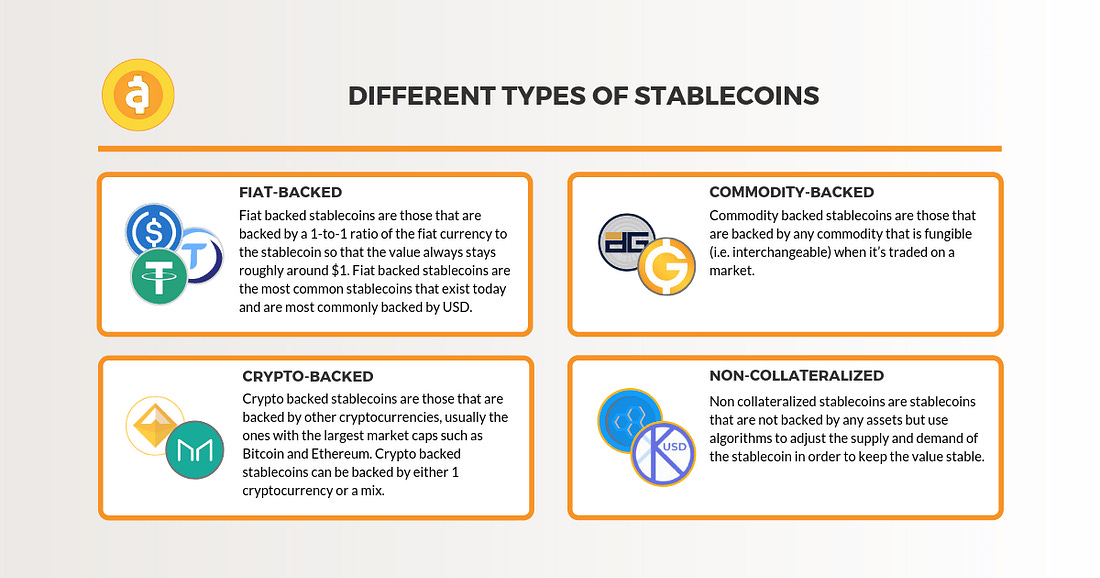

A central bank digital currency (CBDC) is a digital claim on central bank “money”. The CBDC is both issued and backed by the central bank. $1 of CBDC is worth the same as a $1 bill or $1 in a bank account. In this case fiat money ($USD, $EURO). They are “pegged” to those currencies on a 1:1 ratio so they maintain their equivalence.

Up until very recently the idea of this was thought to be “crazy” by the general public. Digital dollars can be difficult to grasp at first. For the “makers”, this idea was generally accepted, but held in question up until a few years ago. Now, we are in the midst of their development, testing, and full scale use.

Why Do CBDCs Matter?

Most people are unaware of the implications of CBDCs because the largest central banks like the Federal Reserve, and the European Central Bank have been moving slowly. They are carefully proceeding forward because CBDCs bring sweeping changes that will completely change the financial system. So they “have to get it right” as Jerome Powell (Chairman of The Federal Reserve) says.

Those involved in crypto today are ahead of the curve and are aware of the ongoing developments of CBDCs. They know the primary reason they are being developed is because Central Banks know they need to adapt. Crypto is much bigger than trading digital assets to take profits in Fiat, and the central banks know that as well. The truth is that they have known about it for years.

An analysis of “virtual currencies” was written by the European Central Bank in 2012.

The ECB started doing research and analysis on Bitcoin back in 2011 and deemed it a “decentralized threat” in the writing of this journal:

“Bitcoin is probably the most successful – and probably most controversial – virtual currency scheme

ECB

to date. Designed and implemented by the Japanese programmer Satoshi Nakamoto in 2009,

the scheme is based on a peer-to-peer network similar to BitTorrent, the famous protocol for sharing

files, such as films, games and music, over the internet. It operates at a global level and can be used

as a currency for all kinds of transactions (for both virtual and real goods and services), thereby

competing with official currencies like the euro or US dollar.“

Crypto has provided a new option to transact in a currency that is more elite and completely outside of the purview of the current traditional system (TradFi). Anyone can access their crypto anywhere they want, use it, and transact with it 24/7.

The legacy financial system’s products are not open source and transparent like they are with crypto. Nor are they as productive and advanced. The Central Banks know this and are trying to adapt and bring new ways to work more efficiently in the traditional system, which brings us to the reasons and the “why” behind developing CBDCs.

There is currently an all out “race to the finish” to implement them. The Federal Reserve, the European Central Bank, The People’s Bank of China, The Bank of Japan, and all other major central banks are carefully designing their CBDCs. The European Central Bank estimates that upwards of ~80 – 90% of central banks are exploring this “digital” version, and the Bank for International Settlements projects the figure is ~ 70%.

To date, two central banks are now live with CBDC, Bahamas and Cambodia. Both CBDCs are now live and fully operational.

As of July 2021, there were 81 countries around the world (making up ~ 90% of that global economy) were pursuing CBDC projects in many different stages. For example, Sweden’s Riksbank is planning an electronic version of its official currency krona, called e-krona, to facilitate the development of an alternate payment system after a decline in the use of cash in the country. Within the United States, a possible introduction of CBDCs in the monetary system is being considered to improve the domestic payments system.

Whatever the motivation, the general consensus is that a CBDC will act as a general representation of a country’s fiat currency. Like fiat currencies, it will function as a unit of account, store of value, and medium of exchange for daily transactions. → Remember this as it is not in any way like Bitcoin or Ether as it will still be subjected to the same monetary policy issues and lack of privacy that we are all seeing today.

Characteristics of CBDCs

$1 of CBDC is worth the same as a $1 bill or $1 in a bank account. In this case fiat money (USD, EURO). They are “pegged” to those currencies on a 1:1 ratio so they maintain their equivalence in spending power. Some of the primary qualities of CBDCs to be aware of are as follows:

Privacy: These are going to assert a lot of control and come with a loss of privacy. Lack of privacy is the primary disadvantage. The data collected like your behaviors, your locations, sending and receiving -> everything is going to be directly stored and saved and sent to the central bank.

Interchangeable: CBDC is an equivalent in value to the nation’s existing currency. It can be exchanged for other currencies, redeemed, or “bought” for equal amounts. The movement and process will involve less friction

Digital: Both for the Retail and Wholesale CBDC. Will be attached to your phone, as seen in China’s CBDC pilot. Will enable both online and offline payments.

P2P, P2B, B2B: Will be able to transact outside of financial intermediaries with each other. Objective is to create convenience and a seamless process for this.

Programmability: As CBDC use cases grow and develop, their definition will adapt as needed. It is certain that each nation’s CBDC will differ as they adapt to unique economic needs. As such, additional characteristics will continue to emerge and be categorized.

When it comes to programmability, we need to remember that the money, the CBDC, and the payments are going to be programmable.

“The two terms are often used interchangeably, but there is a difference. Programmable money is designed with in-built rules that constrain the user. These rules could mean that money expires after a fixed date or its use is restricted to a certain set of goods. This would affect digital currency acceptance and has obvious legal implications. Programmable payments, on the other hand, enable automatic transfers to be carried out or blocked when pre-determined conditions are met. These could include daily spending limits or recurring payments, similar to direct debits and standing orders but with added complexity and conditionality.”

(OMFIF)

The Different “Types” of CBDC

Retail CBDC

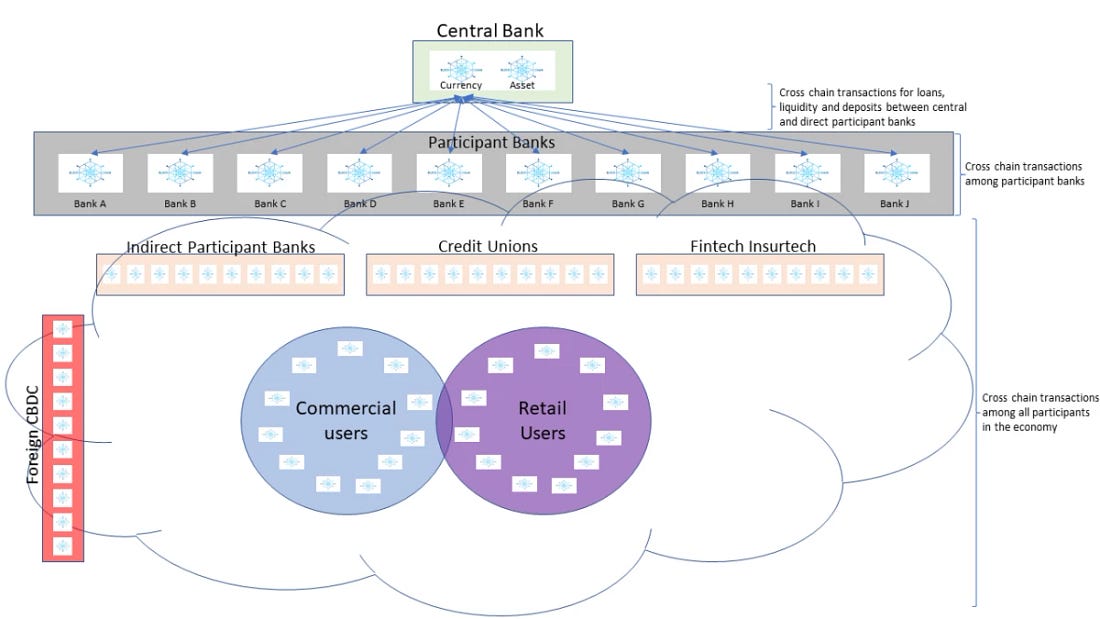

Wholesale CBDCs improve upon a system of transfers between banks. Retail CBDCs involve the transfer of CBDC backed by the government, and is available directly to consumers. This is the biggest argument for it. This is where they take their inspiration from crypto and apply it. They are effectively removing the risk or the risk of any intermediary/middle man.

Wholesale CBDC

These can settle transactions between already existing financial transactions. They can use the current traditional banking and existing financial institutions to run these transactions. One wholesale CBDC transaction for the transfer/distribution of assets involving more than one bank would be conducted via the current process for such transfers, also known as interbank payments, unfortunately already involves considerable counterparty risk.

However, using a DLT (Distributed Ledger Technology) enables more favorable capabilities into a contract (smart contracts). Therefore, a transfer will not occur if the agreed upon conditions are not met.

Wholesale CBDC can expedite the process and create reusable functions for cross-border transfers. The DLT available in wholesale CBDCs theoretically can extend the concept to cross-border transfers and expedite the process to transfer money across borders giving itself an arguable use case.

(Link)

The Benefits of CBDCs

Anyone who is involved in crypto already knows that anything involving intermediaries presents third-party risk and unneeded inefficiencies. CBDCs will provide an advancement in this regard.

“In addition to incremental improvements, many central banks are actively engaged in work on CBDCs as an advanced representation of central bank money for the digital economy. CBDCs may give further impetus to innovations that promote the efficiency, convenience and safety of the payment system. While CBDC projects and pilots have been under way since 2014, efforts have recently shifted into higher gear”.

(Bank for International Settlements)

This will present the opportunity for individuals to transact directly within the current system. This will also come with *costs* to you, the user. It is no surprise you will be subjected to more oversight and more control on your spending. We know that some of these benefits, although undesirable in some cases, bring valuable solutions to current problems such as banking the “unbanked individuals” out there.

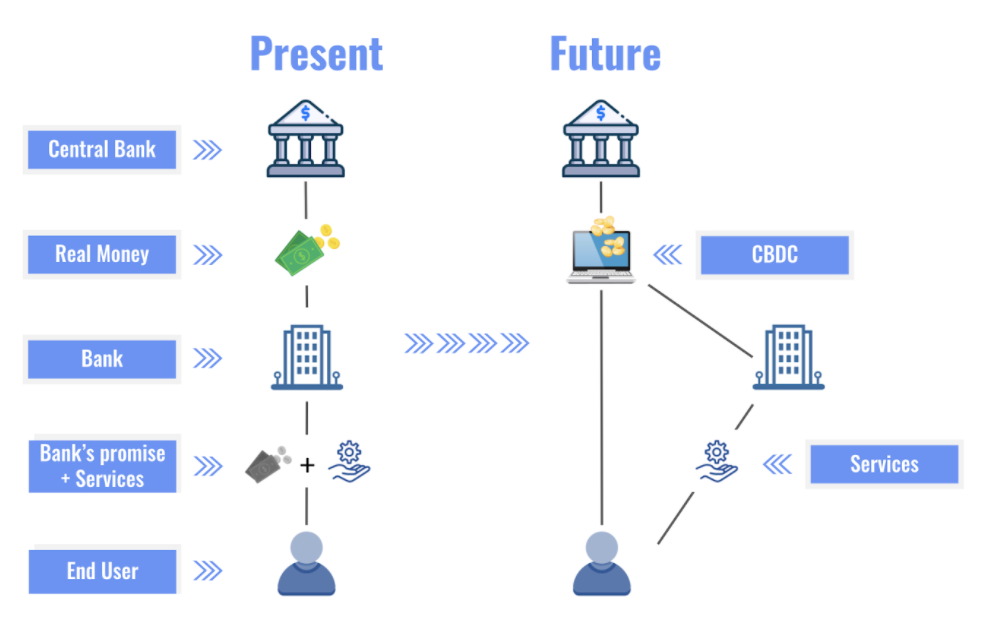

CBDCs and central bank monetary policy come together and will make it easier to distribute and funnel money through the economy. The current structure of the system is heavily reliant and supported by middle men.

They’re needed to funnel money throughout the economy. Contrarily and efficiently designed for an automated process, the CBDC will process between banks through wholesale CBDCs and establish a direct connection between consumers and central banks through retail CBDCs.

CBDCs will present a newer and better system for those who are unbanked. Especially for those living in developing countries. CBDCs can establish a one to one connection between consumers and central banks, and will be eliminating the need for unnecessary infrastructure spending.

CBDCs present and provide more efficiency, and a more frictionless process in government functions. Just as they can promote financial inclusion by simplifying the process to disburse money, CBDCs can also minimize effort and processes for other government functions, such as distribution of benefits or calculation and collection of taxes.

The Disadvantages of a CBDC

It is very obvious and clear that many those “advantages” are also major disadvantages. A central authority, in this case a central bank, creates an interesting scenario. For example, the FED/ECB is still responsible for, and the authority, to every transaction. Therefore, they’ll have total control on the data, the users, and ultimately the transactions between citizens, and institutions.

CBDCs can present scenarios where they prevent certain activity. Flagging anything from a P2P, P2B, or a B2B is very easy. Being digital and integrated with a digital wallet, and owned and operated on a personal device, like a smartphone, it is easy to disable certain activities. It isn’t difficult and does not require anything like a serial number for tracking. Cryptography and a public ledger operated by a central bank creates a simple method to track money throughout their jurisdiction.

Central banks will have the chance of misusing their power and prohibit transactions between citizens for any categorical reason. If there is an integrated system for your credit score tied to your digital wallet (much like the social credit system in China) this could prevent public access/or other forms of consumer control by preventing someone from buying certain items, or not being able to send money to someone for any number of reasons.

CBDCs will erode privacy. A centralized authority is responsible for collecting and sending your digital ID so your transactions can be officially executed. Remember, this is a digital currency issued by your central bank that still operates on the system it runs. This is still the current system.

They will continue to collect all your information and will learn more about you, and will tie it to your digital wallet. This is going to open a box of privacy issues, similar to the ones that plague “big tech”.

The portability of CBDC systems means that a strong CBDC issued by a large nation will very likely end up substituting the local currency of a weaker country as we can already see today. Again, another example of the spread and scope of the large central banks.

Direct and secure transactions running 24/7 and outside of all intermediaries sounds fantastic for any kind of service. Enhancements of financial stability, robust technological advancements, and adopting new ways to serve the public.

It seems logical until you dig into how this will erode privacy.

Current State of CBDC Developments

China

China launched it’s pilot of their digital currency/electronic payment (DC/EP) that included 113,000 consumer digital wallets and 8,859 corporate digital wallets that were opened between April 2020 and August 2020. During that short time, both consumer and institutional/corporate users exchanged, in USD terms, $162 million across 3.1 million digital yuan transactions.

The bank also uncovered almost 7,000 use cases. During that time it is well known that China also banned cryptocurrency mining operations and transactions.

Notice how much stronger China’s anti-crypto rhetoric and anti-crypto policies coincidentally intensified over the years as their ongoing advancements in the digital yuan made progress. The same is said for the anti-crypto rhetoric seen by the ECB’s Christine Lagarde.

The root of CBDC is to maintain control of the money. You can see the unfavorable remarks made by the leaders against global freedom technology.

That is evidence enough.

Mexico

Most recently news has broken on Mexico planning a CBDC by 2024 and to have it in circulation. This story was released 2 days ago, this is brand new information.

“The Central Bank of Mexico (Banxico) plans to launch a central bank digital currency (CBDC) by 2024, the Mexican government confirmed in a tweet on Wednesday evening.

According to the tweet, which was written in Spanish, Banxico “will have a digital currency of its own in circulation” by 2024 as it considers of “utmost importance these new technologies and state-of-the-art payment infrastructure as options of great value to advance financial inclusion in the country.”

(CoinDesk)

Banxico stated they plan to haver this running “at the end of 2024 at the latest”. Keep an eye on this!

Japan

The next bank is the Bank of Japan. The BOJ has already began testing it’s CBDC and is currently in the midst of a trial launch. There needs to be more clarity on how they intend to advance forward and that news is expected to come out around the middle of 2022.

In Japan there is a high emphasis to bring effective payment systems offline, which is possible with electronic payment methods. Their focus is on interoperability and coexistence in the existing system.

“Looking overseas, the European Central Bank has begun the research phase of the Digital Euro Project and has announced that it will decide whether or not to issue it two years later based on the results. In addition, the US Fed plans to publish a public consultation paper on the CBDC shortly to strengthen dialogue with stakeholders. A joint research group of seven central banks, including the Bank of Japan, and BIS recently published a report on common issues. This group has agreed to continue in the future, and the Bank of Japan intends to work closely with it. During this time, large-scale pilot experiments have continued in China, and some countries with relatively small economies have actually issued CBDC as a currency.”

Bank of Japan

The EU

Back in Nov 2020, the EU was in the beginning stages of their “experimentation” phase of a CBDC. Not so much at this stage, they’re in the early stages and agenda setting stages.

Christine Lagarde continues to be dismissive of cryptocurrency, as we all know. Seeing as they have *coincidentally* sped up their pace on a central bank digital currency.

Fast forward to today and the “Digital Euro” and the ECB claim to offer more “privacy and protection”. ECB Board member, Fabio Panetta, who criticized the profit-making agenda of private stable coin issuers is not soft spoken on this agenda.

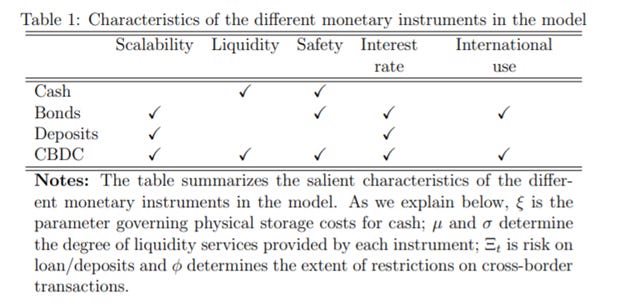

the CBDC is a digital instrument: it is easily scalable and has no storage costs, unlike a physical instrument like cash. The CBDC is also a hybrid instrument: it is both a means of payment and a financial asset. The CBDC is a safe asset: it is not subject to duration risk, unlike bonds, or to risks of bank runs & limited deposit insurance, unlike commercial bank deposits, or to inflation risks when it is remunerated

ECB

The policy issues and interoperability between private and public use cases is what they’re focused on. This is going to involve: B2B, P2B, & P2P transactions. The secure and immutable technology that was introduced by cryptocurrencies gave light to the idea that it could enable better monetary policy and bring more banking services to the ~1.7 billion unbanked people in the world.

They are currently considering and measuring how all of this is going tom work moving forward. How are they going to seamlessly integrate this into ongoing financial services and work it alongside their current rails?

They know the future is 24/7, they need to find a way to remain competitive. The growing demand for crypto called for the innovation of a CBDC. This growth called for newer and more efficient technology. The old system and it’s never ending line of inefficient operations is outdated.

This new system in the pilot stages as seen in China has already created much easier financial access and frictionless payment methods for those holders of (beta version) Digital Yuan Wallets in China. It has so far been successful.

The US and The Digital Dollar

To bring this together, the last section will be covering the ongoing developments in the US and the “Digital Dollar”.

The US seems to be the most welcoming in terms of crypto favorability when compared to the Eurozone and China. We have large developments occurring in Miami, Florida and Texas is looking to become another hub for crypto developments. The US seems to currently be focusing on the regulatory calls for stablecoins.

The Digital Dollar Project is a partnership between Accenture (NYSE: ACN) and the Digital Dollar Foundation to advance exploration of a United States Central Bank Digital Currency (CBDC).

The purpose of the Project is to encourage research and public discussion on the potential advantages of a digital dollar, convene private sector thought leaders and actors, and propose possible models to support the public sector. The Project will moderate programs with interested stakeholders to measure the value of and and establish practical steps that can be taken to establish a digital dollar. (DigitalDollarProject.org)

Regarding the long awaited paper from Jerome Powell at the Federal Reserve. Christopher Giancarlo, a former regulator and co-founder of nonprofit the Digital Dollar Foundation states, “I hope the report confirms the great American tradition of the public sector working with the private sector as policymakers continue to explore developing a digital dollar.”

The Foundation has engaged Accenture as lead architect and technology innovation partner. Globally, Accenture’s CBDC work includes engagements with the Bank of Canada, the Monetary Authority of Singapore, the European Central Bank, and, most recently, Sweden’s Riksbank.

Some direct excerpts from the Digital Dollar Project:

- Tokenization can provide a new level of portability, efficiency, programmability, and accessibility, ensuring the tokenized digital dollar’s ability to complement existing formats of money while simultaneously modernizing our payment and financial infrastructure.

- Programmability is another feature that could unlock additional avenues for innovation and precision in value transfers. A tokenized digital dollar could enhance confidence, efficiency, and functionality in dollar payments across retail, wholesale, and international payment use cases: Retail, Wholesale, and International.

- Assuming the technological efficiency and potentially reduced regulatory costs associated with offering a digital wallet, one can imagine smart phones and devices preloaded with such a solution, or a minimum, the application programming interfaces (APIs) to allow for mobile applications to function. The wallet could be readily registered through a regulated hosting intermediary performing requisite Know Your Customer/Anti-Money Laundering (KYC/AML) checks. Had this been the case during the COVID-19 crisis, many of the currently underbanked may have had an alternative means of receiving funding other than by physical check. We believe that tokenization provides unparalleled opportunities for innovation in the areas of payment and financial infrastructure.

- Hypothetical Transaction Limitations (pg. 20) Thoughtful macro, micro, and behavioral economic analyses should be undertaken to find the equilibrium threshold that maximizes consumer activity and minimizes illicit activities. For physical cash, policymakers have determined that the threshold is at $10,000. As development of a digital dollar progresses, policymakers will need to determine parameters, such as timeframe, participants, and/or amount, that maintain individual liberty and minimize illicit behavior given the newfound ease of use of a digital dollar.

- Cybersecurity will be a central requirement of a digital dollar. There are many solutions addressing cybersecurity such that risk can be mitigated. Our current financial infrastructure exists on legacy systems and has significant modernization needs; as a result, it is vulnerable to exploitation. By launching a tokenized US CBDC, a new infrastructure could be built leveraging the latest cybersecurity technology. The highest standards to which cybersecurity can be advanced will be necessary in the creation of a digital dollar.

- If the US dollar is to remain the world’s primary reserve currency in the unfolding century, it cannot remain an analog instrument and unit of account for things increasingly denominated as digital tokens. It must itself become a digital tokenized currency that measures, supports, and transacts with the world’s digital tokenized things of value.

Summary

There is a lot to say about CBDCs. The technology is going to advance many facets of life and change the entire financial system, again which is why developments are taking years.

Many downsides are the in forefront of the concerns of citizens. It is a difficult subject to discuss because of the financial assistance this technology will provide to those who are impoverished and unbanked.

Thanks for reading, this was certainly a longer article. More on CBDC developments to come in the future.