Crypto lender Celsius Network announced it filed for Chapter 11 Bankruptcy Wednesday 7/13. The Chapter 11 filing comes on the heels of freezing customers funds last month. The filing indicates that retail depositors are being considered as unsecured lenders. This means they are very low on the list for asset recovery. In short, Celsius just rekt their depositors.

What Lead To Financial Troubles of Celsius

Celsius advertised itself as a platform to “buy, swap, earn, borrow and send crypto – all in one app, with zero fees.”

Celsius was considered one of the ‘gold companies’ in the crypto space. Co-founder Alex Mashinsky’s company was offering high-yields and charging no fees. They had positioned themselves as an “unbank” where you got the benefits of TradFi & DeFi.

However, doubters pointed out that offering high yields without fees could only be accomplished with large risks.

Celsius was able to achieve such high yields by investing in other protocols. For example, they were exposed to $Terra / $Luna and were exposed to the $UST stablecoin de-peg. Similiar to 3 Arrows Capital, who just defaulted on a $670 million loan.

Celsius also used LIDO to stake Ethereum for a high yield, at the cost of giving up liquidity. Lastly, Celsius had invested in BadgerDao before it was hacked.

Being in illiquid funds & having investments blow up strained the company’s financials. The general downturn in the crypto markets further dried up liquidity.

This lead Celsius to first freeze customers assets in June with the promise of working on a solution. However the inevitable happened this week.

Celsius confirmed Wednesday that it had “filed voluntary petitions for reorganization under Chapter 11 of the U.S Bakruptcy Code”. They filed in NY court.

Celsius Freezes Depositor’s Assets

Celsius froze depositor’s assets in June of this year. The pause of ‘withdrawals, swaps, and transfers’ was done to “stabilize our liquidity and operations” according to a June 19th release by Celsius.

This memo had given hope to depositors by saying Celsius’ priority was “acting in the interest of our community”.

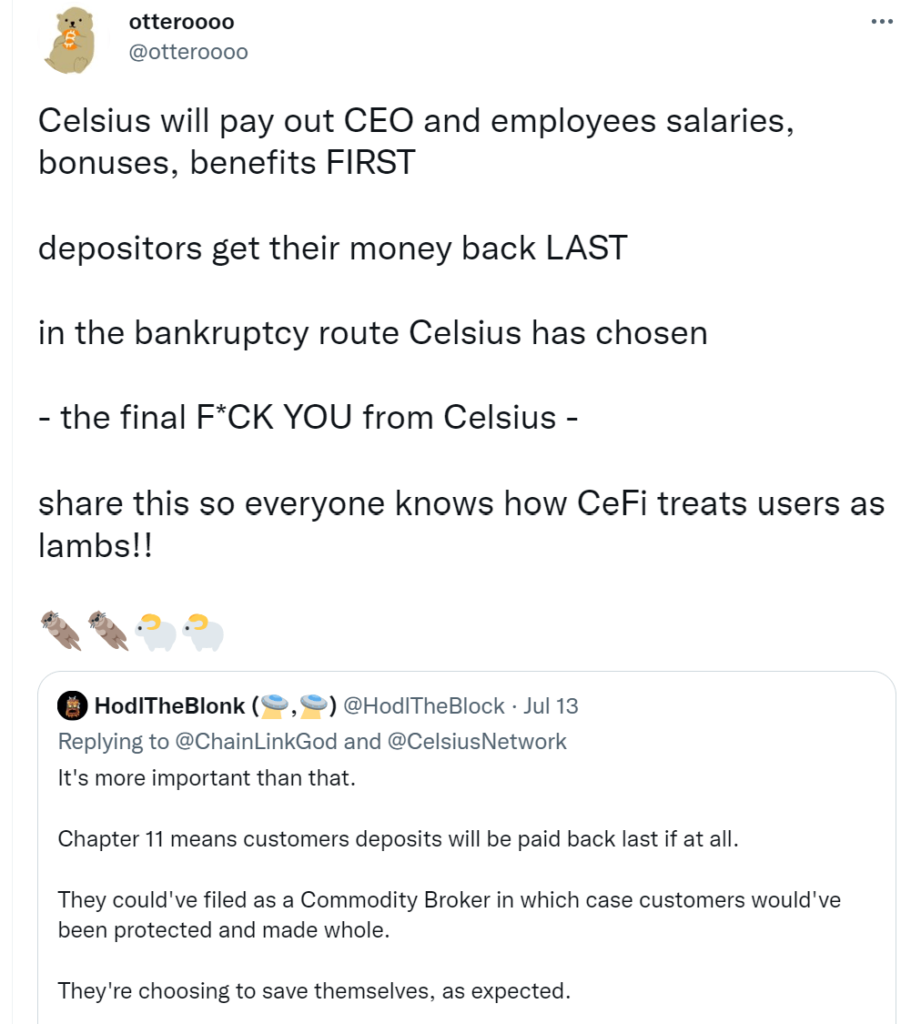

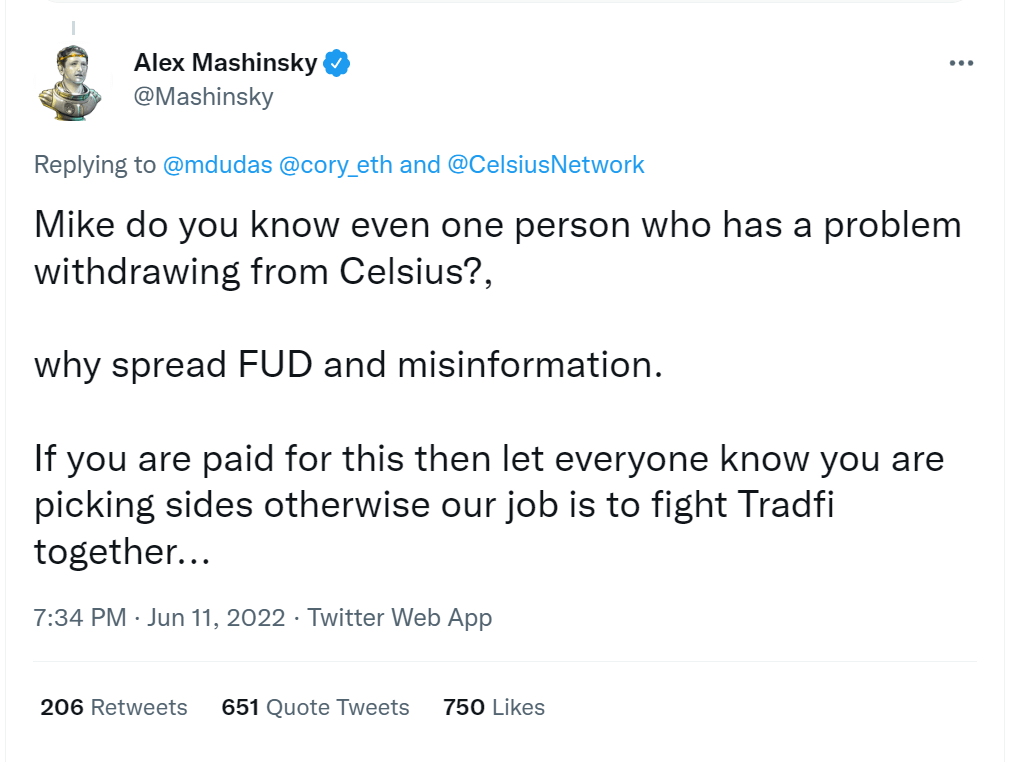

However for people paying attention, the news wasn’t a surprise. Celsius’s Founder Alex Mashinsky aggressively attacking twitter rumors of a freeze as FUD the day before Celsius announced the freeze. (FUD = Fear, Uncertainty, and Doubt).

Hours after the above exchange, Celsius immediately froze all depositor’s assets.

Celsius’s memo on the asset freeze alleged that the actions were done with good intentions. The freeze was to “put Celsius in a better position to honor, over time, its withdrawal obligations.” Additionally the freeze is important as “acting in the interest of our community is our top priority”. The ultimate goal was “stabilizing liquidity and restoring withdrawals, swap, and transfers as quickly as possible”.

As Maury would says, “that was deemed a lie”.

Celsius Bankruptcy

On July 13th an announcement of bankruptcy was released. Celsius admitted to their estimated 1.7 million users they are likely not getting their money back. That is over $8 billion in frozen deposits estimated.

In the filing Celsius indicated it planned to keep operating since it has over $150 million in cash on hand. The company owes over $4.7 Billion in debt and has a $1.2 Billion hole in its balance sheet. Although the hole is likely higher as a large portion of the assets are its own $CEL token.

In the release, it is noted that “to ensure a smooth transition into Chapter 11”, Celsius filed motions to continue to pay all employees and other actions. Not included in any of the filings was a request to unfreeze depositors assets.

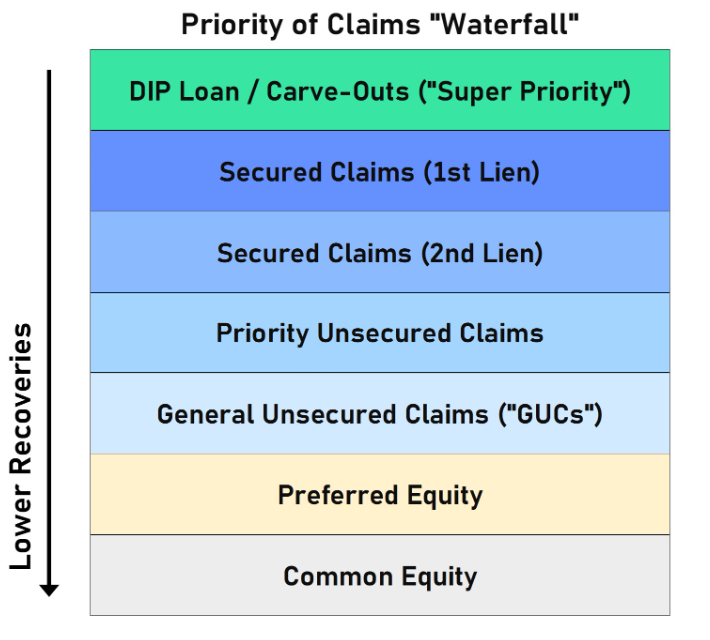

However, Celsius is “not requesting authority to allow customer withdrawals at the time”. This news nuked the last hope of retail depositors being made whole. Retail deposits are considered unsecured credit in the bankruptcy, meaning very low on the priority list.

Celsius also had sizable investment firms are depositors, including a Cayman Islands fund which lent over $300 million in assets.

Lastly, it appears as if depositors are being considered General Unsecured Claims (“GUCs”). In a bankruptcy priority, these are the last debt tranche to be paid, just before the equity. Very rarely do GUCs get more than a small percent of their original principal.

Conclusion: Celsius depositors Are Unlikely to Recover Their Money

Twitter users have pointed out that there are other options Celsius could have pursued that may have better served the depositors.

User “HodlTheBlonk” commented that Celsius could have filed as a Commodity Broker and under a recent change, depositors would be made whole.

However, by going the Chapter 11 route, it is speculated that Celsius is putting itself over depositors.

Alex Mashinsky was also publically stopped at a Morristown, NJ airport on a flight attended for Israel by authorities. This came a few weeks after Celsius freezing depositors assets.

Although he wasn’t arrested, he was removed from the flight and speculation has grown he was trying to flee the country.

These actions continue to point towards a very low probability of depositor’s getting any funds back.

In a recent tweet, a well-known twitter personality Ox_b1, revealed Celsius was not hedging. He was part of a firm that was being acquired by Celsius and got to see the alleged complete lack of risk management.

Ironically, Celsius site is still full of its taglines like “next-level transparency of decentralized finance to a centralized company” and to “unbank yourself”. However, Celsius is another reminder that ‘not your keys, not your coins’.