Overview on Chainlink

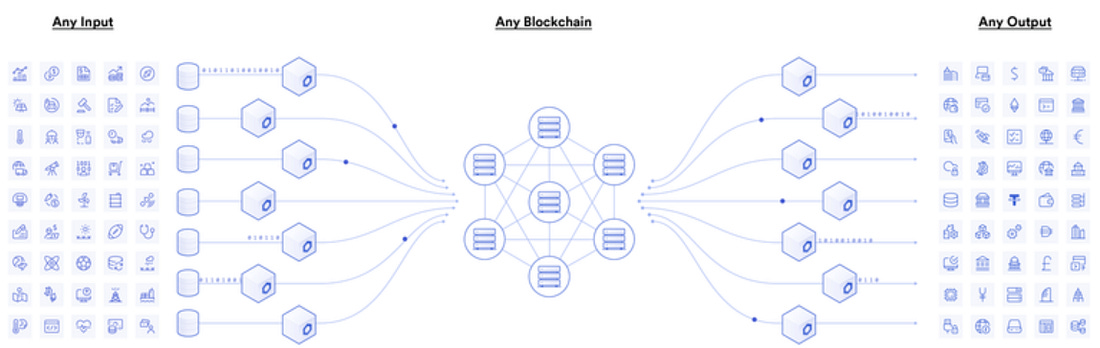

Chainlink is a platform that brings real world data onto blockchain networks through it’s decentralized oracle networks (DONs) and hybrid smart contracts. Essentially, it is key infrastructure for oracle networks and smart contracts to interoperate.

It can securely connect smart contracts on any blockchain to outside data. Chainlink is used by smart contract applications to retrieve data and off-chain computation. Data providers can now monetize their hard earned data by releasing their API and selling it to applications. Chainlink provides data and information, you need oracles to provide trusted data from a variety of sources that allow you to cross reference multiple data points to get to the answer/result you need from a data feed. Chainlink is the fastest way to retrieve data feeds from the “real world”.

Chainlink DONs (Decentralized Oracle Networks) provide decentralized services such as Price Feeds, and the ability to connect to any web API. Chainlink gives us information needed in DeFi for price feeds. Such as 1:1 coins like Wrapped BTC and Wrapped ETH that follow BTC & ETH prices on a 1:1 ratio. This is also important for things like stablecoins where an oracle can provide a price feed needed in order for the stablecoin to maintain it’s price it is “capturing”.

DONs bridge and “create highways” between smart contracts. Chainlink uses oracles to collect external info on chain through a running Decentralized Data Model, which is a smart contract that is programmed to constantly update data. An example of this outside of DeFi is how Chainlink is used by AccuWeather to provide information on the weather.

Oracles are the way to connect blockchains to the real world. They are what enable hybrid smart contracts. They expand the on-chain capability of collaboration that smart contracts can provide. The oracle validates and verifies data to ensure that it is fully tamper proof, in a decentralized manner, and it aims to maintain that reliability.

Cross Chain Interoperability Protocol

Big announcement that many were excited about! Cross Chain Interoperability Protocol, CCIP, was originally announced on Aug 6, 2021 at the Smart Contract Summit. Sergey and the team have been working on CCIP for years. It was announced at a time where this is becoming most necessary in a multi-chain world. CCIP reinforces a productive and dynamic aspect to multi-chain and cross-chain functionality and brings more capabilities to application developments and services.

“The Cross-Chain Interoperability Protocol (CCIP) will enable disparate blockchain, smart contract, and enterprise systems to interoperate with each other using a global open-source messaging standard, unlocking entirely new possibilities for cross-chain innovation.”

chain.link

The simplest way to describe this is that CCIP brings the ability for other blockchains to communicate with one another, and provides interoperability to applications to collaborate with each other. This has massive implication for the abilities for all chains to improve and enhance functions. Therefore presenting more opportunities and capacity to this technology. CCIP seeks to provide connectivity and creates a global standard to allow blockchains to interoperate, and lets smart contracts from other blockchains to send each other commands.

“It will give developers the ability to generate smart contracts on Ethereum, use DeFi protocols on other chains, send a payment on a Hyperledger payment system, maybe get collateral in Bitcoin, or do whatever complicated combination they want to do. It’s something that will unlock an entire world of innovation in our industry. It will unlock an entire new set of applications that were previously not available and previously not possible”

CCIP creates smart contract interoperability across all blockchains. It allows smart contracts from other blockchains to work together creating vastly more functions and innovation, which is a massive win for crypto. It enables developers to contribute easily and bring more functionality and development for dApps. It also reduces gas costs for users and validates cross-chain transactions. CCIP allows for tokens to interoperate with each other form other chains and enable what Sergey deems a “true cross-chain system”. Very exciting times ahead for Chainlink.

LINK

The LINK token is specifically designed to work with oracle networks and is based on the upgraded ERC-677 token, which is backwards compatible with ERC-20. Think of ERC 20 as the “Ethereum token standard”. An ERC-677 token allows tokens to be transferred to contracts and have the contract respond to receiving the tokens within a single transaction.

Smart contracts pay for access to the data feeds on and off chain, Chainlink nodes are paid in LINK for services rendered. Staking enhances the Chainlink network and is denominated in the native token, LINK. The node operators “lock in” to support the network and the DONs.

LINK token is used for node payments, implicit and explicit staking, and Chainlink Oracles for data feeds that follow the request and receive cycle of working with Chainlink.

An example of this in DeFi is needing reliable and trusted access to financial data. Chainlink can ensure this because the network (DONs) can obtain this information from a variety of information sources, thereby providing the necessary data to execute a transaction.

Chainlink has already done this and has proven itself the leader. “Crossing $75Bn in total value secured makes the Chainlink network one of the most value securing forms of decentralized consensus on the planet.”

Sergey Nazarov

LINK Market Data

Market data provided here comes from CoinGecko. Currently, LINK is trading at ~ $24. The 24-hour trading volume is ~ $843 million. LINK price is down -4.4% in the last 24 hours, -13.8% in the last 7 days. The total circulating supply is 470 Million LINK coins and is capped at a total supply of 1 Billion.

LINK had an all time high (ATH) of $52.70 on May 10, 2021. Currently down ~54% since it’s last high and still had an overall successful year in 2021. LINK is a long term hold, the future of it’s cross-chain/multi-chain integrations and it’s capacity in our data driven world is highly regarded. This is a big investment for many in the crypto asset space. Future forecasts are very bullish.

Chainlink has a very strong advisor team that has received some attention recently. The big names on the advisor team consist of: Eric Schmidt (former Google CEO), Jeff Weiner (former LinkedIn CEO), Tom Gonser (former DocuSign founder) and Balaji Srinivasan (former Coinbase CTO).

Chainlink is something to be very excited about. This is a blockchain that aims to part of everything. It securely bridges and connects data together. It is truth in a data driven world that aims to seek out information in a trustless way. Strongly consider adding this to your portfolio.