The U.S. Securities and Exchange Commission (SEC) continues its streak of denying Bitcoin Spot ETFs with its latest decision. The news came Thursday January 27 that the SEC rejected Fidelities spot Bitcoin ETF.

Fidelity’s Wise Origin Bitcoin Trust filed to be listed on the CBOE BZX Exchange as an ETF that would directly hold Bitcoin. The decision was the latest in a long string of denials of Bitcoin spot ETFs, the 6th so far.

The growing pile of denied proposals has dampened hopes of getting an ETF that directly owns Bitcoin approved. There are currently Bitcoin Trusts and Bitcoin Futures ETFs available, but no fund that directly owns the BTC.

Why Does SEC Keep Denying Directly Held Bitcoin Spot ETFs?

The SEC reiterated in the recent denial that the Bitcoin ETF didn’t meet “standards to prevent fraud and manipulation and to protect investors”. This continues to be the stated position in the recent rejections. The actual wording of the SEC statement was:

“It is essential for an exchange listing a derivative securities product to enter into a surveillance-sharing agreement with markets trading the underlying assets for the listing exchange to have the ability to obtain information necessary to detect, investigate, and deter fraud and market manipulation, as well as violations of exchange rules and applicable federal securities laws and rules”

-SEC

However, this is the 6th rejection of directly-held Bitcoin ETFs, clearly indicating that even a large and experienced institution like Fidelity has no idea what the SEC wants. The SEC has approved Bitcoin Futures ETFs and there are also trusts that are available in the market (ie- Grayscale Bitcoin Trust, “GBTC”). There is some nuanced differences between a spot ETF, futures ETF, and a trust.

Difference Between Bitcoin Spot ETF and Bitcoin Futures ETF

The SEC has approved ETFs that track bitcoin futures in the past, but continues to reject spot ETFs. In October, Pro-Shares launched the first-ever Bitcoin futures ETF on the New York Stock Exchange (Ticker: BITO).

These Bitcoin Futures ETFs invest in futures contracts traded on the Chicago Mercantile Exchange (CME). Futures contracts are a promise to buy/sell an underlying asset at a set price and time in the future. Therefore, no actual Bitcoins are purchased when there is buying and selling on this derivatives market.

By contrast, the Bitcoin Spot ETFs would directly purchase and own the underlying Bitcoins in a fund. Therefore, as people invested in the ETF, the fund would need to go and purchase actual Bitcoins to back the price. This feature allows for derivative markets to grow much larger than even the underlying commodity that its based on.

Difference Between Bitcoin Spot ETF and Bitcoin Trust

A Bitcoin Trust, like GBTC, is a company that owns Bitcoin and you invest in the company. Bitcoins make up essentially the entire value of the company, so by owning shares of the trust you ‘own’ the tokens. (Note – own is in quotes as you don’t actually own them). Therefore, the trust’s performance should line up with Bitcoin’s price movement minus the (huge) fees.

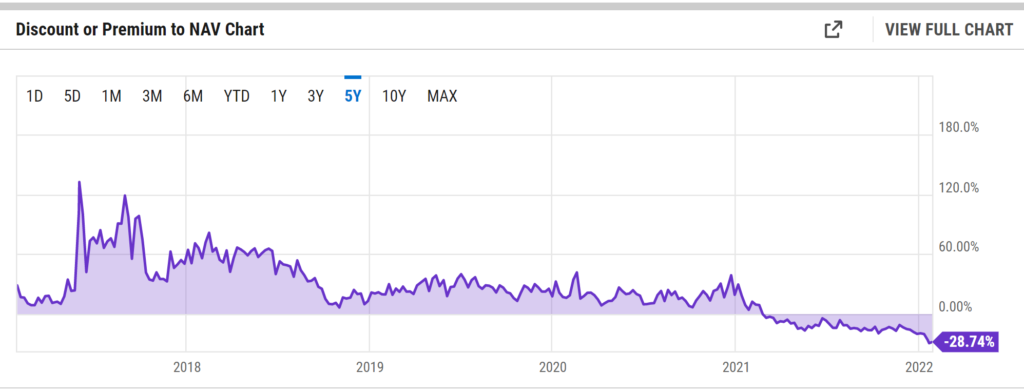

However, this isn’t even true as trusts like GBTC has swung from huge premiums to huge discounts to net asset value (NAV). Greyscale charges a 2% annual management fee on GBTC to….I am not sure why its so high other than they could by being first to market.

If you own GBTC during the recent BTC sell-off, you have performed even worse than just holding Bitcoin. The NAV will reflect BTC price moves, and the discount has blown out even further. And you are bleeding 2% in fees a year too.

Greyscale has stated their intention to convert the Bitcoin trust to an ETF in the future. Presumably they decided this assuming no one would pay 2% for the type of tracking their trust has shown.

If Investors Can Own Bitcoin Futures ETFs and Bitcoin Trusts, Why Not Bitcoin Spot ETFs?

That is a great question.

First, I’d be remiss to not mention that a common saying in crypto is “Not your keys, not your coins”. If you do not have possession of coins on you personal wallet, you don’t really own them. Preferably you use a cold storage wallet, as hardware wallets are open to hacking.

Your first choice should always be ownership of your coins in a hardware wallet.

That said, there are many reasons why a retail investor may prefer owning one of these funds (ETFs & trusts) rather than directly buying Bitcoin.

- Easier to hold in tax-advantaged accounts as you don’t need to set up a self-directed IRA like you do to directly hold crypto

- May not want to learn how to buy and store coins themselves (I’d argue a poor reason)

- May trust big name ETFs from years of being told to purchase Vanguard funds and forget about them

So why is an ETF that invests in paper promises (future) approved by the SEC but a fund holding actual Bitcoin is not?

Reasons SEC keeps denying Bitcoin Spot ETF

The generous read on this, is that the SEC is concerned about the actual purchasing and holding of Bitcoin. The SEC doesn’t elaborate on why spot ETFs don’t “prevent fraud and manipulation and to protect investors”, but futures ETFs do. There could be many reasons here that I’ll speculate on:

- Supporting Nefarious activities

- The same old song & dance about money laundering, drug & criminal enterprises, untraceable movements, etc etc. This seems to always come up as a cover to scare people unfamiliar with the space into supporting oversight. Directly owning Bitcoin is directly supporting the system.

- Whereas, big established Wall St firms swapping paper promises is approved by the SEC. (Honestly, at this point how many people think Wall St is any better than criminals though, SEC?)

- Risk of hack & loss

- A Mt. Gox like hack could result in a massive loss and risk to the system

- Price manipulation

- Bitcoin has a hard cap of 21 million bitcoins produced. Opening up the direct purchase of Bitcoin by ETFs will lead to an increase in demand with a very limited supply. ETFs are also forced buyers and sellers who may leave a low float of coins available outside the funds.

People have also taken a less generous read on the SEC’s actions. This view speculates large institutions are still trying to accumulate Bitcoin and other crypto for themselves to front-run the eventual approval of an ETF. When an ETF is approved, US retail can move a portion of its nearly $20 Trillion in retirement account investments easily into crypto. For comparison, the all-time high for the entire crypto market was only $3 Trillion.

This huge influx of purchases would drive the price of the coins held by institutions up and they can sell to the ETF funds for huge gains.

Since futures of the current Bitcoin Futures ETF doesn’t impact price, institutions are able to keep accumulating BTC at current low prices in the meantime.

Future Promise of a Bitcoin Spot ETF?

There is some promise that a low cost spot ETF could be approved in the near future. Fidelity continues to state that they think the market is ready for a physical bitcoin ETF and will continue its dialogue with the SEC. Fidelity compared the CME Bitcoin futures market to other markets that also have spot-backed futures (ie-the precious metals markets). This indicates the narrative is changing around Bitcoin on Wall St. to being akin to precious metals.

Spot-backed Bitcoin ETFs have been also been launched in other countries recently and the US runs the risk of being left behind. For instance, Fidelity launched a “Fidelity Advantage Bitcoin ETF (FBTC)” in Canada as a fund that holds physical Bitcoin.

Therefore, despite rejecting Fidelity, VanEck, WisdomTree, Kryptoin, Valkyrie, and SkyBridge Capital there remains some hope. There are currently 7 other spot ETFs are awaiting the SEC’s decisions. We will see if one of them can finally get approval for their spot ETF and open the floodgates to all the other funds for approval.