crypto holders. Not only could the US government tax BlockFi, they can tax the returns on the interest earned on the accounts. Pushing innovative companies away is going to be a long-term negative at a time when the US really needs the revenue.

What Happens to Your BlockFi Account?

As of right now, there is no immediate change to your BlockFi Interest Account (BIA). BlockFi put out this announcement after the resolution was reached.

In it they say BIAs will continue to earn interest as they always have, however no new money can be moved in. Additionally, if you transfer money out of the BIA, you won’t be able to transfer it back in. And no new BIA accounts can be opened by US citizens. All new transactions will be with the BlockFi Wallet account and in the future the ‘BlockFi Yield’ account.

BlockFi feels it has enough guidance from the SEC to move forward with gaining compliance. They will need to file an S1 to register a new interest bearing account, currently called BlockFi Yield (BY). BlockFi has stated its intentions to file an S1 in the near future.

All BIA accounts will be exchanged for BY accounts after BlockFi gets approval.

The good news is you don’t need to do anything at this point and should be able to continue earning interest. However, if BlockFi, Coinbase, and other centralized corporations are the only crypto exposure you have, this is a good reminder of the pitfalls to these organizations.

The SEC could just have easily ordered the freezing of the accounts or returning of money with no gains, etc. You should have the majority of your crypto stored on a hardware wallet in your possession. Remember, “not your keys, not your coins” and the money you have on BlockFi is one regulator decision away from not being yours.

Conclusion: BlockFi And the SEC

For an even more in-depth discussion of the SEC ruling and deeper analysis, you can check out the BlockFi article from the giga-brains at the DeFi substack.

There are a lot of headlines posting about the ‘record SEC fine’ on BlockFi, but they are missing the actual bigger story. An American company was sued by the SEC that hasn’t harmed any investor yet. They were forced to stop offering 8%+ interest rates on US dollar pegged stable coins and reasonable interest on coins like BTC and ETH.

Adherence to our registration and disclosure requirements is critical to providing investors with the information and transparency they need to make well-informed investment decisions in the crypto asset space…

SEC enforcement director Gurbir S. Grewal

Gurbir clearly misses the point that, no one cares if their BlockFi product is registered or not.

There is at least some semblance of reason at the SEC though. Commissioner Hester Peirce put out a statement explaining why she dissented to today’s SEC resolution with BlockFi.

As an initial matter, it is difficult to understand how the civil penalty will protect investors. BlockFi will pay the SEC $50 million, and will pay another $50 million in connection with state settlements for the same conduct. While penalties this size are intended to deter bad conduct, here there is no allegation that BlockFi failed to pay its customers the money due them or failed to return the crypto lent to it.

-Commissioner Hester M. Peirce

Hopefully, this is a sign that not everyone at SEC is a complete dope.