A Bill proposed in the United States House of Representatives asks for the United States Treasury to develop an alternative to a CBDC. The proposal comes as a response to the continued work the Federal Reserve and the US Treasury undergo to develop a CBDC. This is a proposal for a “digital equivalent” to physical dollars.

How Did We Get Here?

The first thing to acknowledge is the level of attention developing a digital dollar is getting. “Monetary authorities” have been testing and collecting information on a framework and use case for CBDCs some time now.

Up until very recently the idea of this was thought to be “crazy” by the general public. Now, we are in the midst of the development of development, testing, and full pilot programs like we saw in China during the Beijing Olympics when they tested a larger setting for the Digital Yuan, DC/EP (Digital Currency/Electronic Payment).

Lawmakers passed this US bill to create a more privacy-centric digital dollar. As opposed to CBDcs which are invasive and a threat to privacy. The idea behind E Cash is to be more private and secure to support P2P transactions.

The recent “Executive Order on Ensuring Responsible Development of Digital Assets” was released on March 10th. To Summarize the executive order, the US is currently headed into a more rapid phase of developing a digital dollar. The Federal Reserve was again directed to continue the research and development of a digital USD. Throughout the article phrases like “the rise of digital assets”, “increased use of digital assets”, and “adoption of digital assets” occur 18 different times. An acknowledgement of both the institutional and individual adoption of crypto that has been on display these past few years.

What is the ECash Act?

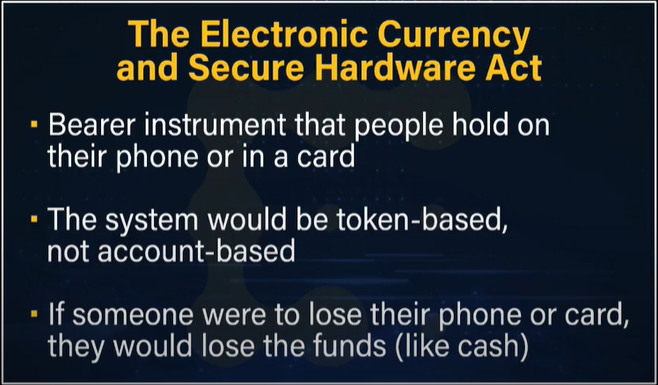

Following in a very different direction the E-Cash proposal was drafted and lead by Rep Stephen Lynch (D – Mass) as the Electronic Currency and Secure Hardware Act (ECash Act/H.R. 7231). Rep Lynch serves on the Committee of Financial Services, and the Subcommittee of Monetary Policy, National Security, and Financial Inclusion. Behind the Bill is also Rep Jesús Chuy Garcia (D-Ill.), Rep Ayanna Pressley (D-Mass.) and Rep Rashida Tlaib (D-Mich.).

The E Cash Act serves to preserve anonymity and privacy. The problem with CBDCs is the lack of privacy, the main resistance toward them in the first place. CBDCs can present scenarios where users are denied from making purchases, denied access to funds, or placed under transaction limitations.

Flagging anything from a P2P, P2B, or a B2B is very easy. Being digital and integrated with a digital wallet that is owned and operated on a personal device, like a smartphone. It makes it easy to disable certain activities and transactions. It wouldn’t be difficult. We saw this earlier this year up in Canada with Emergencies Act and the mobilization of banks against Canadian citizens. That taught us that actions like that wouldn’t require anything like a serial number for tracking. Cryptography and a public ledger operated by a central bank creates a simple method to track money throughout their jurisdiction.

“The idea was to replicate the fungibility and anonymity of cash – especially for small transactions. We don’t want full blown surveillance over every transaction we make. It isn’t a cryptocurrency. It relies on both hardware and software to make sure we have widespread inclusivity. It even operates in areas with no internet connection, people will still be able to transact anonymously.”

Rep Stephen Lynch

It isn’t all sunshine and rainbows though. E Cash aims to provide anonymous transactions, but remember, this is still coming from the US Treasury. All KYC and AML regulations will be enforced. This is simply a better alternative to a CBDC.

Treasury is fully suited to lead e-cash development given that the agency already produces

E Cash Act

hard currency and successfully implements the U.S. Debit Card Program – including the

Economic Impact Payment prepaid debit cards issued to Americans under the CARES Act.

Pilot Program

The Bill requires the Treasury to develop a Pilot Program within 90 days, planning deployment within 4 years. The Pilot is broken down into 2 Phases.

Phase 1:

A) 3 Proof of Concept pilot programs. The objective is to gauge the deployment, design, and execution for launch. Programs are free to partner with universities, non-profits, insured financial institutions, FinTech firms, non-bank payment processors, or existing local, state, or federal agencies.

B) At least 2 technologies must be secure hardware devices that do not involve any distributed ledger tech, at least 1 must involve a a magnetic secure element or a pin, and at least one must be a cell phone option (SIM card optional) for storage and payments.

Phase 2:

Involves at least one larger “field test” deployed to segments of the American public. Involves the same entities listed on Phase 1.

“The general purpose of the pilot programs is to assess the viability and capacity

E Cash Act

of various e-cash technologies to incorporate the security and functionality safeguards that are generally associated with the use of physical currency; deploy rapidly and efficiently; and maintain compatibility with existing financial institution and payment provider systems.”

Key Takeaways

- E Cash as a token based system operates based off the hardware and software developed. It will not be using distributed ledger technology or a centralized ledger so P2P transactions are supported and remain more private replicating the that benefit of physical cash with this proposed version of digital cash.

- Requires the Treasury to establish the Electronic Currency Innovation Program (ECIP) to direct, oversee, and coordinate the development and implementation of e-cash and enabling architecture, technologies, and platforms.

- The Treasury will issue and put E Cash into circulation if approved and passes each phase successfully.

- The privacy features must incorporate security and functionality that is found in existing physical fiat currency today.

- While developing E Cash, the US Treasury must prioritize the use of secure hardware and software technologies and establish a Digital Dollar Council to coordinate developments with the necessary US Dept’s on related activities.

CBDC Update

Augustin Carstens, General manager and Head of the BIS, made a speech on the 18th called “CBDCs for the People”. The big takeaways from the article is the level of focus central banks have on developing CBDCs, and how they’re planning to implement them. The biggest motivation being “financial inclusion” for the 1.7 billion unbanked.

“People need a fast, secure, and cheap way to transfer money. To date, central banks have largely met this need by providing the most inclusive form of money we currently have: cash. However, using cash exclusively leaves the unbanked outside the formal financial system and without the data and transaction trail needed to readily access financial services…But due to the widespread adoption of digital and mobile technologies, the payments landscape is changing. Cash transactions are declining, and there is a shift toward digital activity – a trend accelerated by the COVID-19 pandemic, when online transactions surged. Given these broad developments, it is imperative that we work to close the widening digital divide. “

Augustin Carstens

Spreading and growing central bank jurisdictions is clearly not the motive. Selling the desire to help the “unbanked” and foster financial inclusion is the narrative.

The BIS recently succeeded in their recent project, Project Dunbar, where the central banks of Australia, Malaysia, Singapore, and South Africa operated and completed international settlements over the Corda Network. A network that uses distributed nodes and acts as a system where CBDC applications can be used.

The BIS also released a paper (Central bank digital currencies: a new tool in the financial inclusion toolkit?) detailing the need for a CBDC to support financial inclusion needs and initiatives. All the central banks mentioned in their paper were Canada, China, the Eastern Caribbean, Bahamas, Ghana, Malaysia, Uruguay, Philippines, and Ukraine. The World Bank also was part of the paper and the research for the paper.

The BIS is being firm in their position of central banks in the emerging digital economy and the prioritization for cryptocurrency regulation.

Japan

The Bank of Japan (BoJ) has proceeded to the second phase in their CBDC experiments. On April 13th the executive director, Shinichi Uchida, started phase 2 of it’s proof-of-concept, and will consider a pilot program with financial institutions and payment processors.

Brazil

The Brazilian Central Bank announced last week that the country’s CBDC pilot will go live before the end of 2022. The “Digital Real” will have a fixed supply.

“This is a way of creating the digitalization of the currency without creating a rupture in the banks’ balance sheets. This project should have some kind of pilot in the second half of the year.”

Roberto Neto (President of the Central Bank of Brazil)

Summary

It is becoming easier to see how large of an implication crypto has on the traditional financial system. Project Dunbar is a massive step forward in the development of CBDCs. Although still nascent, the direction is there and all major central banks are actively working on this. It won’t be long until we see the larger pilots take place in the US and EU.