We didn’t even have to wait more than a few weeks since our last rug to find the Rug of the Month for January 2022.

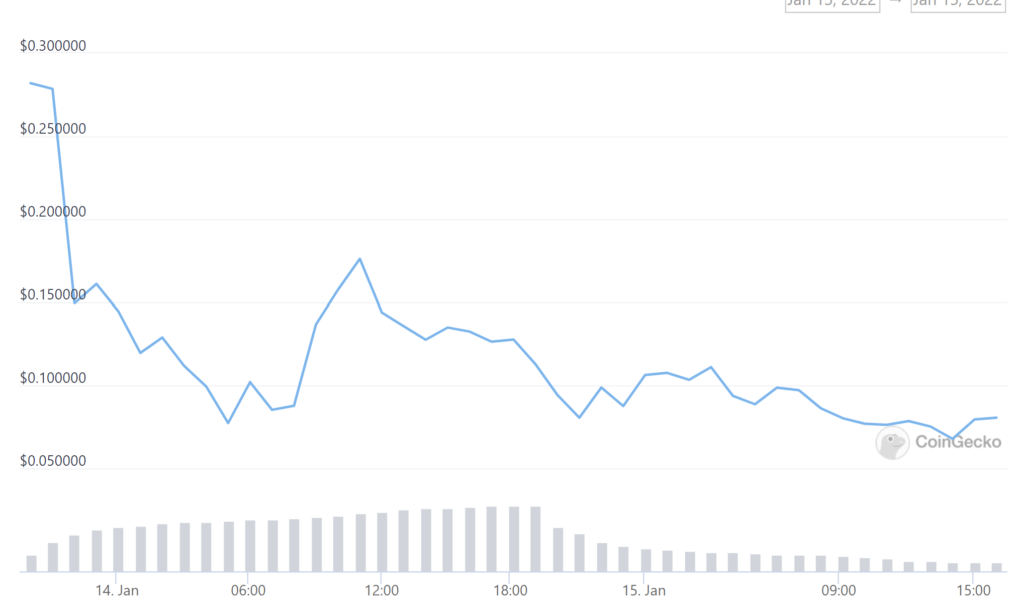

Normally I don’t start with a picture, but that is a thing of beauty. A coin that is worth $1 skyrocketing to 100,000s of ETH and immediate rug.

Also the devs siphoned a few million for themselves from their “airdrop”.

Additionally, this month’s rug also had:

- A meme-able name

- An “airdrop” you had to pay to claim

- A contract that took fees for devs for a coin that was given to users under the guise of rectifying high fees

- A poorly funded liquidity pool leading to chaos

- Lots of questions about the dev teams behavior

- Irony…thick irony…that a token to ‘fix’ prior high gas & fees leads to massive amounts of gas and fees

$WTF is still trading so not a rug in the traditional sense. The devs haven’t pulled all the liquidity like a proper rug. At least not yet. It’s been like 3 days so far.

However, this month’s rug falls under the expanded definition of ‘rug’. Lots of money was drained from some wallets even if the coin is still technically trading. Additionally, the coin has lots of questionable details around it.

Fees.WTF Introduction

Fees.WTF provided an airdrop to wallets that interacted with Ethereum Main Net based on fees racked up.

Fees.WTF is a self-called “OG site” showing Ethereum users their lifetime gas. The “airdrop” not only gives you 1) $WTF token, but also a 2) $REKT NFT, 3) access to a pro-version of the site as long as you hold the NFT, 4) $WTF ‘rewards’, 5) $WTF staking and LP, and 6) an upgradeable referral link that pays you in ETH.

Before going deeper into each, lets just stop to admire all the buzzwords here. Airdrop, NFTs, $WTF & $REKT, pro-version, rewards, staking & LP, and referral links to earn… This is like a picture of a dog on the coin away from hitting for the crypto-pump cycle.

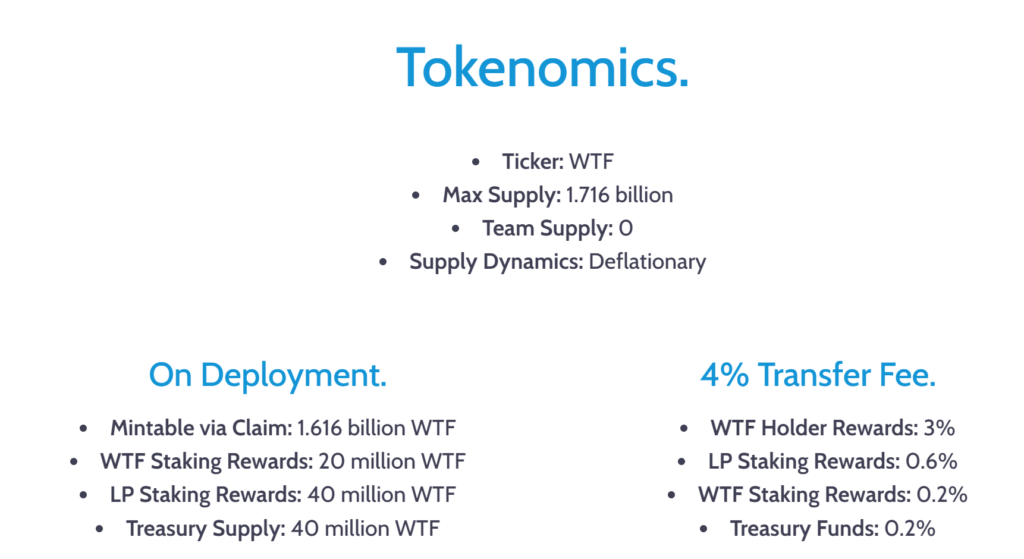

Also, on the front page of their site, it clearly says that the team supply is exactly 0. Wow, what a generous dev group…

I’ll circle back to tokenomics later. First, I want to walk through the launch as that is what drove $WTF to winning rug of the month.

WTF happened with $WTFs Launch

$WTF tried to follow the hype of $SOS and $GAS where the protocol gave tokens based on how much $ETH you spent on transaction fees (gas). The more gas you spent, the more $WTF you could claim.

One aspect of this rug was caused by a poor liquidity pool set up and front-running bots. Not enough liquidity was in the pool which allowed for volatile price movements as people tried to ape in with high slippage. Bots were likely front-running trades with sandwich attacks as well, adding to the chaos.

The LP was set up with only 2200 $WTF and very little $wETH. One of the first trades swapped ~2 ETH for the 2200 $WTF and drained the pool of $WTF. Since the pool had no $WTF relative to $wEth, the price of $WTF spiked astronomically.

Allegedly, there was some bot-on-bot crime as well as bots continued making trades for small amounts of $WTF and feeding more $wETH into the pool. There are numerous swaps in the first few minutes where $wETH is traded for fractions of a $WTF.

For example, looking through Etherscan. Someone paid 42 $ETH ($136,000) for less than 1 $WTF (currently $0.10). This is one of the more extreme examples, but there are many similar trades.

In this chaos, one wallet made a very tiny purchase of $WTF (0.00015 WTF) for 10ETH, then immediately sent through a super high gas transaction selling all the $WTF for 58ETH. This netted a nice 48ETH gain, minus the high gas transaction cost. This is the huge spike up and down of the $WTF price in the chart.

DeFi Background – Liquidity Pools, Impermanent Loss, & Sandwich Attacks

You can skip this section if you are familiar with DeFi. But for those who are relatively new still, the below explanations should be enough to help you follow along.

Liquidity Pool (LP)

Liquidity pools are how defi allow for swaps between tokens. Token holders provide liquidity to each coin in the pool. In exchange they receive a piece of transaction fees for all swaps that happen in the pool. You may remove your liquidity from the pool at anytime, but as the price of the coins in the pair change you can experience impermanent loss (IL).

Impermanent Loss (IL)

Happens when you provide a pair of tokens for a LP and one tokens price changes more than the others. This results in you getting more of the worse performing token.

For example if you put 50 token A and 50 token B into a LP, and the price of token B increases and the price of token A stays the same. If you pull your liquidity you will receive more than 50 of token A and less than 50 of token B and you may have less overall value than if you didn’t provide liquidity.

Sandwich Attack

Basically when a bot front runs a trade where a user puts in an order with high slippage and normal gas. The bot is able to put in a higher gas order to execute first, buy coins to run up the price and then sells them at the higher price. Since the order had high slippage, it will still go through.

For example, if token A is trading for $100 and you put in an order for token A for $100 and 20% slippage. A bot could jump ahead of you by paying more gas, buy token A for $100 and sell it to you immediately for $120 (since it is within your slippage range) and snipe the $20 profit.

The above is important to understanding the $WTF chaos.

If there is a small amount of liquidity in a pool, and a large swap comes in, the prices of the underlying pair can get completely out of whack. Bots are also performing sandwich attacks as people try to ape in with high slippage tolerance (to get their transaction to go through when the price is volatile), this will further drive up price.

If there is a small amount of liquidity in a pool, and a large swap comes in, the prices of the underlying pair can get completely out of whack.

WTF Is Wrong with $WTF Tokenomics?

So the launch was botched, what about the tokenomics?

Let’s start with the team implying they get none of the tokens in their tokenomics section. That may be true, but with a 4% transfer fee on every transfer of which they keep some, it isn’t like they are working for free.

This is very large, but allegedly some of it goes to their referral system. When you claim the airdrop you get a referral link. You can also burn some $WTF and upgrade how your % payout on the referrals. Burning the max 10,000WTF gets your 50% referral rate.

This reeks of a ponzi. And not a fun ‘ohm-fork’ ponzi. More like a Tupperware party MLM type.

Fees to Claim You “Free Airdrop”

There are 2 transactions required to claim your “free airdrop”, each with fees. Why 2 transactions with fees? Well, when you unlock the airdrop, 0.01ETH gets sent to the WTF team. Then when you claim the token you pay the gas on the transaction as well.

Well 0.01ETH doesn’t sound huge right? It adds up. They have pilfered over 115ETH (~$375k) just from this fee already.

And remember, this doesn’t include the 4% transfer fee above, which has clipped another $650,000 or so in $WTF that is sitting in the treasury with full control of the team.

Donations to get a Bigger Airdrop of $WTF

Apparently, the team was taking ‘donations’ of $ETH ahead of the airdrop where you would get a 2:1 ratio of $WTF to donated $ETH. They raised over 150 additional $ETH through this mechanism.

This was allegedly to help with the initial liquidity in the pool.

I will note, the WTF team did say they didn’t put all the liquidity in the pool right away to stop bots from siphoning it all. I don’t know if that is true, but full disclosure as they did address it.

Also, there was a huge spike in gas due to the $WTF airdrop being traded.

Gas was crazy due to $WTF as people tried to trade the token. Looking through etherscan you can see $700+ gas on some of the transactions.

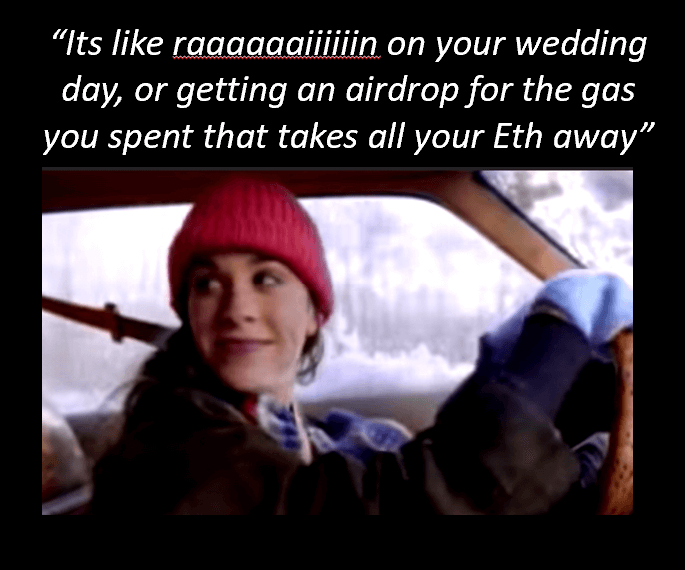

This is personally my favorite part of the story. The irony of this token is savory. The token that was airdropped under the premise of ‘repaying people for the high transaction costs they spent’. And then the token has ridiculous fees to claim and trade, and also spikes gas.

It looks like well over 2,000ETH was spent in gas fees related to $WTF already.

Seriously, this is my favorite part. Moments like this make you think this was all a big joke or not real life. It is irony and satire and makes me chuckle every time.

Wrap-up: WTF $WTF

You can read the post-mortem from the devs here. Lots of sugar-coating but at the end of the day, they are still millions richer from clipping fees on on the transactions & the donations for a team of 4.

Multiple devs from other protocols have stated that the code to sum up gas on contracts and distribute a token from it is literally a few hours of work. So the WTF team is making a pretty good per hour rate here.

My favorite part of the post-mortem though is when they say that ‘fees on transfers’ are extremely common, but then later on note that the Uniswap v3 pool can’t handle them. Also, the code they used to try to force transfers onto v2 is no longer a supported feature. Therefore, you can’t really sell your $WTF on the liquid v2 pool yet and are stuck in the very illiquid v3 pool… You would think for an extremely common characteristic it would be supported.

Huge price swings, devs siphoning big dollars, no liquidity, a meme-able name, and a ton of buzzwords in an airdrop all make $WTF the rug of the month. The fact that they released a post-mortem that is completely unrepentant about the huge fees (they actually wanted 10% at first) or sloppy execution is the cherry on top.

Reminder to Reply Guys

After last month’s post about $RUG, we got a lot of reply guys claiming to have brought in and made money in the time since the article was posted. The price remains fairly volatile due to being a nanocap and every reply guy bought at the bottom and sold at the local top. (sure bro)…

Their argument was that the coin that was 95% off highs, but went up to 92% off highs wasn’t a rug or something? Or maybe that they made money so it wasn’t a rug? Whatever the point, all reply guys insisted everyone involved with the post would forever be poor.

First, no one believes twitter traders.

Second, these posts recount interesting tokens that people lost a lot on and have questionable details around them. It isn’t a recommendation to buy or sell and anyone can buy a nanocap and get lucky if it goes up a lot due to low liquidity.