This article is part of a series covering the Wonderland situation. See Prior Coverage Here.

Omar Dhanani, aka Michael Patryn aka OxSifu, sent 2,000 Eth through tornado cash just days after being voted off Wonderland DAO.

Dhanani is the know fraudster who defrauded $170 Million in a Canadian crypto scam, QuadrigaCX. He was just voted out of the Wonderland DAO CFO position. This despite using his own large $wMEMO bags to vote against the proposal…Keeping it classy.

As CFO of Wonderland DAO, Dhanani was taking $ Millions a month of $TIME out of the protocol and using it to pay “Dev Salaries”.

His DeFi moniker, OxSifu or just plain Sifu, has been linked to many other protocols as an advisor and seed investor. In short, there has been a lot of news around him recently.

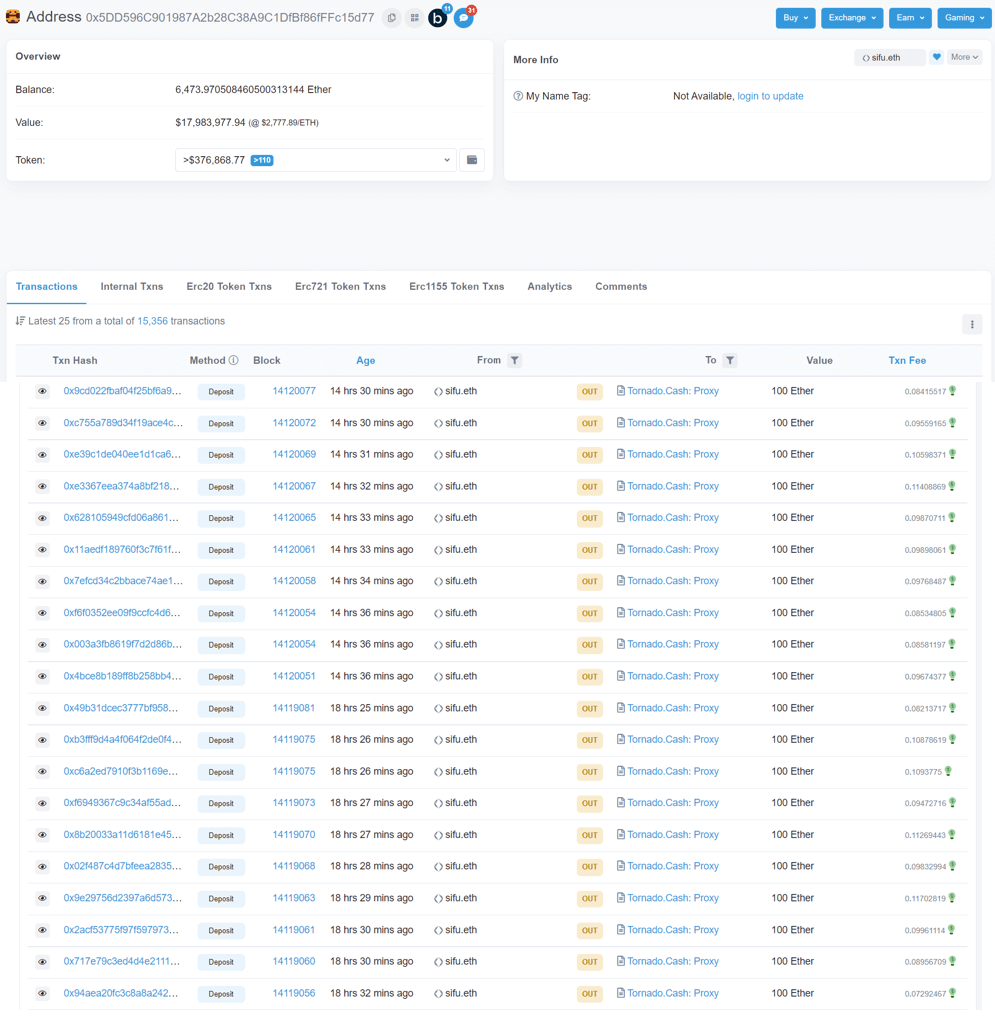

And only a few days after being doxxed and getting voted out as CFO of Wonderland DAO, he just ran 2,000 Eth through Tornado cash. The speculation is that he is laundering unearned money. However, even if it isn’t money laundering, it certainly gives the impression of money laundering.

Dhanani’s Doxxed Wallet Uses Tornado Cash

The news of Dhanani sending millions to Tornado cash was spread on twitter shortly after the transactions posted.

The address is known to be Dhanani’s, and is even tagged with his ENS domain, Sifu.eth. This raised questions if he is even trying to be discreet or if he is enjoying the infamy. The 2,000 Eth are around $5.5 million worth.

Dhanani split the 2,000 Eth in 100Eth transactions and sent 20 separate transactions to Tornado Cash.

The speculation is that Dhanani is laundering this money through Tornado Cash in order to make it untraceable. Once he withdraws it into different wallets, it would be very hard for anyone to claw back.

What is Tornado Cash and Why Would Sifu Use it?

Tornado cash is a transaction mixer. You send your tokens in, and then can anonymously withdraw them to a new wallet.

As long as multiple people are sending tokens to Tornado Cash, and you don’t immediately withdraw the same amount out, it should be nearly untraceable.

For instance, if you send 10Eth to Tornado cash then immediately pull 10Eth out to a different wallet, someone could look at the Tornado Cash wallet and see what you did. They could reasonably assume that the same person made both the deposit and withdrawal. However, if you put 10Eth in, wait a while then take 7Eth out and then later the remaining 3Eth, it would be much harder to track. This is especially true if you make 2 new wallets for the 7 and 3 Eth withdrawals.

Privacy mixers are there because every transaction on the blockchain is traceable. You can track funds as they move from wallet to wallet easily. If anyone wants to obscure any token movement while keeping coins on-chain they need this type of service. Moving coins off and back on chain could also break any links, but come with its own risks.

There are legitimate reasons to use mixers. People wallet watch whales or devs to try to front-run trades and launches. Also, someone may want to move money off-chain and not want prying eyes to know their bank account is flush with cash.

However, at a minimum, the optics of the transactions are poor when you just got doxxed as a known scammer, voted out of the CFO role of a major DAO, and were previously accused of taking an excessive salary. All while small retail investors lost their savings trusting you.

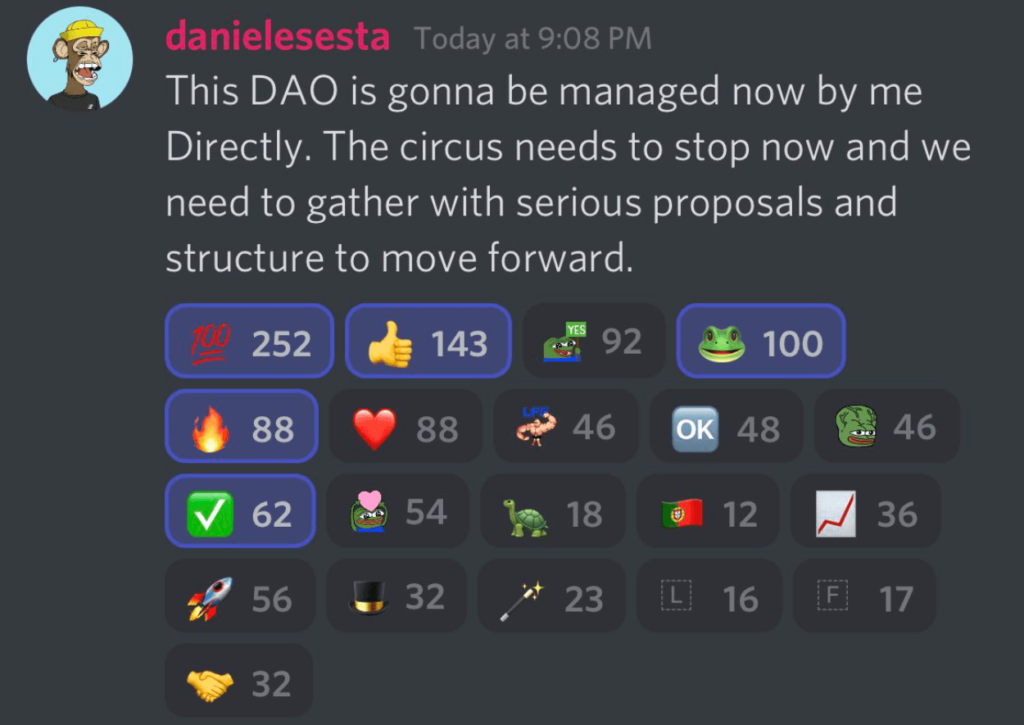

Daniele Sesta Taking Control of Wonderland DAO

A brief update on Wonderland DAO. In the Discord, Daniele Sesta announced he would be directly managing the DAO.

This news was a twist to those paying attention. Recent communications from the Frog Nation leaders had indicated Dani would be taking a step back from the spotlight.

However, the Wonderland discord seemed to approve of the recent change in direction. We will see what form Wonderland DAO takes next. (A DAO is a Decentralized Autonomous Organization….checks notes…wonders how many $wMEMO holders know what DAO stands for….)

Wrapping up – Some Hopium For Crypto

The broader cryptosphere is drawing a lot of attention to Dhanani’s continued bad actions. The non-scammers in the space understand this kind of behavior is going to reflect poorly on broader crypto adoption.

Through the power of memes, Sifu’s recent sending of $ millions to Tornado cash is being shared. Additionally, a broader conversation around focusing on real projects and educating retail is starting to become more prevalent.

Some DAOs have come out with plans to have all devs dox to each other to avoid another…Snifu…(get it, instead of snafu)

Additionally, protocols are looking to set up stronger safeguards. and more transparency.

If there is any upside to the recent events, it may be a maturation in the crypto space to something more sustainable.

Dhanani’s latest cash grab may be a cautionary tale for all crypto investors going forward.

However, get rich quick schemes have been around forever and ‘degens gonna degen’, so probably not going to entirely clean up the space.

Can we all at least to agree that we keep this guy out of any projects despite whatever name Dhanani uses next?