Truflation is a decentralized, censorship-resistant, on-chain inflation index that uses Chainlink oracle to provide a better inflation index than CPI.

The consumer price index (CPI) just hit a 40-year high of 8.5% for March 2022. However, even with the roaring CPI numbers, there is ample arguments that the CPI number is manipulated downwards. (See this free write-up on CPI inflation manipulation that shows the CPI number for Februrary 2022 was in the teens % easily)

Truflation uses real-time data pulled from the Chainlink oracle across many sources to provide a more accurate CPI depiction.

What is Truflation?

Truflation is “the first US inflation index based on independent data sources and metrics” and is available “online, on-chain, via a Chainlink Oracle API”. The Truflation feed provides daily updates and transparent access to the underlying data, calculations, and methods. It is created by HydroLabs and their stated goal is to “provide the most objective, decentralized, and frequent inflation updates possible”. They looked to ‘remaster’ the CPI index to better reflect real customer spending and actual market price changes.

Why is Truflation Needed?

Inflation is a very real cost to consumers. It is a measure of the loss of purchasing power of the consumer over time. The Federal Reserve defines inflation as

Inflation is a general increase in the overall price level of goods and services in the economy

-Federal Reserve

When inflation is high, it quickly decreases your ability to make purchases. Additionally, high inflation distorts rational buying decisions, punishes savers, and hurts those with the lowest discretionary income the most. (Example – this post “Should You Pay Debt When Inflation Is High?“, that shows a rational consumer is better off buying toilet paper than paying back loans at 8.5% inflation).

How Bad Is Inflation?

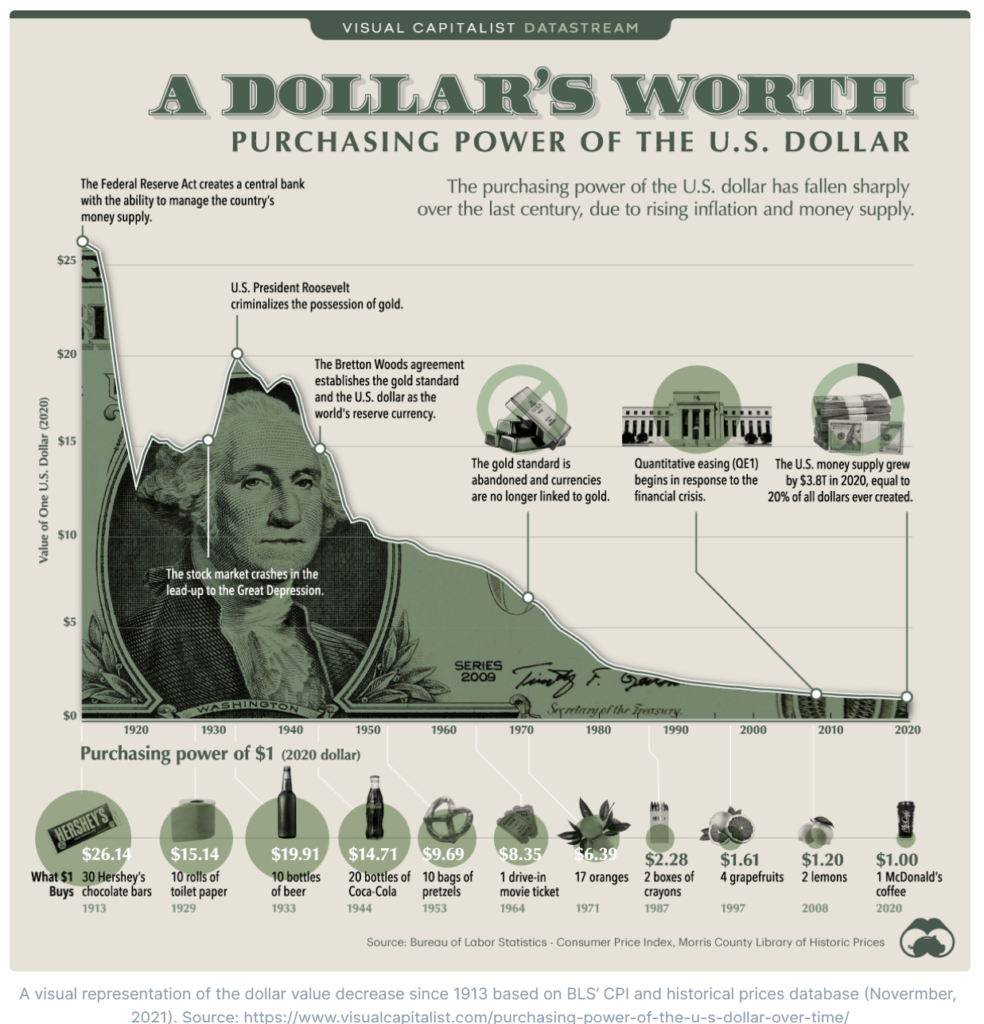

Inflation has been decreasing the purchasing power of the dollar for over 100 years. As the graphic below shows, $1 in 2020 buys ~5% of what it could back in 1913. And this is before the recent record high CPI numbers this year AND assumes CPI is an accurate measure of inflation.

Accurately measuring inflation should be very important due to the large negative impacts high inflation imparts. 63% of Americans couldn’t afford a $500 surprise expense according to a survey by Bankrate in 2016. Someone who lives on $20,000 total expenses a year (including rent) would see a $1,700 increase in living expenses at an 8.5% rate of inflation. And $20k a year of total expenses is very low when rent can easily run $10k+ a year.

What if the real increase in cost of living was nearly double the number reported by Bureau of Labor & Statistics (BLS) in CPI? At 13.5% inflation that same person would see a $2,700 increase in living expenses. It seems important to get the inflation number accurate.

This is doubly true if on-chain protocols are being tied to an inflation number. The code is the law, so if a protocol’s smart contract is making decisions based on a poor inflation measurement, like CPI, it will be making incorrect actions.

Truflation Inflation Calculation

Truflation’s dashboard shows the current calculated inflation value and breaks it out to the major components. Truflation’s calculation has inflation at 13.5% currently vs the 8.5% CPI measure just reported by BLS. The major differences seem to be on shelter & food components (11% vs 5% and 29% vs 9% respectively for Truflation vs CPI).

Truflation’s Calculation Methodology

If 13.5% seems very far off of 8.5%, you are correct. So what does Truflation do to calculate its inflation rate?

For starters, Truflation keeps a similar foundational set up:

- A basket of goods with the same categories & subcategories broken out

- Year-over-year calculation is still the value of the basket at time 1 divided by value of basket at time 0

However, unlike CPI, Truflation also:

- Measures daily changes in inflation

- Changes subcatergories within the category of goods and services

- Updates the subcatergory data daily

- Re-weights the categories monthly instead of yearly to better reflect consumer’s spending

Truflation Data Sources

Truflation substitutes 60-80% of the data sources in CPI with what it deems to be better data sources. For instance:

1. Food (~14% of Truflation Index)

The food componenet uses 10 food commodity markets to capture the daily food prices. These are 1-3 month commodity futures that capture changes in expected prices that are passed to consumers. The 10 food indices are coffee, cocoa, sugar, corn, wheat, live cattle, lean hogs, soybean, soybean meal, and soybean oil.

Truflation argues that directly using the producer-supplier price of food avoids the problem of missed inflation through:

- Shrinkflation – smaller packages

- Substitution – replacing ingrediants with lower-quality ones

- Replacement – consumers replacing more expensive products with cheaper ones.

2. Shelter (~45% of Truflation Index)

The shelter component is largely made up of rent, and smaller categories of utilities, furniture, and household items. Truflation uses the Pennsylvania State University data on rents for the rent numbers. Truflation points out that the current CPI is innaccurate for rents due to:

- Using a survey every 6 months leading to a lag of 6-24 months for the data to get in the system

- Self-reported number rather than actual market analysis

- Only surveying a limited number of cities

- No correction for quality of residential units in survey

- Tracking tenants, not rentals. If a rental price is increased and tenant needs to downgrade unit, that is not captured.

- Smoothing methodology

Penn St University uses the Commercial Property Price Index (CPP) and adjust it for current capitalization rates. This captures a broad average monthly rent by tenants and solves for the problems of the survey method of CPI.

Utilities are captured from the US Energy Information Administration (EIA) site which is required by law to produce objective and independant costs monthly. The BLS again uses a survey for its CPI energy component.

3. Transportation (~17% of Truflation Index)

Transportation includes used and new vehicles, transportation services, and gas.

For used cars, Truflation uses 3 data providers that include across US car sellers and price aggregators. New cars use a major price aggregator. The actual name of the aggregators was not provided in the white paper. For gasoline, Truflation uses the EIA site.

Truflation Uses Chainlink Oracle For Real-World & On-Chain Transfers

Truflation uses the Chainlink Oracle ecosystem to get data & to provide daily truflation inflation updates to applications across the blockchain. (Read more about Chainlink ($LINK) coming updates here). Chainlink is a multi-chain bridge between off-chain data and on-chain smart contracts, a middleman that translates real-world data to computer language.

Truflation charges a 1 LINK fee to call the Truflation oracle. External protocols that would like to use the Truflation data in their smart contracts can call it through Chainlink’s decentralized ecosystem.

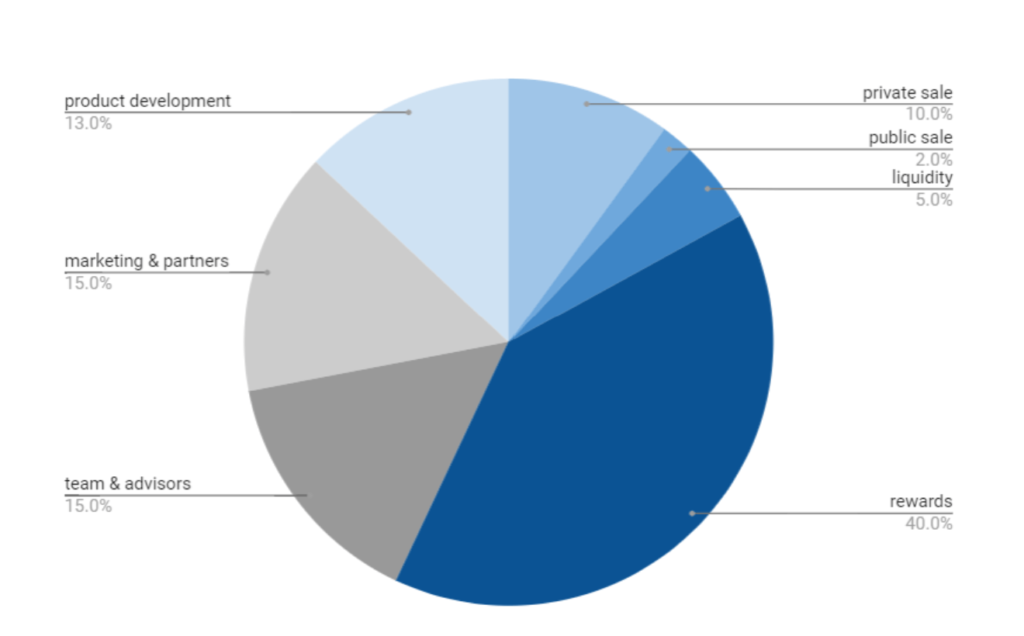

Truflation Tokenomics

Truflation has its own token. The stated purpose of the Truflation token is to “keep the Truflation Index and Oracle independent, decentralized, and self-sustainable”. It does this by:

- Incentivizes sharing of relevant data

- Pay maintenance costs

- Encourage more data sources to share

- Governance rights

There will be 100M total supply of tokens. These 100M tokens ill be divided as follows:

- 40M tokens will be distributed to contributors

- 12M for early investors

- 5M for DEX liquidity

- 28M for product dev & marketing

- 15M vested with team & advisors

Data contributors to Truflation will get paid rewards in both Truflation token and $LINK (or the native oracle token if different). This is to encourage contributors to provide accurate data frequently.

Summary: Truflation A Better CPI

Inflation is quickly becoming very impactful as it continues to rip higher. There are many reasons why protocols could want to incorporate an inflation number into their smart contracts. In addition to having this ability by working with Chainlink, Truflation has also created a better inflation measure than the CPI.

Truflation has replaced the ‘survey’ method that the BLS uses in the CPI with actual, objective data from many sources. They have created a measure that re-weights more frequently and arguably is a significant improvement in measuring the actual rising prices for consumers.

Truflation token may not currently offer any opportunity for retail investors, but the application of a better inflation measure is very helpful. Additionally, the ability to pass off-chain data into the Truflation index calculation and then pass the Truflation number across chain /off-chain is another interesting feature.