PulseChain is an upcoming hard fork of the Ethereum blockchain and… Wait. Did you not know there was a hard fork coming? That seems like major news, right? Especially since $1.2 Billion has already been sacrificed to get a larger airdrop of the future native token.

Additionally, the PulseChain site claims it will be better than Ethereum. However, many detractors argue it is another scam put on by Richard Heart (aka Richard J Schueler), the man behind the Hex token.

Since you likely have tokens on Ethereum, you will automatically receive tokens on PulseChain from the hard fork. Therefore, whether you have never heard of the upcoming fork, you worship at the Richard Heart alter, or you think it is another elaborate scam from the man, lets dive in.

What is PulseChain?

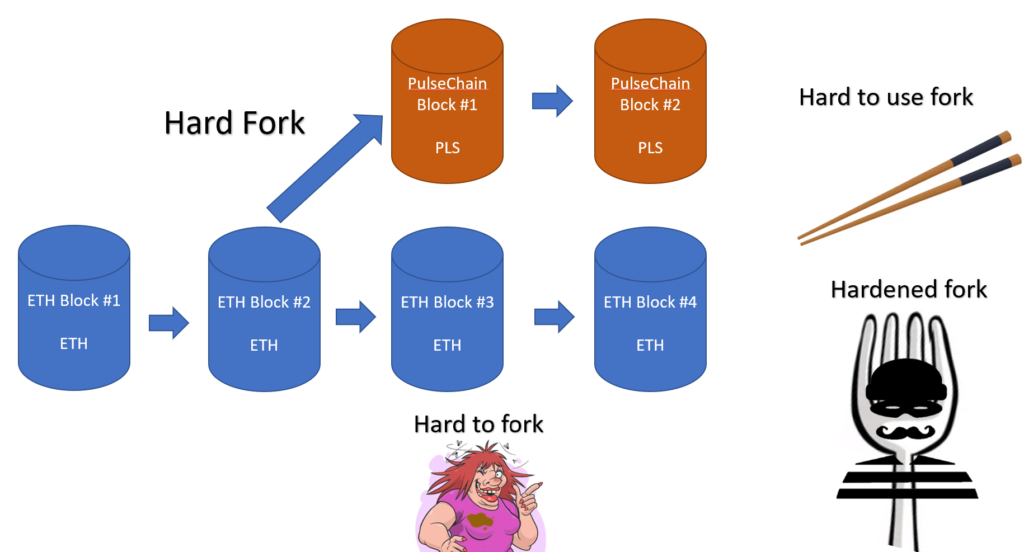

PulseChain is an upcoming hard fork of the Ethereum block chain. It is claiming to be the largest airdrop in the history of crypto. (Note – Forks are different than airdrops and this is technically a hard fork but we can call it semantics).

Everything (ERC20/ERC721/etc.) will be copied over from Ethereum main net 1:1. Every token, every LP, every NFT and every smart contract replicated on PulseChain. Additionally, the fork will have the entire Ethereum transaction history from before the fork.

In a hard fork, you get the replicated items automatically with no need to do anything. Basically, every ERC20 item you have in the block prior to the hard fork, will be there on both chains in the block after the hard fork. After the fork, the 2 chains will diverge and differ on a go-forward basis.

The fork has no impact on the Ethereum main net chain. You could completely ignore PulseChain and your experience would be the same on main net regardless.

The only difference in the first block after the fork will be your ETH will be converted to Pulse (PLS). Just like the Ethereum network has ETH as its native token, the PulseChain network will use Pulse (PLS) as its native token. All other tokens will have their same symbols with potentially a ‘p’ in front. (Different pages have had conflicting info. For instance DAI may be DAI or pDAI on the PulseChain).

Why is PulseChain Hard Forking?

The main stated reason for the hard fork is the high gas fees on the Ethereum network. Additionally, the PulseChain site lists the following reasons/benefits of the hard fork:

- Increase Ethereum’s Value – by sharing the ‘load’, Eth gas should be lowered

- Enrich ETH users – by doubling their ERC20 tokens

- Enrich ERC20 & NFT users – by creating a new ‘gold rush’ during the volatile initial period after the fork as users experience price discovery on the new chain

- Easy to Use – Should be very similar to current Ethereum experience

- Lower PulseChain fees – Pulse chain uses 3 second block times allowing it higher throughput

- Remove pollution – Delegated Proof of stake (DPoS) doesn’t waste energy like proof of work (PoW)

- Improve Game Theory – PLS has 0% inflation and 25% of validator fees burnt

However, on the main net, Ethereum 2.0 will also move to a PoS consensus mechanism and incorporate ‘sharding’ (64 independent portions of the network) in the future. These Ethereum improvements should make a few of the listed benefits above moot.

Who Is Eligible For PulseChain ‘Airdrop’?

Everyone who has self-custody of tokens on main net Ethereum will be eligible to get a replicated token on the PulseChain Network.

Self-custody means the tokens aren’t on a centralized exchange (ie-Coinbase, BlockFi, etc.). You have possession over your tokens on a cold or hot wallet. So the Ethereum or ERC20 tokens and NFTs that are on your MetaMask, Ledger, or Trezor; will be in your wallet address on the PulseChain network.

The ‘airdrop’ also excludes tokens on side chains and L2s. Avalanche, Fantom, Arbitrum, Matic, etc are all ineligible. Therefore, if you really want to receive the PulseChain airdrop, you should move your tokens to main net before the hard fork.

Is PulseChain Hard Fork A Scam?

There is a growing number of voices that are pointing out concerns with the new fork. These arguments tend to be focused on the founder, Richard Heart. They point out issues with the sacrifice phase and some potentially questionable transactions with HEX, Richard’s first crypto project.

The common theme across the concerns is how much money ends up with the founder Richard Heart.

PulseChain Sacrifice Phase Raises Suspicions

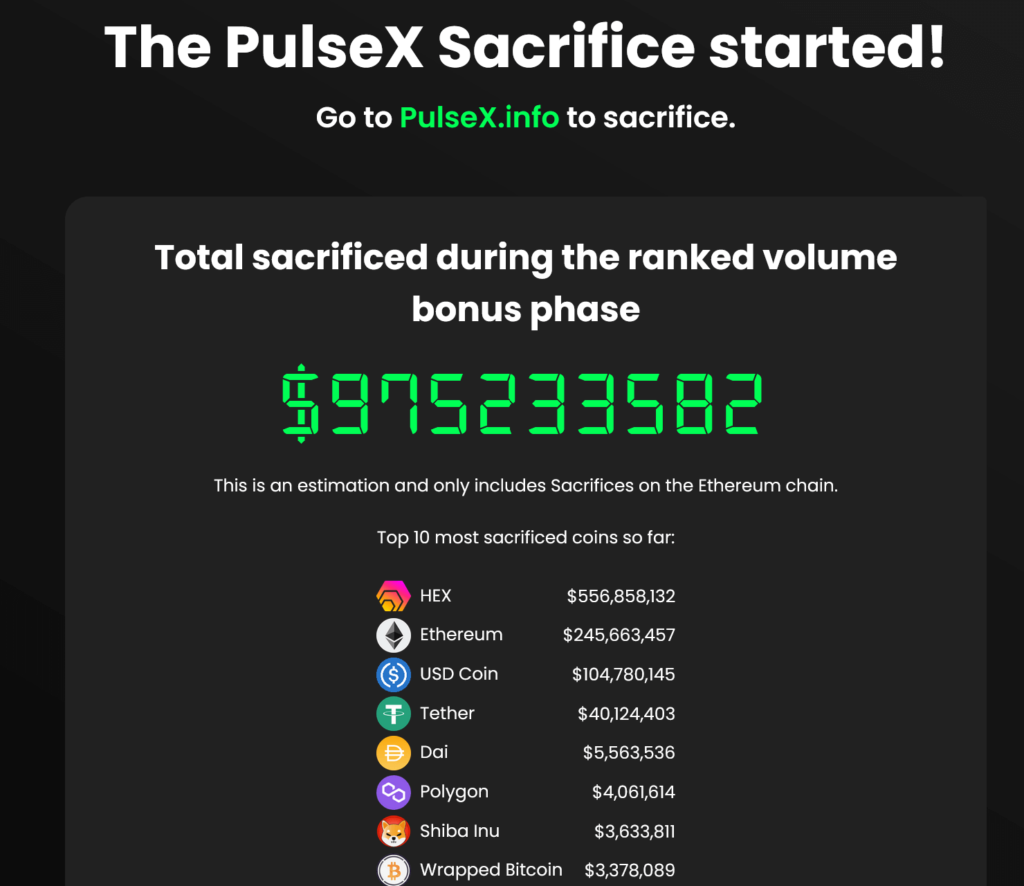

In the summer of 2021, there was a period where users could ‘sacrifice’ ERC20 tokens. Depending on the amount and timing of the sacrifice, you would get a multiplier on the PLS tokens you would receive after the fork. The larger and earlier in the period you sacrificed, the larger the multiplier.

People have questioned what the sacrifice wallet was for and suspect it is just a personal wallet of the founder Richard Heart. Additionally, at the time of the fork, there will be no value to the PLS token. So users are sacrificing a known value for a valueless token. I was unable to find any indication that the sacrificed tokens were going to be used to provide liquidity or value to the new chain. This has lead to questions if the sacrifice is just a big payday for Richard himself.

However, note that users could sacrifice to SENS.org, an organization researching ways to fight age-related diseases. Donating to SENS instead of Richard gave 25% less benefit to the user. Even with the slightly lower amount, $25 million was raised for the organization.

The PulseChain sacrifice wallet looks to have nearly $200 million in it. Even more incredibly, the PulseX sacrifice is claiming to have nearly $1 Billion. (PulseX is a decentralized exchange (DEX) fork of uniswap for the upcoming PulseChain).

Yes. This means $1.2 Billion just got sacrificed to what is speculated to be Richard Heart’s personal wallet if these numbers are accurate. However, keep reading as there is rumors that a lot of the sacrifice is just the founder pumping his own bags by cycling money through repeatedly.

Hex’s Launch Raise Suspicion About Richard Heart

Richard Heart’s previous project was the Hex Token. It is a highly marketed token that compares itself to extremely high-yielding certificate of deposits (CDs).

There was a similar ‘donation event’ at the beginning of the Hex initial coin offering (ICO). Users could donate ETH to a wallet and receive HEX token. However, they could not swap back HEX for ETH with the same wallet. Again, the suspicion is this wallet is Richard’s and he was able to just keep the ETH and exchange a ‘valueless’ newly minted token.

The origin address was drained of all the ETH months later. Each of the 36 transactions were for 1,337 ETH each (~$150 per ETH at the time). People have pointed out 1337 is old hacker slang for LEET, or ‘elite’. This lead to charges of Richard mocking the people he just raised money from.

Additionally, there was charges that Richard was taking ETH from the origin wallet and sending it back through the donation process. This would result in him minting HEX for himself and having the ETH land right back in his wallet. If you take 100 ETH from the donation wallet and send it back to a secondary wallet to donate it again, the end result is your secondary wallets getting airdropped HEX. While you still have all the ETH in the donation wallet.

Early Hex Promotion Raised Concerns

Anyone who held Bitcoin was also able to claim free HEX and then new users received large bonuses for referring others and bringing them into the ecosystem. This lead to a handful of affiliate-type sites popping up to get new users to purchase HEX and both would get a % of the purchase in bonus HEX.

Airdrops and shilly marketing is fairly par for the course for many coins trying to grow a user base. That isn’t necessarily a huge concern.

However, people have pointed out that for every HEX minted from the BTC claim & the referral program, there was a duplicate minted and sent to the origin wallet. (see the section in the article here “Richard Got a Copy of Adoption Bonus and Referral Bonuses”. Note – the author seems very whiny and may have his own motives, but this is the only article that does snapshot the code to back up the claim.)

Basically, the charge is that Richard was minting 50% of all payouts for himself.

Hex’s Fee Distribution Raises Questions

Hex doesn’t apparently earn any actual revenues. The only fees it collects is from 2 penalties it imposes on users:

- A fee if a user ends their ‘staking’ period early

- A fee if a user doesn’t unstake after their staking period is over (1% weekly fee after 14 days)

However, even these small fee amounts are split 50/50 between users and the origin wallet. Therefore, even the small amount of revenue earned sees 1/2 going to Richard.

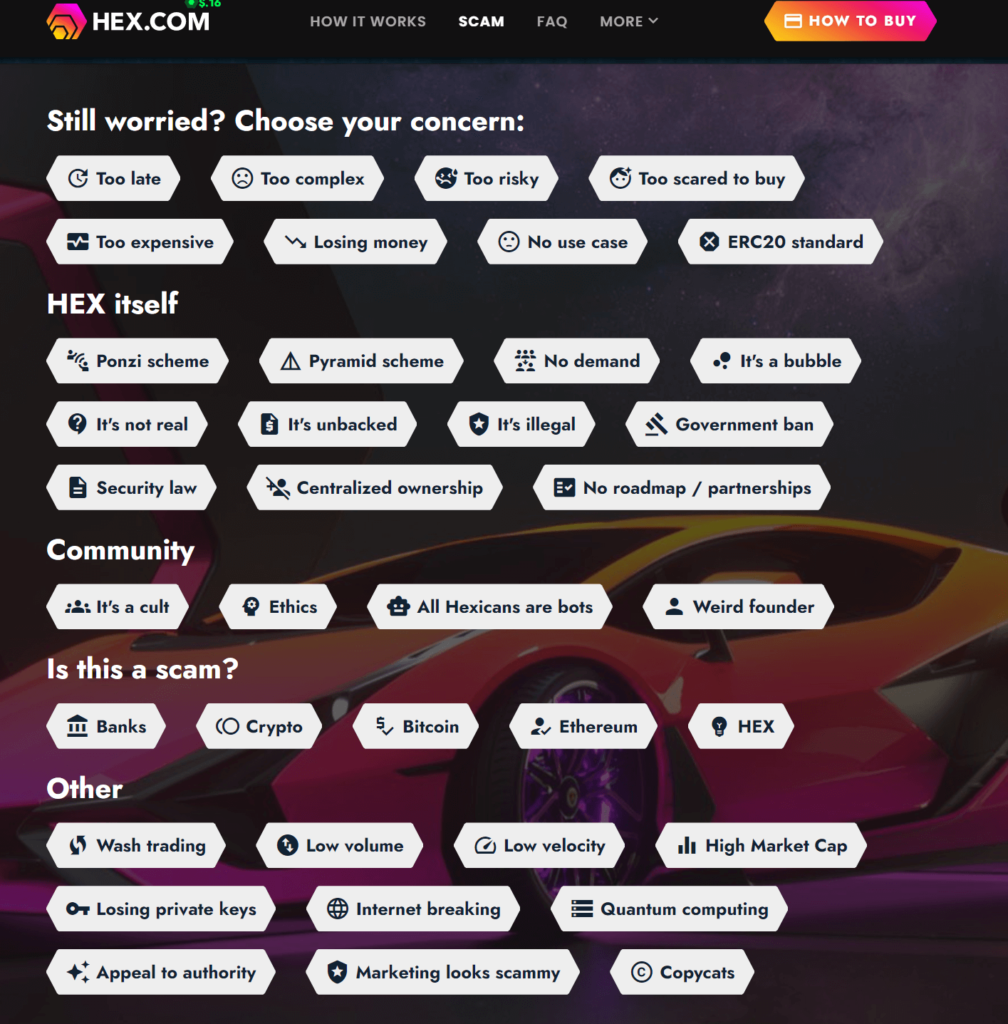

Hex’s “Not a Scam” Page

The Hex site has an entire page dedicated to debunking the claim its a scam.

It has a bit of the feel of ‘doth protest too much’. And unfortunately, only hits on the surface level complaints. Most of the answers are deflections too. For instance, “It’s unbacked” is answered with a generalized, ‘technically nothing has value except what others are willing to pay for it’ answer.

None of the serious charges about Richard Heart’s huge windfall from Hex is addressed on the page. Nor are the questionable tokenomics mentioned.

Hex’s Tokenomics Raises Additional Questions

Hex’s website claims 40% APR but only a 3.69% inflation rate. With very little revenue coming in from the above 2 fees, the only way this works is if a massive amount of token holders aren’t staking their coins.

Sleuths have estimated Richard’s HEX token ownership to be almost 90% of the total supply. This is based on the origin address allocating similar amounts to 100s of separate addresses. All the HEX in these wallets remains unstaked.

Conveniently, having 90% of the supply unstaked allows the 3.69% inflation to be spread across the remaining 10% of staked tokens creating ~40% APR.

Hex also encourages users to lock up their tokens for longer to receive bonuses. The longest lock-up is 15 years, or basically infinity in crypto terms. This certainly helps with limiting payouts in the near-term.

PulseChain’s Lack of Details

As of now, the majority of what we know of PulseChain is:

- A hard fork of Ethereum

- Will have a Uniswap like automated market maker (AMM) called Pulse X

- There will be the ability to bridge between mainnet ETH and PulseChain

Details on the new forked chain do seem to be sparse and the ones that are out there seem to be created by the community. (Note- many of the ‘Hexicans’ (Hex proponents) are driving the PulseChain community sites).

However, many of the community sites don’t seem to have much more details than the heavy marketing that is shown on the Pulse site.

So far, the PulseChain and PulseX launches seem to be mirroring Hex’s launch. Hence, the heavy focus on the concerns that have been raised with Hex.

Summary: Is PulseChain a Scam or Groundbreaking?

Despite all the questions raised above, Hex has made a lot of people big money. The coin is up tremendously since its launch. (Hopefully they have taken gains out and aren’t re-staking it all for longer periods of time)

Hexicans like to argue that HEX has the 3rd largest market cap and coingecko is doing the calculation wrong purposefully to suppress their rank. Regardless of everything above, there is a rabid community of Richard Heart supporters.

PulseChain and PulseX could gain traction and become a successful side chain. There are alternative chains right now that have massive market caps despite not even working and ghost chains out there with value despite being abandoned. If PulseChain can find support, this hard fork could create value for a lot of people.

However, there seems to be a lot of questions that remain about where the large amounts of money being sacrificed are going and why they are needed.

I am fine with casually monitoring this from afar and being pleasantly surprised if I can get any value out of it one day.