Many investors have had their eyes on an opportunity like this since the Covid Crash of March 2020. Crypto prices visited long lost prices over the weekend with Bitcoin going as low as $17,760 and Ether dropping to $897, below their 2017 all time highs. Something that has never happened before, leaving many questioning whether to “buy the dip” or wait for more pain in this bear market.

How It Started

Most of the carnage is overwhelmingly deleveraging with many notable stories along the way. The crypto bleeding started with Do Kwon and the collapse of TerraUSD and LUNA, two of the largest cryptocurrencies at the time of the crash.

Terra is a blockchain protocol containing a variety of algorithmic stablecoins built on Cosmos. TerraUSD (UST) lost it’s peg to the dollar, and Do Kwon deployed their BTC reserves to save UST peg to the USD.

The existing macro environment didn’t help with any of the bleeding and it’s institutional and retail investors panicked.

More damage ensued on June 13. Celsius, a crypto lending firm, restricted all withdraws, swaps, and transfers for all users because of “extreme market conditions”. After failing on their risky investment practices.

Since Celsius behaves like a bank they participated in a lot of practices to boost profits through user deposits by lending them out. A primary example was using depositors Ether and staking it on Lido, a platform where users deposit their ETH for stETH. Operating on a 1:1 to the price of Ether.

Following Celsius was Three Arrows Capital (3AC) one of the more prominent crypto hedge funds. Now is acknowledging significant losses after failing in it’s aggressive investment practices. Like anyone else, they found themselves in the crosshairs of the Terra collapse after investing over $200M in LUNA. On top of that, they’re one of the largest holders of $GBTC (Grayscale Bitcoin Trust) and stETH (Lido Staked Ether) both of which have experienced major downturns.

3AC stated they’re possibly open to “asset sales and rescue from another firm” after overleveraging. Before the downturn the firm managed ~ $10B in assets.

“We are in the process of communicating with relevant parties and fully committed to working this out”

Zhu Su

Now hinting at bailouts, 3AC is looking to FTX and Sam Bankman-Fried. Today, BlockFi received a quarter billion loan from FTX as a “bail out” and 3AC is hoping for the same results. BlockFi liquidated 3AC after it was unable to fulfill margin calls. Zac Prince, BlockFi CEO, said the deal with FTX “bolsters our balance sheet and the platform’s strength.”

Sam believes it is his duty to prevent major downturns and contribute any way he can for the industry. Others see it as a crypto bailout, creating the same issue that people see in the current system that is now full of bail-outs. It’s being viewed as a version of kicking the can down the road by many.

Sam Bankman-Fried defending against the “FTX bailout” narrative said:

“I do feel like we have a responsibility to seriously consider stepping in, even if it is at a loss to ourselves, to stem contagion.” He added that, “Even if we weren’t the ones who caused it, or weren’t involved in it. I think that’s what’s healthy for the ecosystem, and I want to do what can help it grow and thrive.”

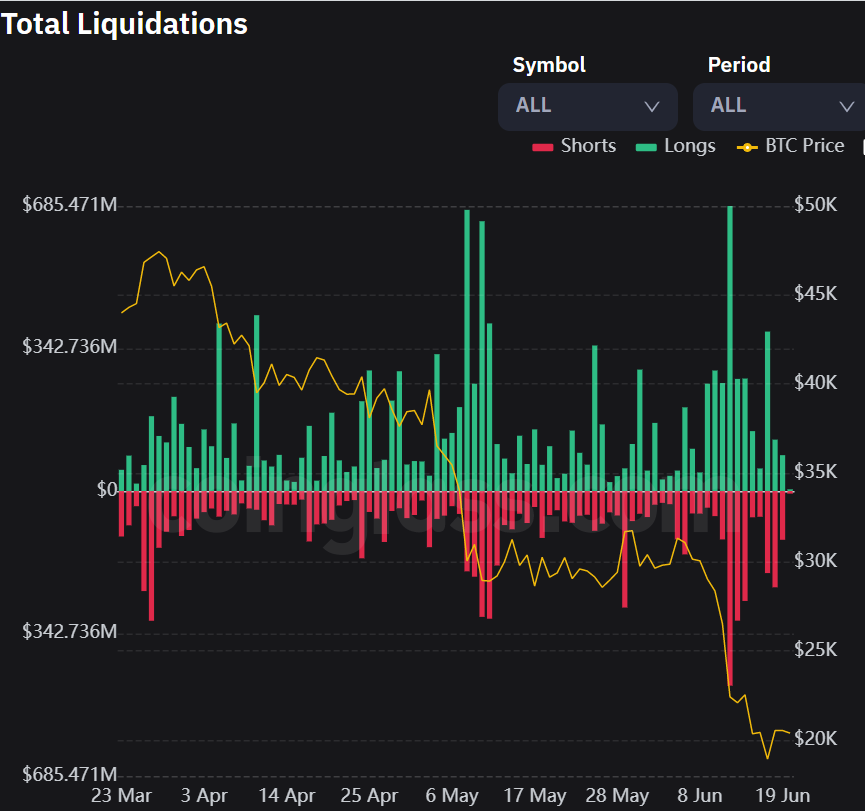

SBF

The liquidations we’re seeing today are not completely uncommon for crypto, even in the face of all the noise with Terra, Celsius, BlockFi, and 3AC. The liquidations and pain will continue as long as there are firms out there being irresponsible with depositors funds. Anyone who was smart, never levered up, and acted responsibly will weather the storm.

So, on to the main question, who is buying this dip?

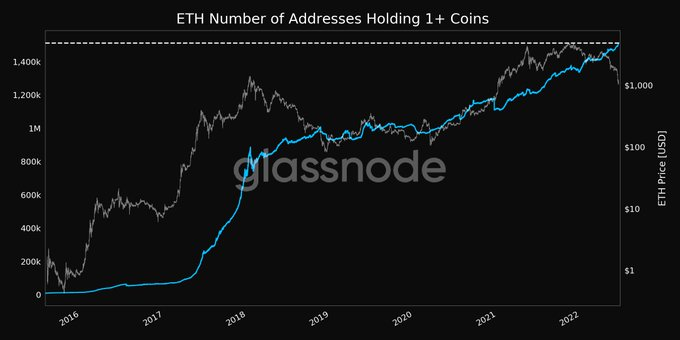

For one, the number of Ethereum addresses holding 1 or more ETH (blue line) has continued to grow despite continuously worsening macro conditions and crypto headwinds. Same goes for BTC as well.

Anyone interested in buying the dip should look at it as an opportunity, as long as they’re responsibly doing so. Long term buyers, HODLers, are able to weather the normal volatility in the crypto markets and play the long game.

Some things to remember:

Not Your Keys, Not Your Coins

If anyone has learned anything from the above, manage risk appropriately, and own a hardware wallet. This is simple. If anyone is going to buy crypto it is important to make sure it is yours. Use a hardware wallet and hold the keys to your coins.

This makes you the sole owner. Do NOT hold and keep your coins/crypto assets on the exchanges. Under no circumstances do not deviate from this rule.

Important thing to remember is to have designated wallets for specific purposes. Having different wallets for different reasons allows you to mitigate risk and give each a dedicated purpose. You don’t want to have your cold storage wallet engaging with DeFi protocols. Your hardware wallet shouldn’t not be confused with a hot wallet, like a MetaMask wallet.

Responsibly DCA

Never Become a Forced Seller. Long term DCAing is always better for 99.99% of people out there rather than trying to time the market. “Time in is always greater than timing.” Select your DCA method and have a plan for the DCA, don’t emotionally or blindly buy into something, always have a strategy and a plan.

If you’re practicing the 80/20 strategy, where your core holdings are the 80%, have a plan for the 20%. De-risk appropriately, and manage greed. If you have a large run-up in your 20% allocation for riskier “bets”, de-risk and convert *most* of your winnings back into your core holdings.

Conclusion

If you’re opting out of crypto, you’re opting in for a CBDC. The bear market can be vicious but this isn’t unfamiliar for crypto.

Keep your eyes on the prize and don’t negate the importance of your personal situation, Everyone always learns that FOMOing in doesn’t solve anything, much less the short term implications of doing so. It would be counterproductive to put yourself in an unnecessary financial predicament that would cause you to sell *any* BTC or ETH because you failed to anticipate an expense, or a surprise occurred.

Think long term. Don’t let life’s surprises ruin your momentum.