Another stable coin? How many of these can there possibly be?

I hear you dear reader.

Stable coins are particularly tough to slog through the white papers knowing all the computations is to try to set 1 something equal to 1 of something else.

So what interested me in Beanstalk DAO in the first place?

I could tell you I was inspired by the technology.

I could tell you it is the novel approach to holding the peg to the dollar and the complex challenge of stable coins in general.

I could tell you the multiple formulas in the white paper that show a lot of thought went into it. And that I definitely read the whitepaper when I invested, not just for writing this post.

I could tell you I am an idle smooth-brain that heard about magical beans on the internet that I could buy with real money and they would make me rich one day…and hopefully allow me to fight a giant…

But the answer is definitely the potential of a 20x return on my money…which I guess kind of is that last option.

So, why write up about Beanstalk now?

The Curve Wars v2 are coming and stable coin protocols may get very interesting, leading to some mispriced opportunities…

Stable Coin Background

Stable coins are tokens that attempt to hold a relationship with a base value. For example, you could try to maintain a 1 stable coin to $1 relationship, 1 stable coin to 1 oz of gold, or 1 stable coin to literally anything. It seems simple, but in practice it is surprisingly difficult.

Why are stable coins important?

Stable coins are important in the DeFi ecosystem as stable coin & token liquidity pools underlie many DEX swaps. Even when swapping between 2 tokens that are not stable coins, many times the DEX will go from Token A to Stable Coin X, then Stable Coin X to Token B due to lack of liquidity in pools of Token A & Token B directly.

Stable coins also allow for a way to keep your coins in the crypto ecosystem while not being exposed in bear market.

Lastly, stable coins tend to be the easiest way to bridge between chains.

How Do Stable Coins Hold Their Peg?

(I never liked the term stable coin since the main ones are pegged to the US Dollar (aka US Trash Token) which is anything but stable, but that’s a twitter rant for another day).

Pegging one token to another is a surprisingly complex task if trying to solve in a decentralized way.

The 1st generation of stable coins were made by centralized organization and claimed 100% collateralization with the base currency, in general. For example, USDC and Tether (ignoring all the drama around it) are centralized entities that hold $1 US Dollar for every $1 of stable coin they release.

In theory, being able to redeem 1 stable coin for $1 US Dollar from the centralized entity would keep the value pegged, otherwise you could arbitrage it. However, this system has all the flaws of centralized organizations.

A 2nd generation of stable coins were developed that were not centralized, but required a lot of collateral. $DAI from Maker DAO is a good example of this. $DAI gets created when people put up collateral and borrow against it, and then $DAI is destroyed when loans get paid back. Since borrowers can’t take 100% of their collateral out in the loan value, this leaves a decentralized and over-collateralized system.

The new generation of stable coins try to adjust mechanically without requiring collateral. Here is where Beanstalk DAO (and others) are operating.

Beanstalk DAO Introduction

Beanstalk tries to solve the stable coin problem through a credit-based method instead of a collateral-based one. They argue that there isn’t enough collateral available to meet the demand for stable coins, which is what drives the high borrowing cost today (demand way higher than supply). However, using credit allows for infinite scalability and increased stability as it grows.

The end goal of Beanstalk is to have their stable coin oscillate in a very narrow range from below to above the $1 peg.

Beanstalk DAO Glossary:

There is a lot of terms to define if any of the next descriptions are going to make sense.

- Bean: The stable coin of Beanstalk

- Beanstalk: The name of the entire DAO that consists of 1) decentralized price oracle, 2) decentralized governance mechanism, & 3) decentralized credit facility

- Bean Farmer: Someone who lends beans in the Field in exchange for Pods

- Field: Beanstalk Lending Facility

- Seasons: time-keeping system where 1 season is approximately 1 hour

- Silo: Passive yield opportunities to bean & LP owners for participating in governance

- Stalk: governance token and “Equity” token of Beanstalk received by staking beans in the silo

- Soil: Current number of beans that can be sown in exchange for pods, where 1 bean is sown in 1 soil

- Pods: Debt asset of beanstalk that you get when sowing beans in soil

- Weather: yield on beans sown for pods

Beanstalk Mechanics

There are 2 main components in the Beanstalk DAO: 1) Silo & 2) Field.

The Silo is very similar to all other stake-able governance tokens. You buy $BEAN or take your $BEAN:$ETH LP token and stake it in the Silo to earn $STALK. Additionally, you get a small amount of $BEAN for every $STALK you hold when the supply of $BEAN is increased by the protocol.

The APY on staking has been in the 1,000%s, but currently is much lower.

The Field is the lending facility and where Beanstalk starts to offer something novel. In the Field, ‘Bean Farmers’ lend $BEAN (called ‘Sowing’) in exchange for $PODS (the debt asset of Beanstalk). This is the credit system that makes Beanstalk unique.

Beanstalk Peg Maintenance

There is a lot of variables that can move around in this system to try to maintain the peg. Here is an exhibit that is helpful from a “Bean Merchant” (aka someone who wrote a few substack posts on Beanstalk)

When the price of a $BEAN is above $1, new beans are minted and the incentive to provide debt to Beanstalk is decreased. If that doesn’t bring the price below $1 in a day, then $BEANs are sold on Uniswap to further push the price below $1.

When the price of $BEAN is below $1, the incentive to provide debt to Beanstalk is increased. This means $BEAN holders will sow their $BEAN for $PODS which takes $BEAN supply down and increases the price.

Therefore, when the $BEAN price is above $1, $BEAN is released to Bean Stakers in the SILO and Bean Farmers in the Field.

Ok But Where is that 20x Returns?

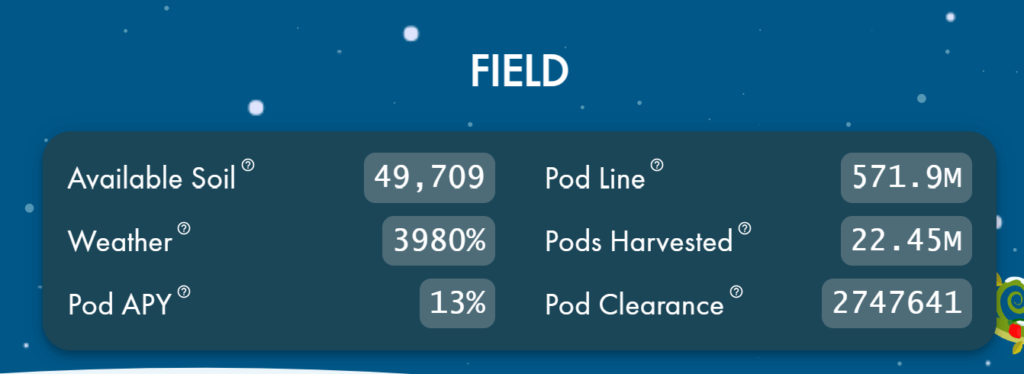

The way the Field works is on a First In, First Out (FIFO) system. When $BEAN is released to the field (when $BEAN > $1), the oldest pods get their $BEAN payout. Currently the ‘weather’ (the APR on pods) has been in the 2,000% to 4,000% range.

Therefore, if you sow $100 of $BEAN and weather is 2,000%, you will get $2,000 of $BEAN once your turn in the FIFO system comes up.

However, how fast the pods ahead of you clear is the unknown. It is dependent on how often and how long $BEAN is over its $1 target. So you know your return, but do not know your time to get your money.

I think of this in concept like a callable-at-par zero-coupon bond. You lent the DAO a small amount of money and are waiting for the DAO to return the full par amount to you at some future point of their choosing…except the future point is all based on smart contracts.

Should You Go Sow Your Beans?

Honestly, the current offering isn’t as lucrative as it was previously.

Yes, your weather is 3980% (get nearly 40x your $BEAN deposit back), but the expected time to make that money back is long. Pod clearance of 2,747,641 seasons (each season is 1 hr) means 114,000 days till you get paid (over 300 years). Hence, why your APY is only 13% despite APR of 3,980%.

The pod line is the number of pods currently in waiting.

However, the 300 years is based on the last 720 seasons (30 days) experience. The last month $BEAN spent nearly the entire time under $1. Therefore, if you think that going forward $BEAN will be able to get above $1 more often, that time to clearance could speed up significantly.

In September, there was a huge pump in $BEAN with the value going up over $4 (from a $1 target) as speculators rushed in. Therefore, it isn’t impossible to see $BEAN get over $1 for an extended period if demand shoots up.

So is there any near term catalyst to watch out for?

Bean & The Curve Wars

For those unfamiliar, Curve is arguably one of the most important protocols to DeFi. Curve is DEX that focuses on efficiently swapping stable coins. However, people who own the curve token are able to direct more yield to the pools of there choice. Therefore, there is a constant battle to control the token and direct more rewards to your pool. This drives up demand for your token and makes your protocol more used.

Bean recently showed up as an option in a Curve pool.

Does this mean the demand goes up? No idea. But it certainly can’t hurt to have your stable listed on the most used stable coin DEX. And it doesn’t hurt that the Curve Wars show no sign of slowing down, meaning Curve is likely going to keep getting more and more users.

I do not see any news of Beanstalk actually trying to enter the actual Curve War and accumulate Curve token. But being on Curve platform has to be better for your demand than not.

Therefore, the previous 30 days used in the Field calculations may not be representative of the go forward experience, which may be a mispricing in the market.

Beanstalk DAO Conclusion

Beanstalk DAO definitely seems like a protocol to keep an eye on.

For those of you who like the technology, the lending facility methodology is pretty interesting. Beanstalk incentivizes $BEAN holders to remove supply (by sowing) when the price is low, and then when the price is high, they are able to reward the farmers & stakers with $BEAN while also pushing the price down. This seems novel vs. more ponzi-nomics, sucking up collateral, or relying on a central authority.

However, Beanstalk is still relatively new, and if people lose faith in it and stop lending to the protocol, they have no way to actually maintain the peg and will fail. As always, do your own research and degen somewhat responsibly.

In closing:

Beans, Beans the magical fruit

The more you sow, the bigger the loot

The bigger the loot, the longer the wait

So please drive up the demand, for goodness sake…

(serious I am like around 400mm in the pod line and would love to see a return before I am 200 something years old)