This Week in Crypto

Big week for crypto. Summary here on the Lummis-Gillibrand Bill, the successful execution of Ethereum’s Ropsten “testnet” merge, and a long term view for Chainlink staking.

Big week for crypto. Summary here on the Lummis-Gillibrand Bill, the successful execution of Ethereum’s Ropsten “testnet” merge, and a long term view for Chainlink staking.

Welcome back to Vyper for Beginners! This lesson covers two data structure types: structs and mappings. The major difference between these structures and the simple data types covered previously is that structs and mappings are designed to hold differing data types “within” themselves. The closest simple data type is a Dynamic Array, which is limited

Solana suffered another major outage, its 8th such halt. Solana advertises itself as being one of the fastest blockchains with a high…

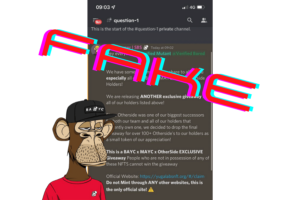

Another day, another stolen ape, and the Bored Ape Yacht Club Discord hacked again. In the wee hours of the morning on June 4th, an attacker was able to compromise mod accounts and bots in the BAYC and Otherside Discord servers, and posted a malicious giveaway link. Victims thinking they would receive a giveaway approved

An ounce of prevention is worth a pound of cure, and most of your crypto security efforts should take place before an incident occurs. Good safety practices and healthy skepticism will prevent many attack vectors. But sometimes, despite our best efforts, the unthinkable happens. What do you do if you fall victim to a crypto

Milady NFTs Founders have been allegedly linked to online personnas that groomed girls, caused a suicide, and used racist language while…

Full run down on everything you need to know about CBDCs. 90 central banks are currently in the process of developing a

CBDC. Are you ready?

Diligent smart contract audits are an essential part of crypto security. Getting the audit is only the first step, though. As a protocol owner, even if you receive an audit from one of the best smart contract auditors, you still have to understand their findings and implement any fixes. As an investor, how do you

Cardano is, at time of writing, the 7th most popular cryptocurrency by market cap of it’s native token, ADA. The coin has gathered much attention, particularly on Reddit and in retail investor circles, due in part to its low unit price. ADA’s price has continued to fall for almost a year despite the launch of

Azuki Founder, Zagabond, self-doxxed as abandoning NFT projects 3 times shortly after mint, and collecting millions in the process. Is Azuki.

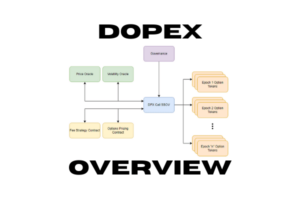

Dopex is the premier on-chain options provider. The Arbitrum-native protocol has broken much ground for delivering decentralized, trustless options trading to the blockchain. This Dopex protocol overview article will dive into some of the technical details that make this protocol so special. Fear not, there is no scary math ahead! Part of my reason for

Crypto markets bleed red today. Terra uses BTC reserves to save the UST from going to zero, and LUNA nukes. Learn why, now.

The FED continues to try to tame inflation. FED raises rates 50 bps, and announces plans for balance sheet reduction, QT, beginning June 1. Currently the FED shows no plans for rate hikes higher than 50 bps.

A CBDC Update for the US, EU, China, and Russia projects. Things are moving along very quickly as 9 countries already use a CBDC, and 14 more are in pilot.

Fantom was rugged by Andre Cronje and one of its whales got dangerously close to being liquidated, causing the entire chain to be …

Dawn breaks Saturday morning in the Americas with a crushing DeFi exploit. Stablecoin provider and Tribe DAO member Fei Protocol was hacked in a series of transactions around 6:30 EST, for a loss of over 26,873 ETH, just over $76 million USD. The protocol is currently offering a $10 million USD whitehat bounty for return

Saddle Finance is no stranger to hacks. They’ve already been hit before, under somewhat suspicious circumstances. This time around, though, it looks like a plain old fatfinger by the developers. Saddle Finance was hacked today, 4/30/22, for the loss of 3,933 ETH, worth over $11 million. The swap between sUSD and saddleUSD-V2 did not use

In Decentralized Finance, protocols live and die by liquidity. Billions of dollars are thrown around trying to manage and direct it. There are entire protocols that only exist to manage liquidity. For much of DeFi history, there was only one answer when it came to efficient swaps for large amounts: Curve. That changed with the