Hive Investments is a soon-to-launch DeFi-as-a-Service (DaaS) protocol on Polygon with an additional NFT marketplace. Hive looks to distinguish itself from other DaaS Nodes through a stated focus on sustainability, transparency, and reliability. They have attracted nearly 30,000 twitter followers in 3 months, creating quite the buzz.

What is Hive? What is DeFi-as-a-Service? What are Nodes? And how do they all fit together into a quasi-“Decentralized Autonomous Organization (DAO)” with NFTs? (and why the scare quotes around “DAO”?

Hive stated they just raised nearly $1.2 million selling 20 ‘founders’ Queen Bee NFTs in addition to another over $1.2 million in a previous private raise. Both these raises were allegedly done at a token price nearly 4x higher than the planned native token launch price.

They are also donating a portion of profits to Bee conservation. The community is able to ‘hive’ a vote on what bee-centric charities the protocol should donate to.

[Note – with a late March launch date scheduled, the information in here is largely based on write-ups Hive has released to date. I try to use ‘stated’ or ‘alleged’ to indicate it is all based on Hive’s pre-launch material. However, I may not always write them. Therefore, take this note as one large warning that this is all the stated intent from Hive. Nothing has been launched so there is nothing to confirm or support any claim made to date.]

Seriously though, the remainder of the bee puns in the article come from quoting Hive.

What Is Hive Investments?

Hive describes itself as a “next-generation NFT and DeFi-as-a-Service (DaaS)” protocol. They are launching on Polygon (Matic) with a focus on “sustainability, transparency, and reliability”. And formed by a “coaliition of expert investors, serial entrpreneurs, and established members in crypto” who will “leverage unique blend of proven strategies and radical innovations in the field of DaaS.”

Hive will be introducing its own native token, $HNY. $HNY will start at a price of $100 at launch. Additionally, $HNY will be the only token allowed on Hive’s native NFT marketplace, Hexagon.

You own a Hive node by purchasing a Hive NFT. Holding a Hive NFT rewards you with $HNY under a similar process to other node services (Strong, Thor, etc.)

What Is DeFi-as-a-Service (DaaS)?

DeFi-as-a-Service is when a protocol manages a treasury of funds on behalf of investors. The returns from the investments are distributed to holders in the form of daily rewards in the protocols native token. Therefore, DaaS is similar to a TradFi asset manager but with lower costs leading to potentially passing more of the returns to the investor.

DaaS is a growing market segment and there are risks from protocols offering higher-than-sustainable yields to early investors. This is known as ‘ponzinomics’ due to the tokenomis being structured like a ponzi scheme. Since ponzinomics require being early, one of the key measures for DaaS nodes is the time to break-even. You want to know how long until you have made enough rewards to cover the cost of buying the node.

Hive is claiming to eschew ponzinomics for a more stable model. Therefore, Hive’s days to break-even is much longer.

What is a Node in DaaS?

For those new to crypto nodes, there are 2 different things both called “nodes”. First is network nodes. For instance, if you own enough ETH you can set up your own ETH network node. These nodes allow you to validate transactions on the blockchain and for assisting in keeping the network safe, you are rewarded with the native token.

Nodes-as-a-Service (NaaS) services were created to combat the prohibitively high cost & technical knowledge required to have your own network node. NaaS allowed for smaller investors to partake in network nodes by pooling assets. (StrongBlock is one of the more popular NaaS).

Network nodes and NaaS are not at all related to the DaaS nodes. DaaS nodes don’t validate transactions and have no connection with the blockchain of the network they run on. DaaS nodes are created when a user spends tokens to ‘make’ one. The money from creating nodes goes into a treasury and is used to feed liquidity pools, reward previous node holders, and look to invest in other projects to grow the Treasury.

Therefore, despite having the ‘node’ in the name, DaaS nodes are basically the same as many other DAOs and protocols who raise a treasury and reward stakers. DaaS treasuries are invested to earn yield, so you are sort of outsourcing DeFi. However, nodes tend to not be unstakeable once created.

Is Hive Investments a DAO?

A Decentralized Autonomous Organization is a system that automates decision making by following rules set & agreed to by the community. In crypto, the rules of a DAO are written into the smart contracts to be followed.

Hive is not a DAO.

In their whitepaper Hive explicitly states “although we aim to operate as a DAO, the Queen (6 foundational members) reserve the right to overturn any decision as necessary for the benefit of the protocol. We define these decision as ‘no voting required’ situations.”

They highlight volatile market times when quick decisions need to be made as the example of a ‘no voting required’ situation. However, the stated right to overturn seems fairly all encompassing, so you are fully reliant they will act in your best interest.

What Differentiates Hive Investments from Other DaaS Nodes?

Hive highlights a few differences between itself and other DaaS nodes.

First, it talks extensively about its focus on sustainability. They plan on providing a ‘sustainable’ APR and not large initial yields to draw in investors.

Hive signifies node ownership through the transferable NFT, not locked Investment Capital. Many node projects make it difficult or not able to sell a node once created. By using transferable NFTs, Hive states that the return on investment (ROI) equation shifts from being “I need to make my entire investment back with rewards” to “I can earn a return on my investment and sell the NFT at the end”.

Also, Hive has a focus on stable $HNY price. As the white paper states “what is the point of high rewards if the rewards aren’t worth anything?” Hive explicitly states they are not going for ponzinomics.

Hive claims their NFT is like a ‘bee-autiful rental property’ (their pun not mine). It’s an asset that provides incomes and can appreciate overtime.

Hive’s Genesis NFT Mint & NFT as a Node

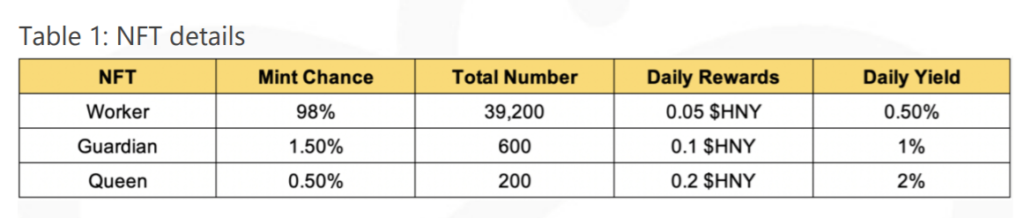

Hive will mint 40,000 NFTs in their initial mint. The price is 10 $HNY and $HNY is pegged to $100 initially, meaning $1,000 for each NFT. There are 3 levels of NFTs available and when you mint you have a chance to win a ‘worker’, ‘guardian’ or ‘queen’ bee.

Additionally, the price of the mint increases by 0.5 $HNY per 8,000 NFTs. Therefore, NFTs 32,001-40,000 will cost 12 $HNY or $1,200. Assuming that you get a worker, you have roughly 200-240 days to collect 100 $HNY worth of rewards, ignoring all the protocol tax & costs.

Hive also has a “Safe-Hive” policy where the listed daily rewards can be cut by 50% in a market downturn and subject to the Queen’s decision.

Hexagon – Hive’s Native NFT Marketplace

Hexagon is the NFT marketplace that will be the first of many pieces to the Hive’s alleged “ecosystem”. Hive recognizes each NFT (‘New Flower There; as they call it) is unique but many NFT collections are scams and rip-offs. Additionally, many of the launched NFT marketplaces are just forks of one another.

Hexagon was allegedly built from the ground up and any listed NFTs will be approved by the Hive’s ‘Queen’ (the 6 foundational member). The ‘Queen’ wants NFTs with a use case or exceptional art that is verified by original creators.

Hexagon will also be the only marketplace to transact with Hive NFTs to own a node. If you want to get a Hive NFT, you need to use the Hexagon marketplace.

Lastly, Hexagon currently plans to bee fee free. All transactions on Hexagon are fee free, the only charges are royalties set up by the NFT creators. Hive will benefit indirectly from the purchase of $HNY to transact on the Hexagon platform.

Hive’s Queen Auction Event

Hive just completed a one off auction for 20 Founder’s Queen NFTs, number 1-20. These 20 Queens are unique as their reward rate is pegged to the price paid for them, 0.2 $HNY per 15,000 $DAI paid. The bidding in the auction went up by 15,000 $DAI per bid.

The auction raised nearly $1.2 million over the week. Hive claims the auction was done at the equivalent of $375 per $HNY. They do this by noting 10 $HNY can get you a worker bee that earns you 0.05 $HNY a day. The Queen’s reward 4x that per day (0.2 $HNY) but cost 15,000 $DAI. If you take 15,000 / 4 times higher rate you get $3,750 and divide by 10 $HNY a regular mint costs gets to $375 price.

The #1 Queen NFT was purchased for $120,000 with the winning bidder coming way over the top of the second highest bid of $45,000.

Hive Tokenomics

Now for the fun part, what are the underlying token allocations for Hive.

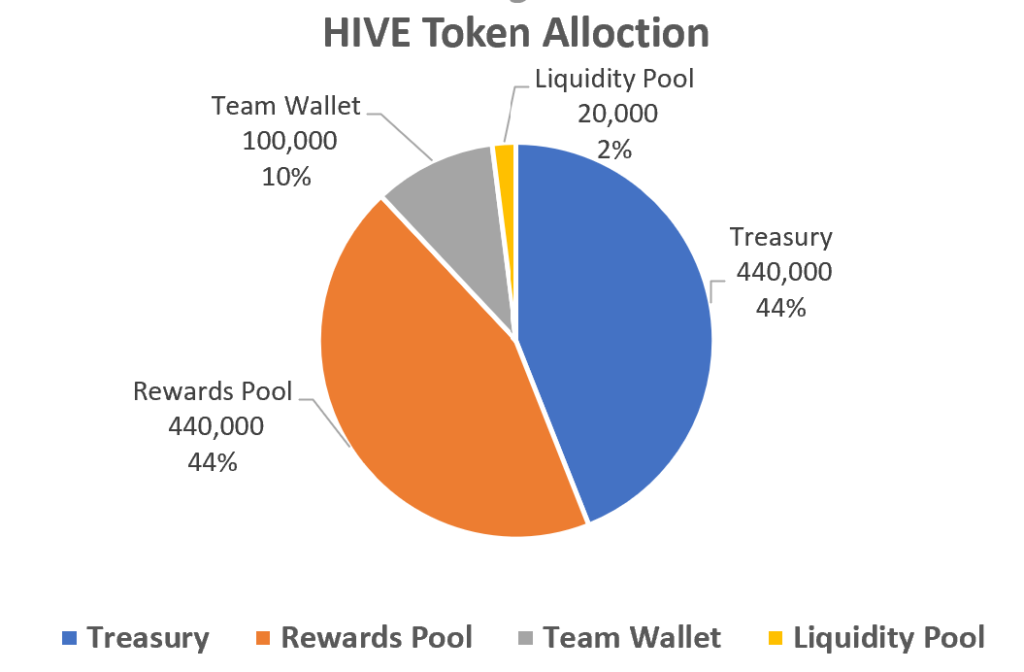

The protocol will mint 1,000,000 $HNY and split it 44% / 44% / 10% / 2% between the Treasury, Rewards Pool, Team Wallet, and Liquidity Pool respectively.

Each $HNY is $100 at launch price, so this is $100 million total at launch.

The $10 million going to the team wallet is vested 25% immediately and 25% unlocks every 6 months with final unlock at 18 months. The $10 million is for compensation, marketing, and future development costs.

Additionally, Hive calls out 4 sources of revenue for the protocol in the whitepaper.

- Mint Proceeds – 53.5% Treasury, 40% reward pool, 5% team wallet and 1.5% to bee preservation & charitable efforts

- Treasury Investments – Majority of Treasury will be invested in low-risk and stable investments with some spread out over medium & higher risk investments. Buy backs of $HNY are also allowed from the Treasury pool.

- Sales Tax 15% – When you sell $HNY on SushiSwap there will be a 15% sales tax. A 1/3rd goes to the Treasury for reinvestment and 2/3rd goes to team wallet for expanding and operating costs

- Queen’s Tribute (Monthly Tax) – NFT holders pay 3 $MATIC every 30 days which all goes to the Treasury. You can not claim $HNY until the tribute is paid.

Hive claims proprietary modeling to show that the above revenue and their investment strategy is enough to pay all the rewards and continue to grow the Treasury. In earlier iterations they also had a fee on the Hexagon NFT marketplace but decided that was no longer needed.

Hive Governance Model

Hive will follow a standard governance model. $HNY is the governance token in a weighted voting system. NFTs all count for 10 $HNY. The community will vote on any proposals submitted and if a community proposal passes there will be a reward for the person who proposed it. The Queen has final say so the 6 core high members need to approve.

Hive will also produce investment reports so ‘no bee left behind’ on the current policy and investment landscape.

There will also be a Bounty system where community members can earn $HNY for completing all sorts of tasks from articles to tweets to designs to smart contract audits. This is in place of outsourcing the work to a third party.

Lastly, the Queen has ultimate power despite all listed above. This is not a DAO. The white paper explicitly states the Queen has “the right to overturn or make any decision as necessary for the benefit of the protocol”.

Pros vs Cons of Hive

Based on the material released so far, here are what I view as the pros & cons of Hive”

Positives

- Focus on sustainability

- Leave room for quick decision-making

- Hexagon vets NFT projects for scams

- NFTs may have residual value

- NFTs look nice

- Private raise & Queen’s Auction were at a premium to the planned launch price of $HNY

- Bounty system rewards & keeps money in the community

Negatives

- 15% Sales Tax & Queen’s Tribute

- Not a true DAO

- Queen can decrease rewards

- Long breakeven time with rewards

- Investment strategy is proprietary

- Would prefer a fee on Hexagon for non-Hive NFTs in exchange for lower fees for Hive users

To elaborate on 2 of the negatives a bit further. First, the long time till break-even on the rewards. If you account for the 15% sales tax & the monthly Queen’s Tribute, it takes about 245 days to break-even from rewards. (Assumes 10 $HNY mint, a worker bee, and $HNY=$100 & $MATIC=$1.50 for entire time). This ignores any residual value from the NFT.

Second, the whitepaper uses shows a Monte Carlo simulation and shows a sample of the the equations used to minimize and maximize parameters to optimize the Treasury. Modeled results depend on assumptions, historical data, and back-testing. There is always the risk that the Treasury management doesn’t perform as expected. Since the actual management plan is ‘proprietary’, and the samples in the whitepaper aren’t enough to discern what is going on, you are relying on the Queen.

Summary: Hive Investments

Hive definitely has laid out an ambitious ecosystem plan. They are planning to launch a DaaS node, NFT project, and NFT marketplace all on a new native token. When I see a buzzword salad of popular DeFi terms it tends to raise red flags. The low rewards on the node means early investors don’t have a chance to pull out principle if the project doesn’t gain widespread support.

The 6 core team members (referred to as the “Queen”) are KYC’ed by Assure. The smart contracts are being audited by CertiK, and multi-sig will be on all wallets. If those items are important to your decision.

However, there is a lot of excitement on Twitter for Hive. The NFTs also are top notch so far, this isn’t a Pixelmon quality NFT rug. I like the focus on stability, and if the team can gain traction with the NFT marketplace that could lead to an increase in the native token.

Overall, Hive seems like a good project to keep an eye on as they go to launch.