When the crypto market was ripping higher, everyone was WAGMI (we are gonna make it). Now that the bear market is here, you are seeing who people really are. In that vein, Yuga Labs, the owner of Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Otherside NFTs is getting sued. The lawsuit alleges that the NFTs and ApeCoin (APE) were ‘inappropriately’ promoted to retail who bought the ‘financial products’ before getting dumped on. Bear Market things…suing protocols when price down…

Who Is Yuga Labs?

Yuga Labs is the creator of Bored Ape Yacht Club (BAYC) and the spin-offs Mutant Ape Yacht Club (MAYC), Bored Ape Kennel Club (BAKC), and the Eth-based token ApeCoin (Ape). They also purchased CryptoPunks and Meebits NFT collections from Larva Labs. BAYC and CrytpoPunks are 2 of the NFT collections considered to be ‘blue chip’ collections.

Yuga Labs was started by 4 core members who remain pseudonymous and go by their BAYC avatar names: Gargamel, Emperor Tomato Ketchup, No Sass, & Gordon Goner.

BAYC is recognized as one of the NFT creators who generated buzz by having exclusive parties, events, giveaways, and freebies by being a BAYC owner. The Yuga Labs team continues to try to grow the products by working on games and metaverse options for BAYC holders.

BAYC In The News

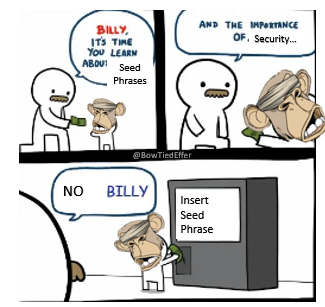

BAYC is commonly in the news. For one, the owners of BAYC NFTs have gained notoriety for being scammed out of their NFTs. It started to become a meme that BAYC NFT holders were some of the least sophisticated ‘crypto-rich’ that there were.

There was numerous cases of BAYC users getting scammed out of there 6-figure NFTs due to giving their seed phrases away. Basic crypto security is to never share your seed phrase, ever.

Additionally, the BAYC Discord was hacked and the BAYC Instagram was hacked as well where 100s of NFTs were lost.

Though Yuga Labs wasn’t in the news just due to BAYC holders losing a lifetime’s worth of wealth. They also just raised $450 million from a16z crypto fund and a host of game studios, which put the company at a $4 Billion valuation.

Yuga Labs has also been trying to generate a buzz for their metaverse staring the BAYC and its derivatives.

Yuga Labs Getting Sued

The law firm Scott & Scott has set a class action lawsuit against Yuga Labs claiming they ‘inappropriately induced’ ‘unsuspecting investors’ to buy Bored Ape Yacht Club NFTs and the affiliated ApeCoin (Ape) cryptocurrency on the Ethereum chain.

The recently published suit claims Yuga Labs used celebrity endorsement & promoters to ‘inflate the price’ of BAYC NFTs and Ape token and the prospect of continued outsized returns on any investment in the BAYC infrastructure. The suit states:

“After selling off millions of dollars of fraudulently promoted NFTs, Yuga Labs launched the Ape Coin to further fleece investors”.

Celebrities like Tom Brady, Paris Hilton, and Snoop Dogg were some of the celebrities that endorsed BAYC.

However, the suit contends, all the continued growth was dependent upon the on-going promotion of the products to bring in new money, instead of actual utility or any underlying technology. In the end, retail investors have lost over 87% from the inflated high price.

$APE had topped at $26.70 before dropping down to $4.66 in June. Additionally, the floor price of the BAYC NFTs have dropped from 151 ETH down to below 90 ETH, at the same time the price of ETH dropped more than 50%.

Meanwhile, the entire crypto market is also down significantly and many NFTs have lost even more value than the blue-chips like BAYC which has arguably held up well during the NFT carnage.

BAYC Supporter’s Respond

BAYC members mocked the lawsuit online, pointing out that it was just salty people who brought the pico-top and can’t take responsibility for their own actions. BAYC holders called out the suit as being from people who FOMO bought into the market top before the bear market and are just trying to get money back through the legal system.

Additionally, they point out that Yuga Labs didn’t create ApeCoin. The coin was created by ApeCoin DAO and then later adopted by Yuga. The coin was airdropped for free to BAYC holders too. This means any BAYC holder didn’t have to purchase the coin and any value the coin has was given for free.

Summary: Yuga Labs Suit

One angle that may work for the suit is if they can prove that the celebrity promoters did not follow disclosure rules about being paid advertisers. This seems like a more promising route than the claim of Yuga running a ‘pump & dump’ scheme seeing how the BAYC products have held up better than a lot of the rest of the market.

There continues to be a lack of clarity of what constitutes a security or not, and if these products would be considered selling an unregistered security. This would be a very interesting case if it helps to clarify if NFTs and airdropped tokens are indeed unregistered securities as that would have huge impacts across the crypto sphere.

Scott & Scott is currently exploring for more holders to join their suit. It will be interesting to watch how the suit plays out and if users who FOMO end up able to recoup some of their losses. If so, you can assume many follow-on suit from ambulance chasers against any DAO or protocol that is down big…which would be most of them with the whole crypto market down 60%+.