It is no secret that investors are looking to add a position in crypto into their investment portfolio after the spotlight that crypto was under in 2021. Individuals began adding COIN, GBTC, and MSTR holdings to their traditional portfolio, hopefully you all are savvy enough to understand the negative effect holding those equities has over simply owning the coins . Regardless, companies are adding BTC to their balance sheet like TSLA and SQ, and smaller countries are adopting it like EL Salvador.

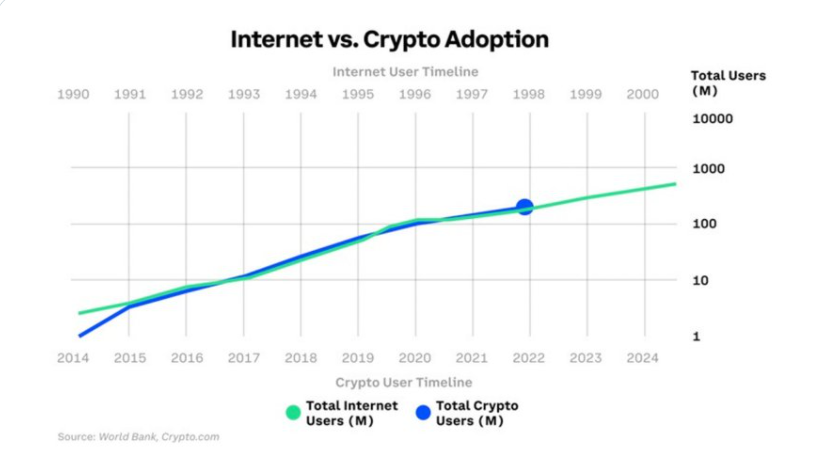

It is estimated that right now crypto is on pace for global adoption much like the internet during the 90s. Relatively speaking we’re right around 1998.

So, what does that mean for you?

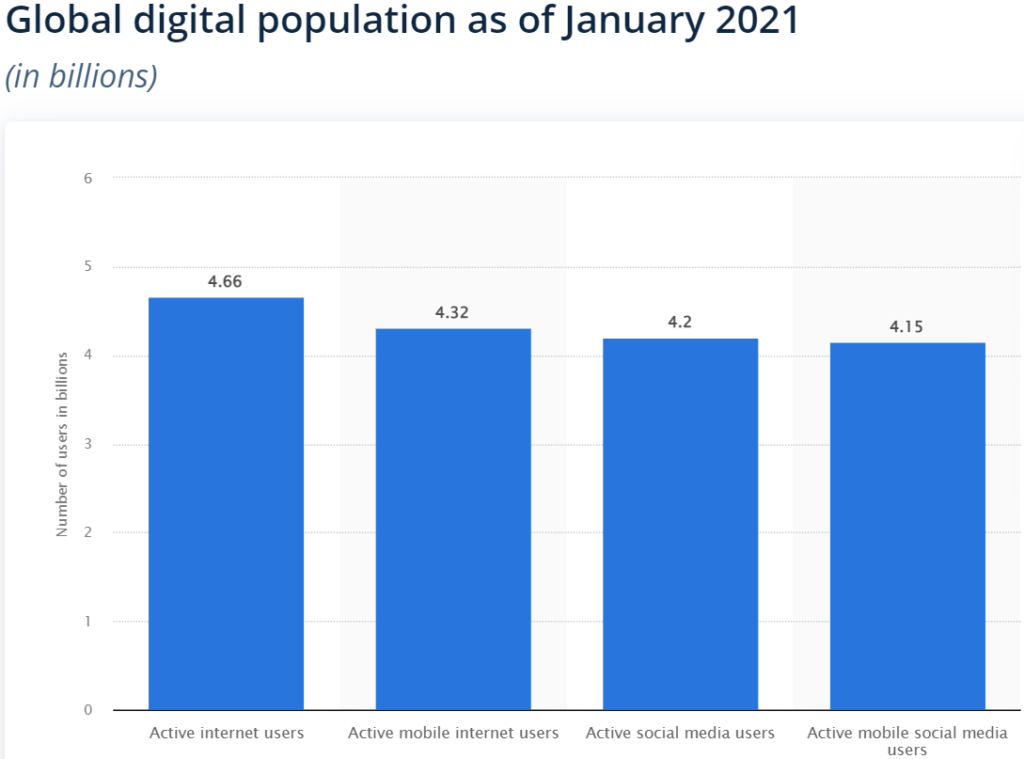

You still have plenty of time to learn about crypto, how to buy and use it, and get in early to take advantage of the opportunities in DeFi. Compare the figures and growth of the internet from 1998 to today. You’ll see approximately a 23X in user growth.

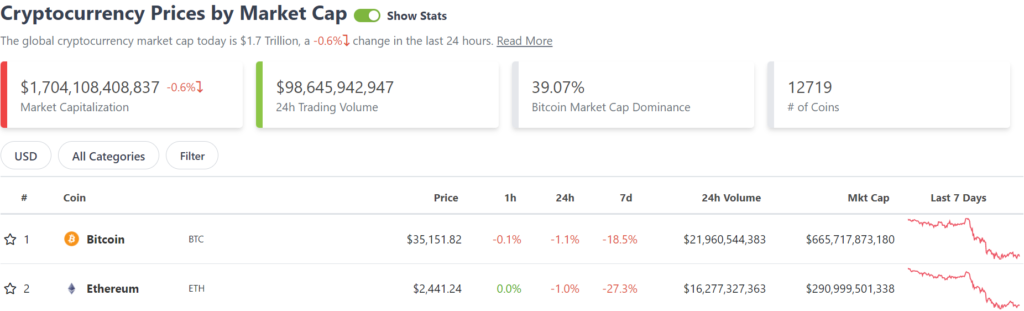

For context, the crypto market cap right now is ~$1.8T with the DeFi market cap sitting right around $115B. There is a lot of upside ahead.

The common problem for most is that new users are having a hard time figuring out how to add crypto into their current investment strategy. They either don’t know how to think about risk vs reward for their allocation or don’t know where to start. Considering the bad inflation situation, people are struggling with managing their personal finances. Current rising prices of good and services, and global markets are creating a tough situation for many. The good news is it isn’t permanent.

Keep your eyes on the prize and don’t negate the importance of the personal financial decisions and the short term implications. It would be counterproductive to put yourself in an unnecessary financial predicament that would cause you to sell *any* BTC or ETH because you failed to anticipate an expense, or a surprise occurred.

Think long term. Don’t let life’s surprises ruin your momentum.

Personal Finance

Connecting and bringing new technology in with the traditional financial framework you know is what is going to make life easier for you. The people who use financial knowledge to their advantage + learn and utilize disruptive technology + think and act long term are winners

Where do you want to be “financially” in the next 3 – 5 years? How well established are your personal finances?

Action #1: Have *at least* 6 months of expenses saved.

If you don’t have 6 months saved, get there ASAP. This is going to be an important and key piece of advice to take in your path toward a healthy financial position. This is going to turn any emergency situation into a simple inconvenience. It is a “boring” subject regarding personal finances, but it needs to be remembered.

By taking the weight off during a bad situation, and knowing you can pay for it, you won’t have additional debt to pay it off, or will you have to sell *any* assets and incur additional capital gains taxes. A major point of investing is compound growth, don’t disrupt it by not planning ahead.

The average US salary in 2021 was ~ $60K pre tax and inflation is ~30% -> Avg 6 Months of Expenses is ~$15,000 – $17,500

Action #2: Increase your Income

The person making ~ $50K – 60K annually at their job (post tax) is right around the average annual salary in the US. Inflation isn’t going away, and we all know the rate of it is understated. The rate of inflation will eventually slow down, but given the fact that costs will still continue to rise, owning assets and building more income streams is your best bet. Your job isn’t going to save you, set yourself up for financial success.

Now, given the average salary, after taxes and expenses most are only saving approximately $1550 month. Now, assuming $0 in savings, it is going to take someone almost 1 year to save for the emergency fund. That also assumes no surprise expenses like no job layoff, no illness/hospital visits/injuries, etc.

We all know in the current economic environment, costs are consistently rising. The need to save, spend less, grow income, and grow investments has never been more important. Start finding ways to break into making over 100K annually as your first big step if you aren’t there yet. Increase your income to increase your asset holdings.

Action #3: Reduce your Expenses

The first thing to remind ourselves of is that cutting costs is only going to take you so far. If you’re carrying around a load of credit card debt and consumer debt pay that down quick. This is another ball and chain that is going to slow you down so do not carry this around forever.

This step of cutting expenses will help you in the short term though. Being aggressive and efficient at the beginning is important, but several paragraphs on clipping coupons and cutting costs is unnecessary. The truth is that cutting costs is not going to help you become wealthy, it’s going to keep you in a *loss mindset*.

Adopt that growth and abundance mindset because the goal is to make more money, not scrounge for deals and waste your time. You want to make more money so you can pay for services that *save you time*. You all know what to do.

Stop going out every weekend, stop drinking, stop buying designer clothes, stop trying to impress people, stop using STUFF to make you feel better, stop procrastinating on your future. If you can control your need for self-gratification you will get further. Focus on the object at hand.

Action #4: BUILD

Build. Build. Build. Grow yourself and your finances. Get in the gym. Learn and teach yourself about crypto. Start something on your own and grow your cashflow. Grow your portfolio. Just respect yourself enough to not work for someone else for 40 years and only come out with maybe a few million in the bank, or less.

Investing in Crypto

Own a Hardware Wallet

This is simple. If you’re going to buy crypto you are going to use a hardware wallet and hold the keys to your coins. This makes you the sole owner. Do NOT hold and keep your coins/crypto assets on the exchanges. Under no circumstances do not deviate from this rule. Put them to use in DeFi or move them to “cold storage”.

The hack took place between March and May 20 of this year, according to a copy of the letter posted on the website of California’s Attorney General.

Action 1: You want to own a hardware wallet and “own the keys to your coins”. The first step is to purchase a Ledger or a Trezor wallet. For personal security reasons have these wallets placed in a secure location. Just like you would have anything sensitive or important located in secure spots.

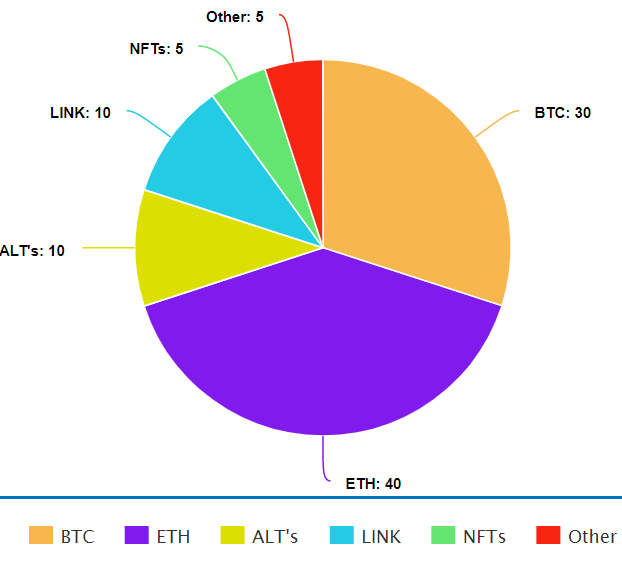

Action 2: You are going to include the purchases of these crypto assets in your overall investment strategy. I would recommend purchasing BTC, ETH, and LINK on a regular basis (dollar cost averaging). Until you have a decent amount just focus on stacking these coins and storing them using your hardware wallet.

Action 3: You’re going to begin purchasing off Centralized Exchanges (CEXes), we’re playing the long game here so you can plan on using Decentralized Exchanges later.

Purchases from any exchange like Coinbase, Coinbase Pro, Binance, Kraken, OkCoin, and such are easy. By taking them off the exchange and put into cold storage you’ll begin to become more confident with your crypto. The first “threshold” is getting off zero, start by purchasing some BTC and ETH to start.

Personal Security

Make sure you are responsible and securing your crypto for the long term. This means that you are using good security practices. Good security requires a lot of forward thinking and technical awareness. Some people who are new to crypto aren’t tech savvy, but that doesn’t mean they don’t learn.

A) Do not under any circumstance share your seed phrase (recovery words) with anyone. Ideally you want use a metal plate/seed plate to record the phrase. Have backups for the phrase and your password recorded and stored in separate locations.

B) Have designated secure locations where you are storing your seed phrases and hardware wallets. (Don’t put all your eggs into one basket). These should be in locations that are accessible to you, and are hidden and secure. Safes and passcode for access is preferred.

C) Have multiple wallets to distribute your holdings across. Store these and the associated seed phrases in separate locations.

D) If you want to take extra precaution, ship *any* crypto related item to an address that is not your home or your work and use a discreet payment method (Ex: visa gift card purchased with cash).Note: This does not make you a “shadowy super coder”.

Dollar Cost Average

Always remember: 1 BTC = 1 BTC and 1 ETH = 1 ETH.

Keep it simple and buy your crypto assets on a regular dollar cost average basis. Your DCA can be once a week, bi-weekly, or monthly: Whatever it is for you keep buying at the same times. This keeps you disciplined and consistent. We all know the smart play here is for the long term. Take the opportunity to learn more as you go.

If you are someone who hasn’t purchased any yet, and you have some liquid funds to start with, by all means take a decent position in the beginning if you can.

Volatililty

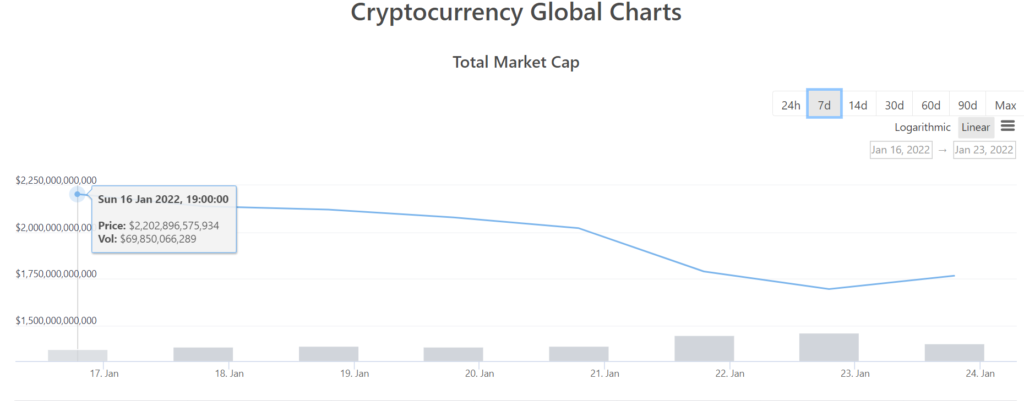

Everyone understands that crypto is very volatile, more so as of recent. The recent pressure on the market has pulled it downward from $2.2T to $1.7T in total crypto market cap over the last 7 days alone.

For this reason it is usually good practice to keep some extra cash on the side to capitalize on these short-term opportunities. Usually on those days you will see ~15% drops like we did last Thursday, don’t miss them.

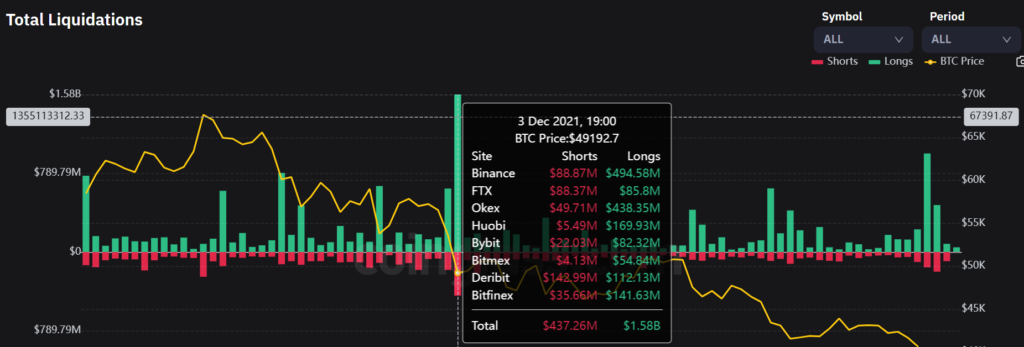

Never Use Leverage

Using leverage is taking borrowed capital to generate a return. You are using debt to trade which is unnecessarily risky and never a good idea. People do this so they can multiply their potential return.

Many people fall for the gamble, and end up losing a lot, sometimes owing on the trade and going further into debt. Don’t let yourself fall victim to this. Those who do are choosing to learn this lesson the hard way, and it happens much more often than it should.

Don’t fall in love with any single crypto asset. You may hear the term “maximalist” or “maxi” thrown around. This term is referring to the people who only believe in one project and disregard all others. It is an emotional mental mechanism that keeps people from seeing the direction of where the entire space is going. They miss out on the big picture and the constant developments to only hold onto their bias.

Don’t hinder yourself like that. There is more development occurring in crypto and providing new opportunities on a daily basis. Keep yourself honest and have your eyes open for new projects to learn about. It is best to keep an open mind.

Allocation + Risk

Overly exposing yourself and putting too much emphasis on one position can result in costs. It can be measured in multiple ways like impermanent loss, liquidations, or opportunity cost. Usually this happens when someone is putting too much of their portfolio in a small cap coin, a risky NFT project, or even a levered play. These gambles can cause you to lose capital and will require you to recoup your funds.

Don’t get caught up chasing winners

It’s okay to try a small and reasonable “bet” every once in a while as it can be just fun, as well as the value in the learning experiences. It’s important to give yourself chances like this. Make sure you’re keeping yourself focused on the big picture too. Following the 80/20 rule is always a solid strategy.

By putting 80% of your allocation in BTC and ETH in your portfolio, it gives a remaining 20% for higher risk higher reward plays . Over time, earnings will shift these around as needed, one thing you can count on is an increase to positions with promise and give a solid allocation to those.

The solid and long term play deserves the largest allocation. That is where you should put your returns from the small bets you have. If at any point your experience a small position that has a quick run-up in a short period of time, sell most of it and distribute that into one of your larger positions.

Wrapping it Up

This will get emotional for anyone new. Your first year or so will involve a lot of learning and experience. It is easier if you apply the rules and the information here. Don’t stare at the prices and hope for quick returns. In the early days you feel a lot of FOMO, rushes, excitement, fear, uncertainty, etc. just like anything else new.

You’ll probably end up talking to your close friends and family a lot about this. You’ll feel regret missing out on it up to this point. Maybe you’ll find a cool project, look at it for a while, and one day suddenly it’s up 70% and you don’t know whether it’s going to keep on going, or suddenly crash. You don’t know what to do and feel loss at what you want to do. All of this is okay, don’t be too hard on yourself. Don’t let your emotions take over. It’s all about what you’re doing today to set yourself up for the long run.

Remember, your biggest project is building your own business and getting yourself in large positions in the big solid projects like BTC, ETH, LINK. Don’t chase and expect to make a return of a lifetime over night. That’s not how this works.

Be Active and learn by doing. Don’t sit around and wait for someone to hold your hand and tell you what to do. Get involved, get dirty, research some projects that are interesting to you. Play around on the protocols, read up on the recent developments, look at different exchanges, research some pairings, learn the terminology, etc.

This is what is going to make you feel like you’re getting somewhere. You have to get involved and learn what it is that is happening so you can see the direction in where we’re going. Don’t sit around and watch this lifetime opportunity pass you by.

You can see over the long term, with long term adoption trends and consistent growth that crypto is going to continue to grow and become a bigger aspect of society. You can see the overall long term trend when you “zoom out”.